Genpact Limited (NYSE:G) continues to strengthen its portfolio of enterprise digital transformation solutions. Following the launch of its artificial intelligence (AI) platform Genpact Cora and the acquisition of Rage Framework, the company recently announced the acquisition of TandemSeven, a design thinking based customer and digital experience innovator.

Per TandemSeven “Design Thinking is a people-centered model that encourages creativity and innovation to create a product or service that solves a complex problem for your target customer or user.”

We believe that the addition of TandemSeven’s core design thinking process to Genpact’s AI platform will help the company become more customer-oriented. Moreover, design thinking supports Agile projects, which ensures dynamic collaboration with insights from clients in each and every step of product development. This is another positive.

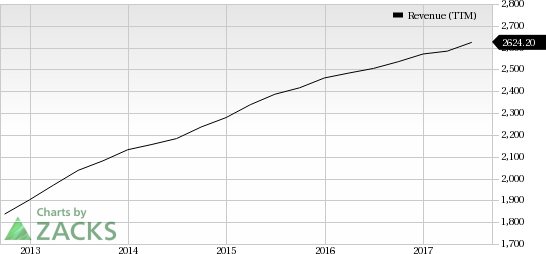

Genpact has gained 17.2% year to date, significantly outperforming the industry’s 0.3% rally. The stock has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Acquisitions Expanding AI Portfolio

With AI driven solutions taking precedence, Genpact seems to be in the right direction.

The company’s progress with AI involving machine learning, data analytics and Internet of Things (IoT) coupled with the interactive solution providing technique of TandemSeven is expected to boost the company’s prowess in the domain. This will eventually improve end-to-end customer experience.

We anticipate this acquisition together with Genpact’s own offerings to bode well for the company and provide it with a competitive edge against peers like International Business Machines Corp. (NYSE:IBM) , Cognizant Technology Solutions (NASDAQ:CTSH) and Accenture (NYSE:ACN) .

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Genpact Limited (G): Free Stock Analysis Report

Original post