Major News this Week

The Greek saga is looking more and more like a soap opera that is a bit long in the tooth. Last week’s news fluctuated, with one day bringing us closer to solving the deadlock between the Eurogroup and the people of Greece, and the next informing us that there had been a setback. The Eurogroup meeting planned for Monday, February 13 (when Greece was supposed to receive €130 billion that the ministers of finance of the eurozone had promised if it would agree to their requirements) was postponed to today. The market has lost all sense of where this story line is heading, and the USD/CAD responds to each piece of news coming over the news wires. We also received inflation data on Friday that was in line with analysts’ expectations. Here are some highlights of the economic news expected this week.

Canada

Canadian economic news will be sparse this week. The only significant indicator expected is Retail Sales for December. This data will be known Tuesday and analysts expect the figure to be -0.2%, which would be down from its last reading at 0.5%. Mark Carney, Governor of the Bank of Canada, will deliver a speech in New York this Friday.

United States

The release of economic data will begin on Wednesday with figures on Existing Home Sales in January. Given the most recent U.S. data have been encouraging; economists are expecting homes sales to have increased by 400,000 since the last announcement. On Friday, we will know the University of Michigan Consumer Sentiment Index. This important U.S. measure is expected at 73, compared to 72.5 last month.

International

The week will be filled with international economic news. On Tuesday, Australia will release its report on the latest meeting of its central bank. It should be recalled that the bank decided to stop reducing rates, leaving them unchanged on the heels of two consecutive reductions. The report will provide an indication of expected future movements. Also on Tuesday, we will know the Consumer Confidence indicator for the eurozone. On Wednesday, the eurozone will release its Manufacturing Purchasing Managers’ Index, which is expected to be 50.5, and England will release a report on the latest meeting of its central bank. On Friday morning Germany will release annualized GDP data for the fourth quarter. Analysts believe that the figure will be unchanged, at 1.5%. Naturally, we will continue to monitor the Greek soap opera very closely, as in previous weeks. Have a good week!

The Loonie

The only function of economic forecasting is to make astrology look respectable.

