The global bond market rout has turned into a global stock market rout - which means no rest for the wicked FX markets. All the trade war noise from the IMF's World Economic Outlook and expected global growth downgrade will also be unhelpful. Watch for how the PBoC fixes USD/CNY after the Golden Week holiday - anything close to 6.90 would be another negative.

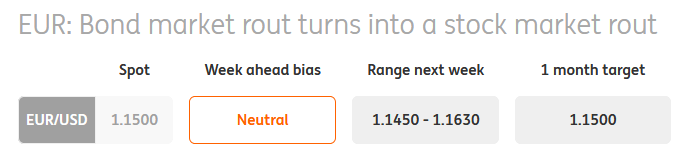

- It was a noisy US jobs report - with the substantially weaker headline Sep payrolls figure offset by a very strong prior revision. The cue really for bond and FX markets was the 2.8% YoY wage growth reading - with the prior month's reading revised lower to +0.3% MoM (versus +0.4% MoM). This may have come as a marginal disappointment for inflation bulls and put a dent in the USD's charge higher. A possible stabilisation of the US yield curve around current levels may also put a lid on further USD strength for now - though our rates team do warn of possible further momentum-driven moves in long-dated US yields. The real risk to global markets, however, comes from the equity market - and the sell-off in global stocks; the spike in the VIX has all the hallmarks of another stock market rout similar to that seen in February 2018. With the USD having benefited from procyclical US equity inflows in recent quarters - we don't think all short-term stock market corrections will materially weigh on EUR/USD and instead, think that the risks are for a neutral-mildly bullish outlook for the pair in this scenario. In the week ahead, we'll get Sep PPI (Wed) and Sep CPI (Thu) - with the market looking for a significantly lower 2.4% reading (prior 2.7%). Besides this, we also get a number of Fed speakers.

- What's keeping the EUR in check is ongoing Italian budget noise. Our house view is that a budget compromise between Italy and EU will be reached later this year. We don’t think there will be any major sustained sell-off in BTPs – and for now re-denomination risks (think mini-BOTs talk) remain low. As such, we think the Italian budget will be more of a headwind – rather than an active drag – on the EUR in the short-term. With those risks set to fade later this year – the EUR could give back some of its recent losses. On the data front, our economists note that it will be the first moment of truth for the German economy, with hard macro data for July showing whether the rebound, which was suggested by confidence indicators, actually materialised. Elsewhere, the minutes of the European Central Bank's September meeting should shed some light on the ECB’s current thoughts on their path.

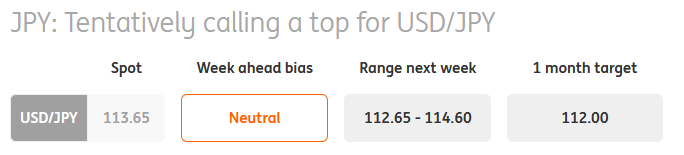

- While rising US bond yields took USD/JPY up to an intraday high of 1.1455 earlier in the week, the upward trend channel has stalled - with the pair moving back below 114. Part of the reason is the broad sell-off in global tech stocks - in particular the NASDAQ - which may well have fuelled JPY repatriation flows. We're tentatively inclined to say that this may be a short-term top for USD/JPY - but would need to see a sustained move below 1.1330/50 to provide confirmation of this. External risks ahead include any ongoing US stock market woes, negative US-China trade war rhetoric, negative global growth sentiment from the IMF WEO report (Tue) and a fading USD rally.

- As our economists have been chirping in recent weeks, the Japanese macro story is actually quite constructive. This puts the 30 October BoJ meeting into greater perspective - where markets may see risks of a more explicit hawkish tilt from Japanese policymakers. A run of strong Japanese data would only put more pressure on officials to engineer a steeper curve - look out for Aug core machine orders (Wed), Sep PPI (Thu) and Sep M3 money supply (Thu) as second-tier data to watch in the week ahead. We'll be keeping an eye on the 10-year JGB yield (currently around 0.15%) in and around BoJ bond auctions in the middle of next week.

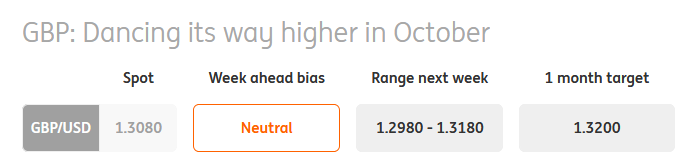

- With the pound safely seeing off the Tory Party Conference event risk relatively unscathed, the Brexit focus now turns to finalising a deal on the Irish border backstop ahead of the 17-18 October EU summit. Reports that a deal is 'very close' - with concessions likely from both UK and EU officials - have helped to lift GBP/USD above the 1.30 level despite a broadly weak European FX backdrop. Indeed, if it wasn't for a weaker EUR/USD - we think GBP/USD could be trading close to 1.32-1.33 as markets price out the risks of a no-deal Brexit. There are still hurdles to be overcome - not least whether a majority within the UK House of Commons would be willing to support any new Irish border backstop deal. But we take the view that the PM is unlikely to agree on a solution that doesn't meet this test - while the real issue for UK politicians is the nature of the future trading relationship with the EU (not the Irish border backstop). The latter won't be solved this side of March 2019 - and has no major implications on the odds of an imminent cliff-edge Brexit early next year. Hence, we think the short-term Brexit risks priced into GBP are likely to unwind even further as we firmly steer away from a possible catastrophic cliff-edge Brexit scenario.

