The Australian dollar was boosted after news that a trade war between the world’s two largest economies is on hold. China has agreed to purchase more U.S. goods in an effort to reduce the trade deficit with the U.S., which is placing on hold the previously announced $150bn of trade tariffs. China is Australia’s biggest trading partner due to strong demand for iron ore, coal and natural gas. So, this easing of trade tensions reduces the risk to the Australian economy as a result of softening demand from China and supports the Australian dollar. However, the Reserve Bank of Australia (RBA) is not expected to hike rates until mid-2019 and so the policy divergence with the U.S. Federal Reserve will exert bearish pressure on the Aussie.

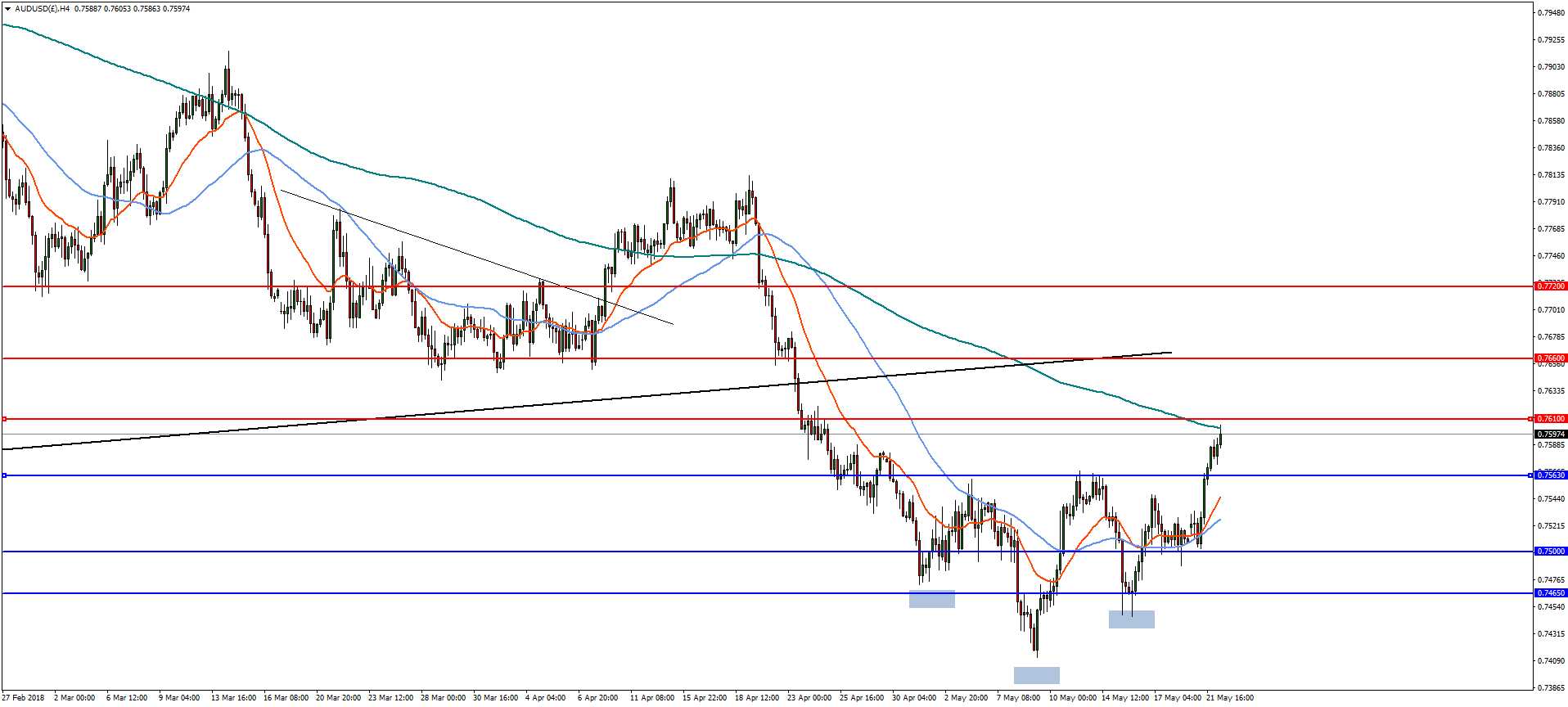

On the 4-hourly chart, AUD/USD has formed an inverted head and shoulders pattern with a measured upside target of 0.7720. Upside resistance will be found at 0.7610 and then the 61.8% retracement from highs of April near the trend line at 0.7660. A reversal below the neckline at 0.7563 will negate the outlook with support at 0.7500 and then 0.7465.

