Covered call writing is a low-risk option-selling strategy that allows us to generate monthly cash flow in sheltered and non-sheltered accounts. One of the main reasons this has been the go-to strategy in the stock portion of my portfolio is related to the fact that the strategy can be crafted to specific investment scenarios and goals. In this article, we will highlight three ways selling call options can assist us in generating these income streams.

Three different income scenarios

Traditional covered call writing

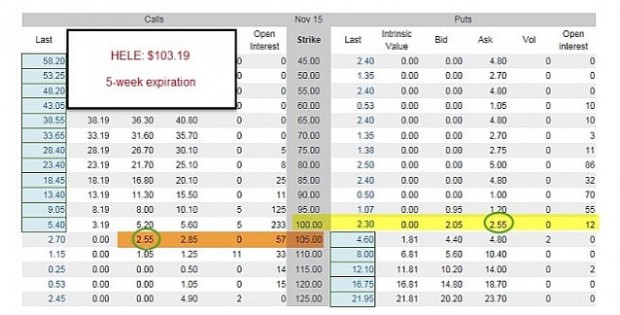

We first buy a stock or ETF based on fundamental, technical and common sense screens. We then sell an option based on overall market assessment, charts technicals and personal risk tolerance. Once our positions are established, our position management skills may be needed. Portfolio mix turns over frequently especially due to our rule of avoiding earnings reports.

Portfolio overwriting

We already own the shares and want to enhance annualized return by selling call options. Frequently, the stocks are of low cost basis and are dividend-bearing. We may have concerns regarding exercise and sale of our securities due to possible tax consequences if not trading in sheltered accounts as well as loss of the dividend income streams.

Goals

- Elevate returns to target goal

- Avoid exercise

Hypothetical example

- Annual additional income target: 6%

- Monthly goal (in addition to share appreciation and dividend distribution): 1/2% per month

Key strategies

- Sell only out-of-the-money calls to generate two (potential) income streams

- Be prepared to roll options if strike is in-the-money at expiration

- Avoid ex-dividend date issues

Zero-dollar collar

In this situation, we already own the stock which has dramatically increased in value. We feel (based on 3-pronged screening process) that share value has a good chance to appreciate even more but we also want to protect our unrealized huge profits.

In this case, we buy a protective put below the current market value, giving us the guarantee to sell at the strike price, if we choose to, and protecting against catastrophic loss. The bulk of our unrealized profit is protected however, there is a cost to this “insurance policy” To eliminate the cost factor, we can also sell an out-of-the-money covered call. This latter trade will accomplish two goals:

- Allow for additional share appreciation from current market value up to the strike price

- Pay for the cost of the put (there may be a small bet debit or credit) as shown below:

Note how the cost of the put and the cash generated from the sale of the call cancel each other out.

Discussion

Generating income from stocks or exchange-traded funds we already own can be accomplished using covered call writing. The manner in which we use this conservative option-selling strategy will depend on the specific situation our portfolio resides in as well as our goals and concerns.

Market tone

Global stocks moved a bit lower this week as the US Federal Reserve kept the door open for a rate hike as early as September. The Chicago Board Options Exchange Volatility Index (VIX) was unchanged on the week at 11.34. Crude oil rallied to $48.00 from $43.83 last Friday. This week’s reports and international news of importance:

- Sentiment indicators have turned lower following the June Brexit vote by the United Kingdom to exit the European Union, but “hard” economic data such as the unemployment rate and retail sales have proven surprisingly resilient. This week’s unemployment report showed that the jobless rate held steady at a low 4.9% last month. Better still, July retail sales had their best monthly performance in 14 years, rising 1.4% versus expectations of a 0.2% increase

- However, minutes of the recent ECB meeting show that European central bankers are very concerned about economic growth in the eurozone as a result of the UK’s vote to leave the EU

- Members of the Federal Open Market Committee were split on the need for a hike in the federal funds rate soon, but they are keeping their options open, according to the minutes of their July meeting. A rate hike as soon as September can’t be ruled out, but a December hike is seen as more likely

- In July, output rose in all sectors — manufacturing, utilities and mining — according to the Fed. The 0.7% monthly advance was the largest since November 2014. A weaker US dollar and firmer commodity prices contributed to the improvement, according to economists

- The market from Brent crude oil has shifted from a bear market to a bull market in just over two weeks. Prices have risen over 20% since August 2, with the latest surge tied to the possibility of an OPEC output cap being negotiated. Brent crude ends the week above $50 for the first time since late June

- After being politically paralyzed for eight months, Spain looks as though it is somewhat closer to finally putting together a government

- Russia has massed tens of thousands of troops along its western border in new military installations. According to the Wall Street Journal, US and other allied officials believe Russia’s strategy is to provoke an overreaction from Kiev, one that would help undermine the case in Europe for sanctions against Russia

THE WEEK AHEAD

- Flash readings of the Markit purchasing managers’ indices are released globally on Tuesday, August 23rd

- Q2 German gross domestic product is reported on Wednesday, August 24th

- Central bankers gather in Jackson Hole, Wyoming, on Wednesday, August 24th

- US Federal Reserve Chair Janet Yellen addresses the meeting on Friday, August 26th

- Q2 UK gross domestic product is reported on Friday, August 26th

- Q2 US core personal consumption expenditures are released on Friday, August 26th

For the week, the S&P 500 moved slightly down by 0.01% for a year-to-date return of +6.85%.

Summary

IBD: Market in confirmed uptrend

GMI: 5/6- Buy signal since market close of July 1, 2016

BCI: Moderately bullish favoring out-of-the-money strikes 2-to-1

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts continue to point to a bullish short-term outlook. In the past six months the S&P 500 rose by 14% while the VIX declined by 45%, still a moderately bullish picture.