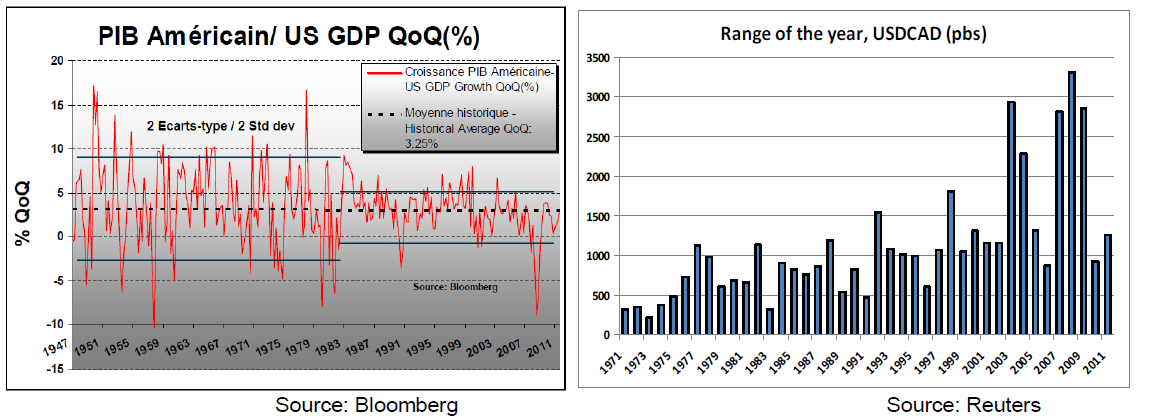

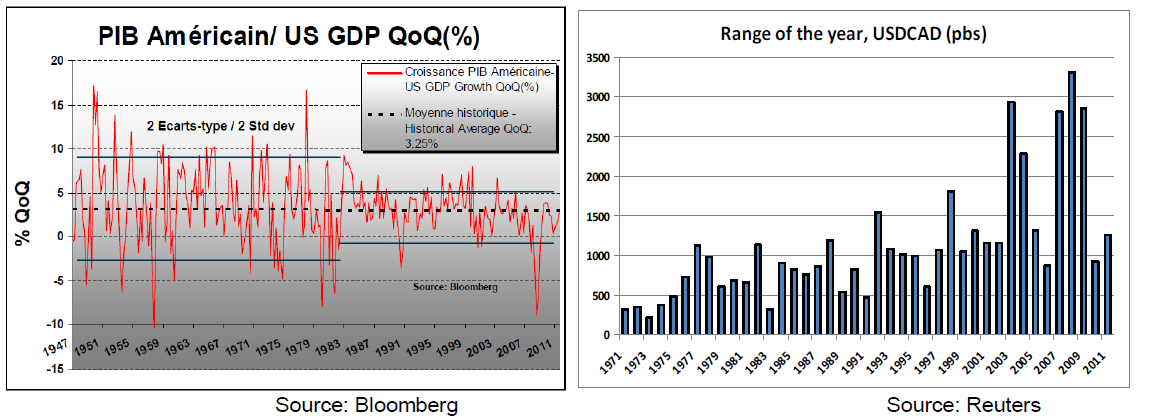

The following graph, which illustrates annualized quarterly changes in economic growth in the U.S., demonstrates how volatility in GDP growth has diminished over the years. It appears that a better understanding of economic drivers and the larger reliance on services has dampened swings in economic activity. Unfortunately, this improved economic stability has not reflected itself in financial market activity. As can be seen in the second graph, fluctuations in the currency market seem instead to have grown over the years. This phenomenon can also be seen in the stock markets, whose plunge in 2008 was the worst correction in the last 50 years.

What is the cause of this situation?

First, it is becoming increasingly easy (and inexpensive) to buy and sell financial products. This improved liquidity allows investors to react to the smallest changes in economic outlook. Since it is often difficult to determine a “value” for a financial asset, investors tend to trade on the basis of foreseeable changes in its price (its direction), without considering the asset’s actual value. This is why we are seeing more and more financial bubbles. In this context, forecasting prices of a financial asset has become even more difficult. In addition, the current economic environment makes forecasting even more complicated. Not only do we need to anticipate changes in the major macro-economic variables (GDP, inflation, the trade balance, etc.), we also need to forecast the actions (or inaction) of various political leaders. While a financial crisis rages on in most of the West, political leaders must make important (and unpopular) decisions on what comes next. As if this was not already difficult enough, we also need to predict the public’s reactions to such decisions.

In this environment, the surest prediction is that we will continue to see considerable volatility in the prices of financial assets. As seen in 2008, the sheer amplitude of these movements may catch us off guard, while events considered improbable based on the statistical record are occurring with increasing regularity. It has therefore become even more important to seek protection from the moods swings of the financial markets. Have a great week!

Technical Analysis:

USD/CAD: The expected rebound occurred, but failed to go above 1.0051, only reaching the start of the 1.0052-1.0072 range. In short, nothing much has happened to the USD/CAD, which has remained in the 0.9920-1.0072 range since January 25.

EUR/USD: The following graph provides daily data. Complete indecision, which can be summarized as follow: an inability to move above the 100-day moving average (the green line), an inability to return to the medium-term bearish channel (in pink), and closing right on its 20-day moving average (the red line), the crossing of which in mid- January (the red line) spurred a 450-point surge. The EUR/USD remains in a long-term bearish channel (in blue).

Volatility: We know that many FX pairs are experiencing extremely low volatility, and this represents a great opportunity to buy options at very reasonable prices, to cover rising or dropping levels, depending on whether you are a buyer or seller. Contact your dealer for more information.

