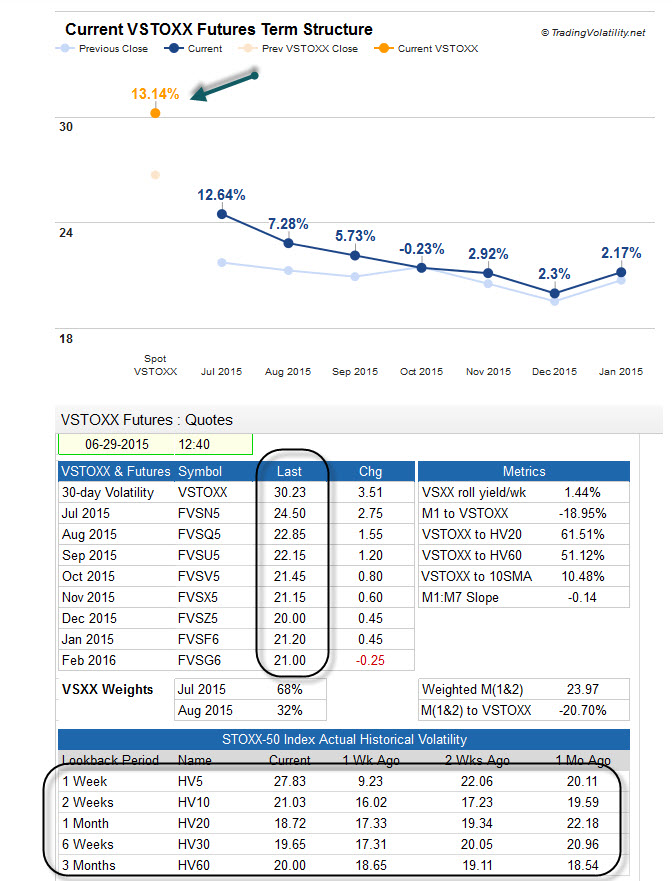

Since the middle of June we have seen some remarkable market action. What started out with a rather shallow dip morphed into a near-catastrophic drop following the Brexit decision toward the end of the month, leaving many to wonder if they should have followed the 'sell in May and go Away' advice from the prior month. Volatility started to kick up mid-month as the Brexit vote came closer, in fact European markets reacted far more negatively leading up to the vote with the VSTOXX term structure showing panic-stricken investors were lining up.

The cost of protection was still rather inexpensive as we barely saw VIX move, even post-Fed meeting where the committee showed deep concern about the fallout from the upcoming Brexit vote, and even downgraded the economy. But when the Brexit happened markets went into a tailspin, the media and market experts got it wrong. Friday June 24 saw a spectacular drop lower and gap down to the tune of 600 Dow points, and the following Monday was nearly as bad. Over 1000 Dow Industrial points lost in two days.

When the markets gapped lower on these two days it made for difficulty to get engaged into the action. Further, anybody who had long positions might have been stopped out or just tossed their stocks to the side in disgust. Yet, when the pain was at its greatest is where the markets turned, and turn they did in short order. The gap up on Tuesday with a strong close was followed up by three more solid days, completely wiping way the two day swoon. And just like that, the market failure from Brexit was over.

If you blinked, you missed it. In fact, if you look at a weekly chart there is little movement and just a long tail. We'll have to see what the next week or so brings and whether there is damage from the probes to lower levels. The gaps up this past week made it equally as hard to gain the confidence to get on board, many feeling left behind when the moves were made in overnight futures. That is an uncomfortable feeling for most, and then the chase is on to get back on board - often late to the party and losses occur again when the next move down happens. Rinse and repeat.

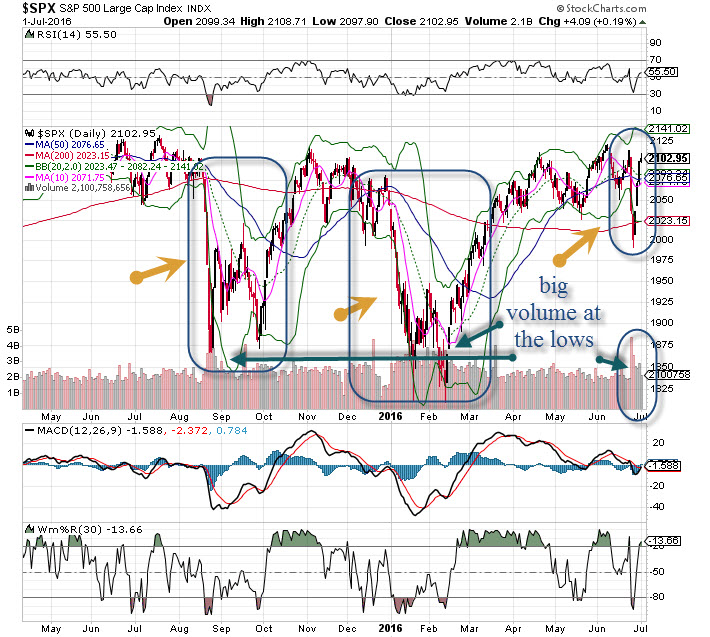

The SPX 500 chart shows the familiar V pattern, something we have not seen since late 2014. That move was a whopper, well over 220 SPX points into the holiday period only to show some incredibly volatile action for the next five months. More recently we have seen the W pattern appear, twice since last summer. Both of these patterns are indicative of violent up/down action, moments of terror and excitement. Markets always show some volatility when the uncertainty kicks up, but that doesn't make our investing/trading jobs any easier, as levels are penetrated like a hot knife through butter.

V-shaped bottoms are rare and far less desirable than a W-shaped pattern. So, we currently have a V that 'could' turn into a W. What's it going to be? If we look to clues from the prior W patterns in Jan/Feb this year and last fall we can see the move down was prolonged and deep, different than this recent drop (only two days). While a W is possible on the SPX 500 we are likely headed for a rangebound market once again, bracketed to the upside at 2115 and 2040 on the downside.