Video game retailer GameStop Corp (NYSE:GME) late Tuesday posted mixed third quarter earnings results and provided an in-line forecast for the holiday period.

The Grapevine, Texas-based company reported adjusted Q3 net income of $0.49 per share, which was $0.02 better than the $0.47 that analysts had expected and at high end of GME’s guidance of $0.45 to $0.49. Revenues fell 2.8% from last year, however, to $1.96 billion. That total missed Wall Street’s $1.99 billion estimate, as well as the company’s own guidance of $2.0 billion.

Comparable store sales fell -6.5% in the third quarter, which was exactly in line with the -7% to -6% range GameStop had predicted. Due to a video game demand slowdown in late October, new hardware sales plunged 20.6% and new software sales fell 8.6%.

Looking ahead, GME forecast Q4 EPS to range from $2.23 to $2.38, which straddles analysts’ view of $2.36 per share. On a sour note, GameStop said Q4 comps would fall between -12% and -7% for the all-important holiday period.

The company commented via press release:

“Our third quarter results were in line with the revised guidance we issued on November 2. While the video game business has underperformed recently, we are focused on maintaining our leading market position, especially during the holiday season, as well as driving diversification through the growth of Technology Brands, Digital and Collectibles.”

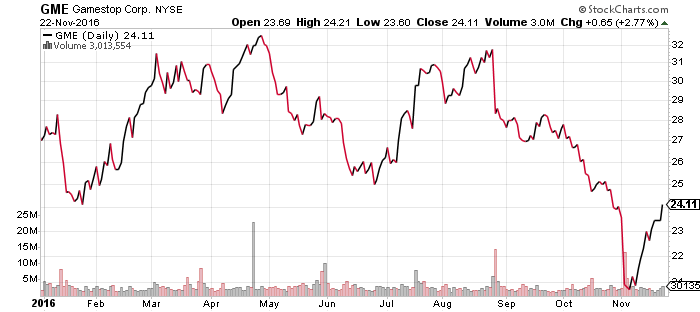

GameStop shares rose $0.89 (+3.69%) to $25.00 in after-hours trading Tuesday. Prior to today’s report, GME shares had fallen -14.02% year-to-date, versus a +8.19% gain in the benchmark S&P 500 index during the same period.