Fixed Income

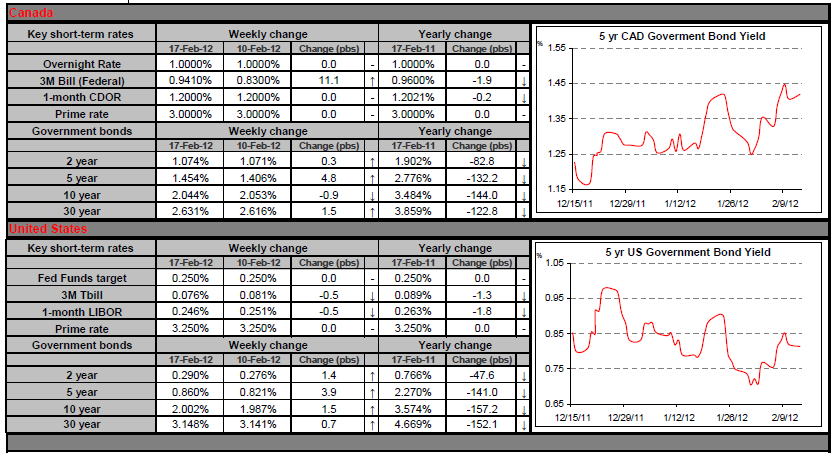

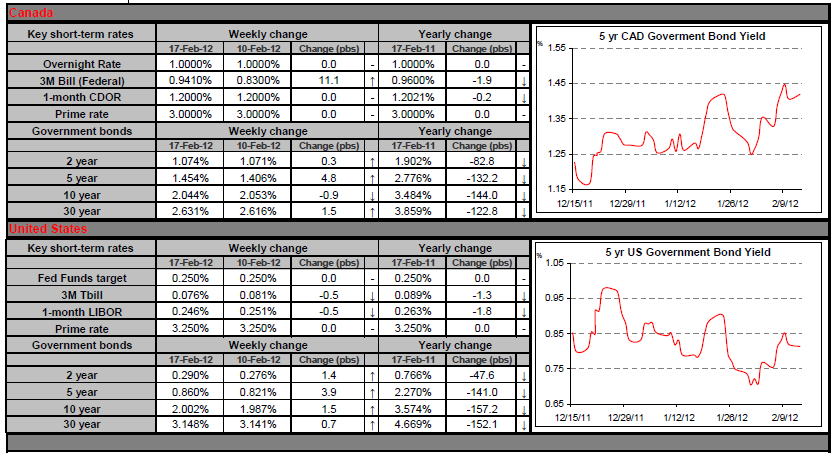

Canadian swap and government yields ended the week unchanged for most maturities, as domestic inflation numbers temper the effects of weaker US economic data, and the overall nervousness caused by European markets.

Yields dropped last Tuesday, as weaker-than-expected U.S. retail sales data and a series of downgrades in Europe by credit rating agency Moody's fuelled demand for Canadian government bonds.

Market sentiment shifted on Thursday on encouraging news for the US housing and labor markets and signs of progress on the Greek debt crisis.

The move continued Friday morning after the release of higher inflation numbers in Canada. The total inflation rate climbed 2.5%, outpacing the 2.3% anticipated by most economists. Although the number was still in line with the central bank's forecasts, traders reduced their bets for a rate cut in the second half of 2012.

This week, we will watch a series of corporate earnings releases from blue chip companies (Walmart, Home Depot, Kraft, Dell …), and a few key economic indicators. Tuesday will see the release of Canadian retail sales; the German GDP is scheduled for Thursday, while US housing market statistics are expected on Friday morning. Enjoy your week.

