The General Electric Company (N:GE) is 123 years old -- or just over 30 if born on a leap day. Back then, GE actually meant something. A guy you may have heard of, Thomas Edison, had a hand in the company’s formation. It was one of the original 12 Dow Jones Industrial companies and the only one that's still around.

What does any of this have to do with anything? This is an old company with a rich history. Investments in these types of companies are supposed to be reserved for seniors looking for dividend income. But this stock looks ready to make a big move to the upside.

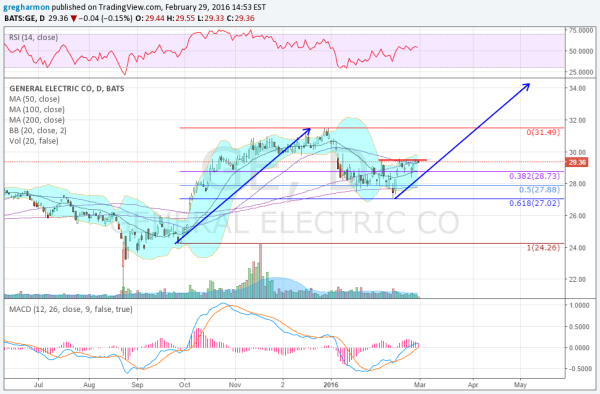

General Electric was drifting until it was pulled down with August's market dump. But like a Phoenix it rose from the ashes over the last quarter of the year. The pullback with the market to start 2016 resulted in a near 61.8% retracement of that last leg higher. Now it sits at resistance at 29.50.

The momentum indicators are not full-on bullish but rising nonetheless and the Bollinger Bands® are turning higher. And that supports an upside move that should get more so if it occurs. A break over 29.50 would give a target of 34.20 on a Measured Move -- or AB=CD. That's a 15% move. Not bad for 123-year old.