I have been hinting at possibility of further escalation in geopolitical tensions on the blog all year long. As debt levels continue to rise, countries around the world are playing a very strategic game of chess and hotspots everywhere are flaring up. Major issues continue to be East & South China Sea, Ukraine Russia boarder and the overall instability in the Middle East.

In recent developments overnight have seen Israel send troops into Gaza, while in Eastern Europe yet another Malaysian plane has crashed and was apparently shot down over Ukrainian airspace. All of these events have put pressure on the financial markets, impacting various asset classes. Here are a few charts I am currently looking at (no particular order):

- JPY could benefit from geopolitical tensions and risk aversion!

- USD/EUR has been falling since ECB cur deposit rate to negative…

- Gold continues to consolidate sideways since crash in April ’13

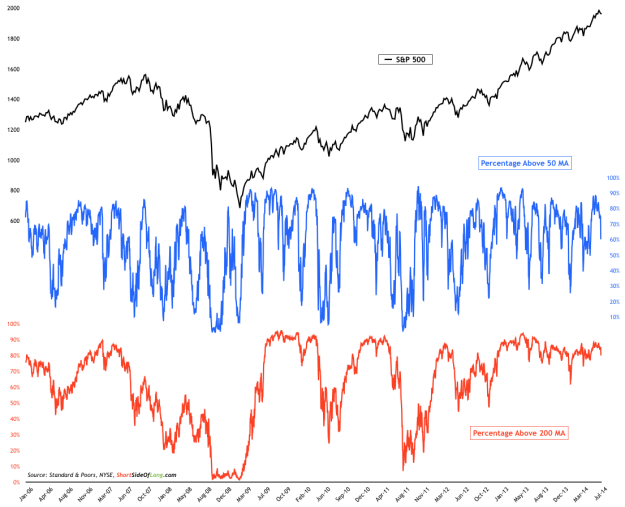

- S&P 500 has spent 87 weeks above the 200 day moving average

- US stock market internals show a deterioration in participation!

- Russian equities have been caught in the middle of it all, again!