Commodities

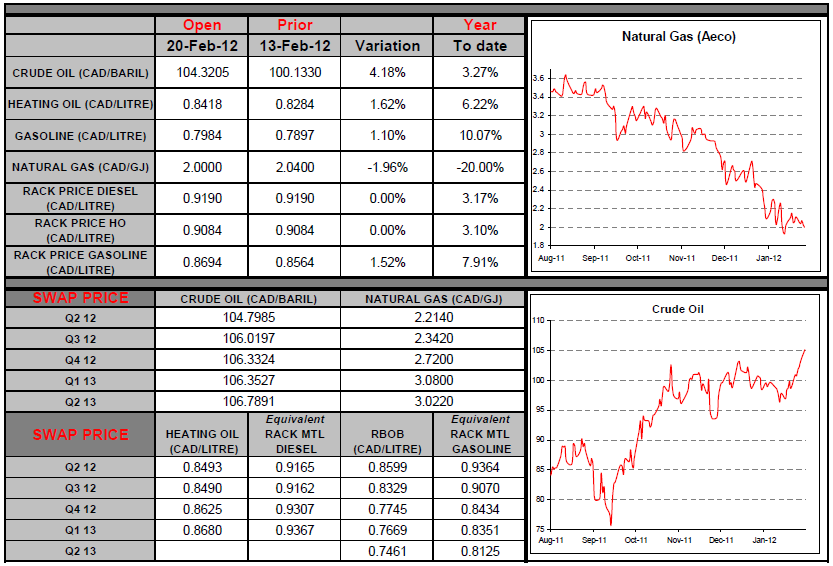

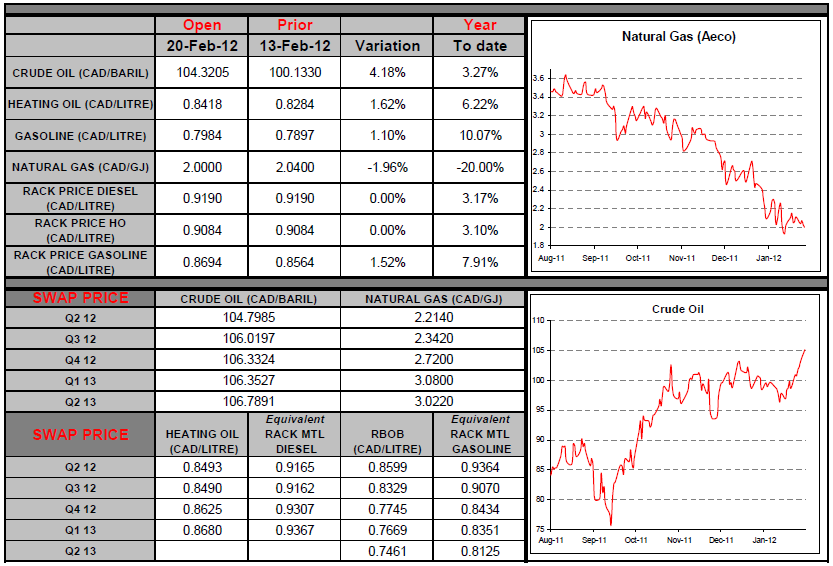

In response to the oil embargo set by the European Union (EU), Iran will increase its deliveries of crude oil to China. It now seems clear that the Chinese government will not adhere to the sanctions imposed by the U.S. The tug-of-war between the West and Iran is far from over, and the countries of Europe, already hard hit by the financial crisis, will be the next victims of this confrontation. The price of a barrel of light sweet crude (WTI) for delivery in March surged during the week, closing 5% higher. The price of heating oil, the main index used to hedge the price of diesel, was stable for the week, following a very strong increase earlier in the month. Setting aside the fears raised by the situation in Iran, the possibility of an agreement on the Greek sovereign debt problem is good news for markets, which expect conditions in Europe to stabilize. Combined with better data announced in the U.S., this good news could also support the price of oil over the coming months.

Last Week at a Glance

Canada – In January, the year-on-year inflation rate sprang to 2.5%. On a month-over-month basis, the CPI rose 0.5% in seasonally adjusted terms. The movement was driven mostly by the transportation component (+1.3%). Six of the eight broad CPI categories saw monthly advances. Health/personal care and recreation/education were flat on a seasonally adjusted basis. The Bank of Canada core CPI, which shocked with its softness in December, bounced back 0.2% (0.3% seasonally adjusted). This nudged the year-on-year rate two ticks higher to 2.1%. Still, over the past three months, core inflation has remained subdued, progressing only 1.0% annualized. In December, Canadian factory shipments jumped 0.6%, well short of the 2% gain expected by consensus. Twelve of the 21 industries rolled forward. The main thrust was provided by transportation equipment (+3.7%), with autos the main contributor. These increases more than offset decreases in petroleum and coal products and machinery. In volume terms, shipments grew 1.2%. Elsewhere, Canadian securities transactions data for December revealed that foreigners added C$7.4 billion in Canadian assets to their portfolios. These included a mix of bonds (+C$2.1 billion), money market instruments (+C$3.5 billion) and stocks (+C$1.7 billion).

United States – In January, the consumer price index rose 0.2% over the prior month. Both energy and food prices were up 0.2%. The annual inflation rate dropped a tick to 2.9%. Excluding food and energy, prices climbed a consensus-matching 0.2% on impulse from higher medical care, tobacco and apparel prices, among others. These increases more than offset declines in other segments, including vehicles where prices pursued their downward slant for a fifth month running. The year-on-year core CPI ticked up to 2.3%. On a three-month annualized basis, core CPI stood at 2.2%, a five-month high.

