Gap Inc. (NYSE:GPS) just released its second quarter fiscal 2017 financial results, posting earnings of 58 cents per share and revenues of $3.8 billion. Currently, GPS is a #3 (Hold) on the Zacks Rank, and is up almost 6% to $24 per share in trading shortly after its earnings report was released.

Gap:

Beat earnings estimates. The apparel retailer reported adjusted earnings of 58 cents per share, topping the Zacks Consensus Estimate of 52 cents per share. This number excludes 10 cents from non-recurring items.

Beat revenue estimates. The company saw revenue figures of $3.8 billion, also surpassing our consensus estimate of $3.77 billion but falling 1.4% year-over-year.

Gap reported positive 1% comparable sales growth for the second quarter, up from a 2% decrease in the prior year period. Breaking it down by brand, Old Navy saw a 5% increase in comps, while Gap and Banana Republic saw a 1% and 5% decrease, respectively.

Looking ahead, Gap has increased its adjusted EPS guidance to a range of $2.02 to $2.10 for fiscal 2017. The company continues to expect comparable sales for fiscal year 2017 to be flat to up slightly.

“With a third consecutive quarter of comp sales growth, we are seeing our investments in product, customer experience, and brand equity begin to pay off,” said Art Peck, president and chief executive officer, Gap Inc. “Based on the strength of the first half, we are pleased to increase our full year earnings guidance.”

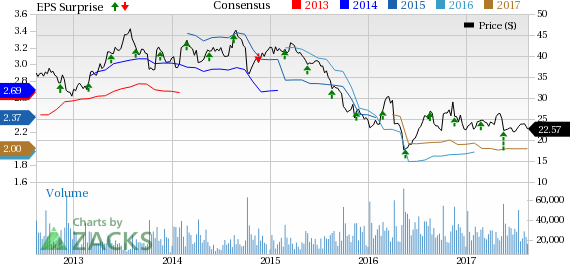

Here’s a graph that looks at Gap’s price, consensus, and EPS surprise:

The Gap, Inc. is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women and children under the Gap, Banana Republic and Old Navy brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Original post

Zacks Investment Research