Here’s a technical snapshot of the major FX pairs as we kick-start the trading week:

EUR/USD

Super Mario sent the Euro surging through the 1.1300 Trump election highs last week.

The ECB president’s upbeat speech was perceived by many to signal the end of the post-crisis easy money era.

Those of you that follow our FX market preview will know that EUR/USD has had a bullish technical structure since March. Indeed last week’s expansive move higher didn’t come as much of a surprise given that the market had been coiling within a series of tight ranges for over a month.

With prices finding resistance at the June 2016 highs (1.1450) on Friday, the market is taking a well-earned pause for breath. We’d expect the 1.1300 broken resistance barrier to create a platform of trend support, especially given that this structural level coincides with a 50% retracement of breakout move.

GBP/USD

Carney matched Draghi’s hawkish tone on Wednesday, stating that “some removal of monetary stimulus is likely to become necessary.”

While Cable didn’t quite tap the May highs, the market’s near exponential burst higher has created a backdrop of bullish momentum.

Bullish momentum in itself is of course no reason to buy. A distinct lack of price compression combined with a bucket load of Brexit-based political risk leads us to believe that there are higher probability swing trades elsewhere.

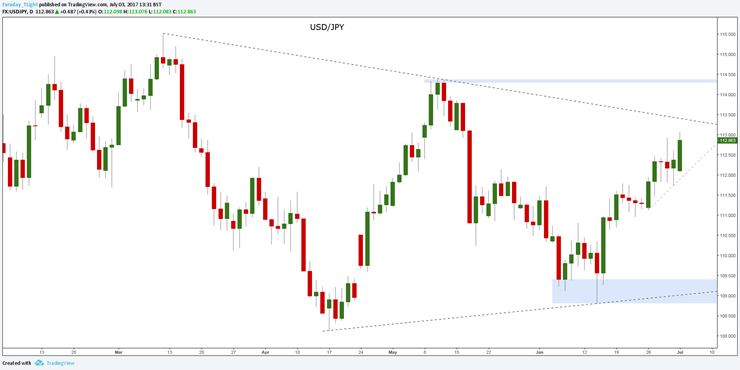

USD/JPY

This price chart represents a dog fight between two weak currencies and for once. the buck is coming out on top.

USD/JPY has been stair-stepping higher since mid June and prices are now poised to test trend-line resistance at 113.40.

Given the greenback’s under-performance against other peers we will continue to play yen weakness through the crosses.

AUD/USD

The Aussie enjoyed last week as much as any of the other majors, surging though 0.7640 resistance.

The horizontal level of broken resistance is confluent with an ascending trend line, creating a ‘value zone,’ which many trend continuation traders will be targeting.

Having formed a small pin-bar candle on Friday, Monday’s pullback ahead of the RBA's rate decision Monday evening is unsurprising.

Barring any major shock from the RBA, we’ll be looking to buy bullish reversal patterns within the value zone.