Still in January, retail sales swelled 0.4%, half as much as expected by consensus. The prior month was revised down one tick to flat. The downside surprise to the headline results was due to autos. It should be noted that while unit auto sales were actually very strong in the month, dollar revenues slipped 1.1% on the back of discounts at auto dealerships and of rental car purchases, which are accounted for under business fixed investment. Excluding autos, sales were much stronger, rising 0.7% after sinking a downwardly revised 0.5% in December. The ex-autos increase was fuelled by a rebound in gasoline (+1.4%), sporting goods (+1.1%) and food/beverages (+1.3%) sales. These more than offset declines elsewhere, including in health/personal care (-0.3%). Discretionary spending (i.e., retail sales excluding gasoline, groceries, and health/personal care) notched up 0.1% after rising 0.5% the month before. With January’s gains, real retail spending has now risen at more than 7% annualized since consumer confidence struck bottom back in August. This is the greatest five-month increase in retail sales since December 2010. After expanding at an annualized rate of 8.7% in 2011Q4, real retail spending growth is presently tracking at 1.9% annualized in 2012Q1, which is consistent with moderating yet still healthy GDP growth on the quarter. Again in January, U.S. industrial production held level instead of climbing 0.7% as per consensus expectations. However, the prior month was revised up six ticks to +1.0%. Capacity utilization fell one tick to 78.5% (from an upwardly revised 78.6%). Manufacturing production expanded 0.7% after swelling an upwardly revised 1.5% in December, thanks primarily to auto production, which ramped up 6.8%. Mining output sank 1.8% after posting robust gains in the prior three months. After showing unexpected weakness in December, utilities contracted sharply once again (-2.5%), probably due to unseasonably warmer winter temperatures. In February, the Philadelphia Fed index of manufacturing activity rose to a four-month high of 10.2. The new-orders component reached 11.7, its highest point since last April. The shipments index soared to 15, also a high mark since April. The New York Fed’s Empire Index of manufacturing activity flew to 19.53 in the month, its highest level since June 2010. The two activity indices point to increased factory activity in February consistent with Q1 GDP growth of about 2% annualized. Back in January, U.S. housing starts bounced back sharply to 699K, topping consensus expectations for 675K units. Single starts fell after three straight months of solid growth, while multi-unit starts rebounded slightly after a disappointing December. Building permits rose to 676K (from a downwardly revised 671K), roughly in line with consensus expectations. Single and multi-unit permits were up 0.9% and 0.4%, respectively. Hence, the January drop in single starts is not likely the start of a downtrend.

Euro area – The eurozone economy shrank less than expected in Q4. According to the Eurostat flash estimate, GDP fell 0.3% (non-annualized) after gaining 0.3% the previous quarter. France saw its economy grow 0.2%, providing some offset to the weakness in other member countries, including Germany (-0.2%), Italy (-0.7%) and the Netherlands (-0.7%). Of the countries that have reported GDP estimates, Portugal recorded the weakest economic activity (-1.3%). In comparison, the economy of the United States grew 0.7% in Q42011, while those of Japan and the United Kingdom contracted 0.6% and 0.2%, respectively.

The Greek saga is looking more and more like a soap opera that is a bit long in the tooth. Last week’s news fluctuated, with one day bringing us closer to solving the deadlock between the Eurogroup and the people of Greece, and the next informing us that there had been a setback. The Eurogroup meeting planned for Monday, February 13 (when Greece was supposed to receive €130 billion that the ministers of finance of the eurozone had promised if it would agree to their requirements) was postponed to today. The market has lost all sense of where this story line is heading, and the USD/CAD responds to each piece of news coming over the news wires. We also received inflation data on Friday that was in line with analysts’ expectations. Here are some highlights of the economic news expected this week.

Canada

Canadian economic news will be sparse this week. The only significant indicator expected is Retail Sales for December. This data will be known Tuesday and analysts expect the figure to be -0.2%, which would be down from its last reading at 0.5%. Mark Carney, Governor of the Bank of Canada, will deliver a speech in New York this Friday.

