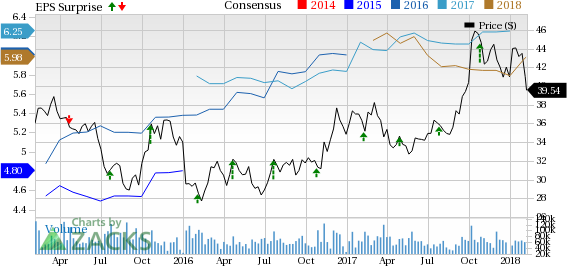

General Motors Company (NYSE:GM) reported fourth-quarter 2017 adjusted earnings per share of $1.65, up 21.3% from that of prior-year quarter. The bottom line comfortably beat the Zacks Consensus Estimate of $1.34.

General Motors reported revenues of $37.7 billion, reflecting a decline of 5.5% from the year ago quarter. However, revenues surpassed the Zacks Consensus Estimate of $33.3 billion.

For any fourth quarter, adjusted EBIT set a record. This was aided by sales of crossovers, strong pricing and cost-control initiatives, which were partly offset by a wholesale volume decline.

For full-year 2017, adjusted earnings came in at $6.62 per share, up 8.2% from that of prior-year quarter. Revenues were $145.6 billion during the year, down 2.4% from that of 2016 figure.

During the quarter, total wholesale unit sales declined to 1.24 million vehicles from 1.41 million in the fourth quarter of 2016. Worldwide retail unit sales decreased to 2.59 million vehicles from 2.85 million in the year-ago quarter. The automaker’s global market share was 10.3% during the reported quarter, reflecting a decline from 11.4% in the year-ago quarter.

Segment Results

GM North America (GMNA) generated net sales and revenues of $28.8 billion during the fourth quarter of 2017, down from $31.3 billion in fourth-quarter 2016.

GM International (GMI) net sales and revenues came in at $5.7 billion, declining from $6 billion in the year-ago quarter.

GM Financial generated net sales and revenues of $3.23 billion during the quarter, reflecting an increase from $2.6 billion in the year-ago quarter.

Financial Position

General Motors had cash and cash equivalents of $15.5 billion as of Dec 31, 2017 compared with $12.6 billion as of Dec 31, 2016.

Adjusted automotive free cash flow during the quarter came in at $4.2 billion, up $1.7 billion from fourth-quarter 2016.

Zacks Rank

General Motors carries a Zacks Rank #3 (Hold)

.

A few better-ranked stocks in the auto space are Volkswagen (DE:VOWG_p) A.G. (OTC:VLKAY) , Oshkosh Corp. (NYSE:OSK) and Daimler A.G. (OTC:DDAIF) . While Volkswagen sports a Zacks Rank of #1 (Strong Buy), both Oshkosh and Daimler carry a Zacks Rank of #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Volkswagen has an expected long-term growth rate of 18.7%. The stock has gained 5.4% in the last three months.

Oshkosh has an expected long-term growth rate of 14.5%. Shares of the company have surged 13.3% in the last six months.

Daimler has an expected long-term growth rate of 2.9%. In the last six months, shares of the company have rallied 17.6%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

General Motors Company (GM): Free Stock Analysis Report

Daimler AG (DE:DAIGn) (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

Original post

Zacks Investment Research