Apparel retailer Gap Inc (NYSE:GPS) late Thursday posted in-line Q3 earnings results, but its comparable sales slumped considerably from last year.

The San Francisco-based company reported Q3 EPS of $0.60, matching Wall Street estimates. Revenues fell 1.5% from last year to $3.8 billion, which the company had pre-announced recently.

Q3 comparable store sales fell 3% from last year, which was worse than 2015’s 2% decline. Gap Global comps fell 8%, as did Banana Republic. The lone bright spot were Old Navy comps, which rose 3% from the year-ago period. Comparable sales are a key indicator of a retailer’s health, since they measure the performance only of stores open at least one year.

Looking ahead, GPS reiterated its prior full-year 2017 forecast for EPS of $1.87 to $1.92, which would badly miss analyst estimates of $2.00.

Gap also noted that it now expects net closures of about 65 company-operated stores in fiscal 2016, along with a 3% reduction of square footage as compared to last year.

The company commented via press release:

“I’m pleased to see improved product across our brands, as well as areas of healthier merchandise margins, even against the backdrop of challenging traffic trends during the quarter,” said Art Peck, chief executive officer, Gap Inc.

“As we move into the holiday season, our teams are sharply focused on execution and delivering great experiences across the portfolio,” Peck continued. “Looking forward, we remain dedicated to utilizing our scale advantage in supply chain, as well as through knowledge sharing, in order to drive product innovation across brands and categories.”

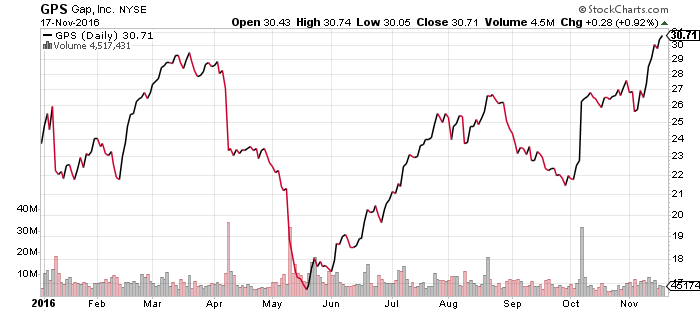

Gap shares fell $1.45 (-4.72%) to $29.26 in after-hours trading Thursday. Prior to today’s report, GPS had gained 24.33% year-to-date, more than tripling the return of the benchmark S&P 500 index during the same period.