United States

The release of economic data will begin on Wednesday with figures on Existing Home Sales in January. Given the most recent U.S. data have been encouraging; economists are expecting homes sales to have increased by 400,000 since the last announcement. On Friday, we will know the University of Michigan Consumer Sentiment Index. This important U.S. measure is expected at 73, compared to 72.5 last month.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

International

The week will be filled with international economic news. On Tuesday, Australia will release its report on the latest meeting of its central bank. It should be recalled that the bank decided to stop reducing rates, leaving them unchanged on the heels of two consecutive reductions. The report will provide an indication of expected future movements. Also on Tuesday, we will know the Consumer Confidence indicator for the eurozone. On Wednesday, the eurozone will release its Manufacturing Purchasing Managers’ Index, which is expected to be 50.5, and England will release a report on the latest meeting of its central bank. On Friday morning Germany will release annualized GDP data for the fourth quarter. Analysts believe that the figure will be unchanged, at 1.5%. Naturally, we will continue to monitor the Greek soap opera very closely, as in previous weeks. Have a good week!

The Loonie

The only function of economic forecasting is to make astrology look respectable.

The following graph, which illustrates annualized quarterly changes in economic growth in the U.S., demonstrates how volatility in GDP growth has diminished over the years. It appears that a better understanding of economic drivers and the larger reliance on services has dampened swings in economic activity. Unfortunately, this improved economic stability has not reflected itself in financial market activity. As can be seen in the second graph, fluctuations in the currency market seem instead to have grown over the years. This phenomenon can also be seen in the stock markets, whose plunge in 2008 was the worst correction in the last 50 years.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

What is the cause of this situation?

First, it is becoming increasingly easy (and inexpensive) to buy and sell financial products. This improved liquidity allows investors to react to the smallest changes in economic outlook. Since it is often difficult to determine a “value” for a financial asset, investors tend to trade on the basis of foreseeable changes in its price (its direction), without considering the asset’s actual value. This is why we are seeing more and more financial bubbles. In this context, forecasting prices of a financial asset has become even more difficult. In addition, the current economic environment makes forecasting even more complicated. Not only do we need to anticipate changes in the major macro-economic variables (GDP, inflation, the trade balance, etc.), we also need to forecast the actions (or inaction) of various political leaders. While a financial crisis rages on in most of the West, political leaders must make important (and unpopular) decisions on what comes next. As if this was not already difficult enough, we also need to predict the public’s reactions to such decisions.

In this environment, the surest prediction is that we will continue to see considerable volatility in the prices of financial assets. As seen in 2008, the sheer amplitude of these movements may catch us off guard, while events considered improbable based on the statistical record are occurring with increasing regularity. It has therefore become even more important to seek protection from the moods swings of the financial markets. Have a great week!

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Technical Analysis:

USD/CAD: The expected rebound occurred, but failed to go above 1.0051, only reaching the start of the 1.0052-1.0072 range. In short, nothing much has happened to the USD/CAD, which has remained in the 0.9920-1.0072 range since January 25.

EUR/USD: The following graph provides daily data. Complete indecision, which can be summarized as follow: an inability to move above the 100-day moving average (the green line), an inability to return to the medium-term bearish channel (in pink), and closing right on its 20-day moving average (the red line), the crossing of which in mid- January (the red line) spurred a 450-point surge. The EUR/USD remains in a long-term bearish channel (in blue).

Volatility: We know that many FX pairs are experiencing extremely low volatility, and this represents a great opportunity to buy options at very reasonable prices, to cover rising or dropping levels, depending on whether you are a buyer or seller. Contact your dealer for more information.

Fixed Income

Canadian swap and government yields ended the week unchanged for most maturities, as domestic inflation numbers temper the effects of weaker US economic data, and the overall nervousness caused by European markets.

Yields dropped last Tuesday, as weaker-than-expected U.S. retail sales data and a series of downgrades in Europe by credit rating agency Moody's fuelled demand for Canadian government bonds.

Market sentiment shifted on Thursday on encouraging news for the US housing and labor markets and signs of progress on the Greek debt crisis.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The move continued Friday morning after the release of higher inflation numbers in Canada. The total inflation rate climbed 2.5%, outpacing the 2.3% anticipated by most economists. Although the number was still in line with the central bank's forecasts, traders reduced their bets for a rate cut in the second half of 2012.

This week, we will watch a series of corporate earnings releases from blue chip companies (Walmart, Home Depot, Kraft, Dell …), and a few key economic indicators. Tuesday will see the release of Canadian retail sales; the German GDP is scheduled for Thursday, while US housing market statistics are expected on Friday morning. Enjoy your week.