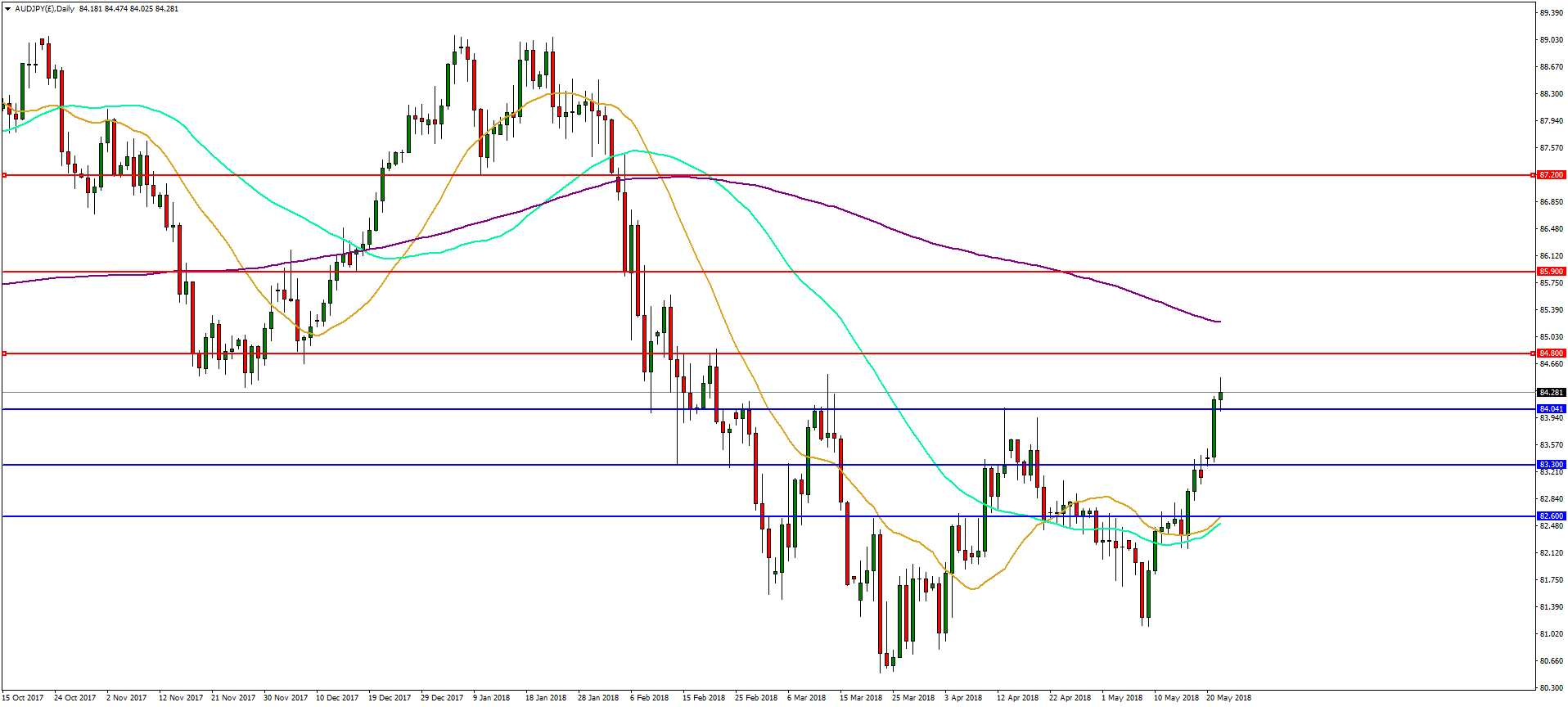

Strength in the AUD combined with the recent weakness in the JPY has resulted in a sharp rally for the AUD/JPY pair. In the daily timeframe, AUD/JPY has broken above the 84.00 level which opens the way for continued upside to resistance at the 50% retracement of the highs from January at 84.80 followed by the 61.8% retracement at 85.90. On the flip-side, a bearish reversal below 84.00 will see declines with support at 83.30 and 82.60.