- The standout data point in the week ahead will be the Aug monthly GDP release - and the consensus is for a +0.1% MoM increase (which takes the 3M/3M change to +0.6%). We also have Aug industrial production, manufacturing production and trade releases at the same time. Also next week, we'll be keeping an eye on the Bank of England's latest Financial Stability Report - especially some of the stress-testing scenarios around no-deal Brexit and UK external imbalances. Both may pose subtle headline risks to GBP - but the report itself shouldn't be a game-changer.

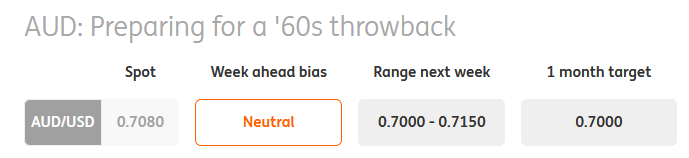

- Whether it's a weaker Chinese yuan, sliding industrial commodity prices, rising US yields or waning risk sentiment - the external backdrop looks pretty bleak for the AUD. It's, therefore, no surprise that we've seen AUD/USD fall down towards 0.70. While we continue to see 0.72 as a short-term anchor point for the pair - the challenging external environment could see AUD/USD significantly and sustainably undershoot this level. A move below 0.70 risks marking a new dawn for the pair - although for now, we think we may see something similar to Jan 2016 where AUD/USD only briefly traded below 0.70.

- There are some areas of the domestic economy that are still holding up well - the Aug retail sales data positively surprised (+0.3% MoM), while the latest PMI readings showed signs of recovery. The week ahead will see Sep foreign reserves data (Mon), consumer confidence (Wed) and Oct consumer inflation expectations (Thu). The semi-annual RBA Financial Stability Review (Fri) will be quite important - especially as the central bank may share more thoughts on the issue of domestic Australian banks independently raising mortgage lending rates and any fresh housing market vulnerabilities. Watch for CNY spillover risks early in the week as all eyes will be on where the PBoC fix USD/CNY after the return from the Golden Week Holiday; any fix north of 6.90 could trigger another round of selling pressures for Asia FX.

- While we got very little new information on the domestic front, NZD/USD slid by more than 2.5% as global markets were dominated by the rout in developed bond markets (led by the US). There's no doubt that the market is extremely short NZD/USD (the 14-day RSI is just hovering above the oversold 30 level); yet, with little in the way of positive newsflow in either the domestic or external markets, it's hard to pinpoint a catalyst for a short squeeze or bearish positioning adjustment.

- It's another relatively quiet week in the New Zealand calendar - with only Sep consumer spending data (Tue), REINZ housing data and Sep business manufacturing PMI (Thu). With the RBNZ having linked their dovish outlook to the lack of domestic business confidence, any further slowdown in manufacturing PMI (prior 52.0) could weigh on the kiwi.

- While we had thought that a confirmed NAFTA 2.0 deal (or 'USMCA' as the POTUS would like to rebrand it) should have seen USD/CAD trading down to 1.27-1.28 - the pair failed to make much headway below 1.28, as both volatility in elevated oil prices and a negative external environment kept the loonie under wraps. The latest Canadian jobs report saw strong employment growth (although all part-time employment) - while the main negative was the big miss wage growth (+2.2% YoY versus +2.6%). This mixed data didn't really help USD/CAD move back below 1.29.

- Looking to the week ahead, it's pretty quiet on the domestic data front - meaning that there are limited risks to BoC policy pricing (note markets are fully pricing in a 25bp rate hike on 24 Oct). The key risk will be oil prices and whether we get a reversal from here; it's worth noting that the CAD hasn't been participating in the rally in oil as Western Canada crude prices haven't been dragged higher with Brent (the differential is around -42.50 and the widest since 2013). This reinforces our strategic view that supply-side shocks in benchmark oil prices do not have a positive spillover effect into petro currencies.

- While headline risks for European politics (Italy and Brexit) remain fairly high - EUR/CHF has spent much of the past few weeks on an upward trend (since dipping below 1.12 in early September). We think this trend could continue higher towards 1.15 - although sporadic Italian budget noise will likely see knee-jerk moves lower in EUR/CHF. The evidence, however, is that moves lower have not been sustained - and we would only see a scenario in which EUR re-denomination risks (think mini-BOT talk) returns.

- On the domestic Swiss agenda, we saw some slightly softer Sep CPI readings (1.0% YoY versus 1.2% prior) restore pressure on the SNB to keep a relatively dovish policy stance. The week ahead sees Sep unemployment (Tue) - and the consensus is for the seasonally adjusted figure to show a lower jobless rate (2.5% expected; 2.6% prior). Look for EUR/CHF to remain supported above 1.1380 in the absence of any sustained European risk-off sentiment.

- As is the case in Sweden, the key data point of the week in Norway is the Sep CPI (Wed). Albeit it is expected to decline modestly, it should remain still at elevated levels (headline CPI at 3.2%YoY vs 3.4%). This means that the (positive) spill over into the NOK should be somewhat lower when compared to SEK. Nonetheless, the still robust CPI coupled with the rising oil prices suggest an ongoing support for NOK and the currency's outperformance vs SEK should the risk environment deteriorate again (with NOK/SEK moving back above the 1.1000 level)

- Apart from the September CPI, the new monthly Norway GDP indicator (Wed) will be published for the first time. Our economists expect it to show a continued solid expansion.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”