Commodities

In response to the oil embargo set by the European Union (EU), Iran will increase its deliveries of crude oil to China. It now seems clear that the Chinese government will not adhere to the sanctions imposed by the U.S. The tug-of-war between the West and Iran is far from over, and the countries of Europe, already hard hit by the financial crisis, will be the next victims of this confrontation. The price of a barrel of light sweet crude (WTI) for delivery in March surged during the week, closing 5% higher. The price of heating oil, the main index used to hedge the price of diesel, was stable for the week, following a very strong increase earlier in the month. Setting aside the fears raised by the situation in Iran, the possibility of an agreement on the Greek sovereign debt problem is good news for markets, which expect conditions in Europe to stabilize. Combined with better data announced in the U.S., this good news could also support the price of oil over the coming months.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Last Week at a Glance

Canada – In January, the year-on-year inflation rate sprang to 2.5%. On a month-over-month basis, the CPI rose 0.5% in seasonally adjusted terms. The movement was driven mostly by the transportation component (+1.3%). Six of the eight broad CPI categories saw monthly advances. Health/personal care and recreation/education were flat on a seasonally adjusted basis. The Bank of Canada core CPI, which shocked with its softness in December, bounced back 0.2% (0.3% seasonally adjusted). This nudged the year-on-year rate two ticks higher to 2.1%. Still, over the past three months, core inflation has remained subdued, progressing only 1.0% annualized. In December, Canadian factory shipments jumped 0.6%, well short of the 2% gain expected by consensus. Twelve of the 21 industries rolled forward. The main thrust was provided by transportation equipment (+3.7%), with autos the main contributor. These increases more than offset decreases in petroleum and coal products and machinery. In volume terms, shipments grew 1.2%. Elsewhere, Canadian securities transactions data for December revealed that foreigners added C$7.4 billion in Canadian assets to their portfolios. These included a mix of bonds (+C$2.1 billion), money market instruments (+C$3.5 billion) and stocks (+C$1.7 billion).

United States – In January, the consumer price index rose 0.2% over the prior month. Both energy and food prices were up 0.2%. The annual inflation rate dropped a tick to 2.9%. Excluding food and energy, prices climbed a consensus-matching 0.2% on impulse from higher medical care, tobacco and apparel prices, among others. These increases more than offset declines in other segments, including vehicles where prices pursued their downward slant for a fifth month running. The year-on-year core CPI ticked up to 2.3%. On a three-month annualized basis, core CPI stood at 2.2%, a five-month high.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Still in January, retail sales swelled 0.4%, half as much as expected by consensus. The prior month was revised down one tick to flat. The downside surprise to the headline results was due to autos. It should be noted that while unit auto sales were actually very strong in the month, dollar revenues slipped 1.1% on the back of discounts at auto dealerships and of rental car purchases, which are accounted for under business fixed investment. Excluding autos, sales were much stronger, rising 0.7% after sinking a downwardly revised 0.5% in December. The ex-autos increase was fuelled by a rebound in gasoline (+1.4%), sporting goods (+1.1%) and food/beverages (+1.3%) sales. These more than offset declines elsewhere, including in health/personal care (-0.3%). Discretionary spending (i.e., retail sales excluding gasoline, groceries, and health/personal care) notched up 0.1% after rising 0.5% the month before. With January’s gains, real retail spending has now risen at more than 7% annualized since consumer confidence struck bottom back in August. This is the greatest five-month increase in retail sales since December 2010. After expanding at an annualized rate of 8.7% in 2011Q4, real retail spending growth is presently tracking at 1.9% annualized in 2012Q1, which is consistent with moderating yet still healthy GDP growth on the quarter. Again in January, U.S. industrial production held level instead of climbing 0.7% as per consensus expectations. However, the prior month was revised up six ticks to +1.0%. Capacity utilization fell one tick to 78.5% (from an upwardly revised 78.6%). Manufacturing production expanded 0.7% after swelling an upwardly revised 1.5% in December, thanks primarily to auto production, which ramped up 6.8%. Mining output sank 1.8% after posting robust gains in the prior three months. After showing unexpected weakness in December, utilities contracted sharply once again (-2.5%), probably due to unseasonably warmer winter temperatures. In February, the Philadelphia Fed index of manufacturing activity rose to a four-month high of 10.2. The new-orders component reached 11.7, its highest point since last April. The shipments index soared to 15, also a high mark since April. The New York Fed’s Empire Index of manufacturing activity flew to 19.53 in the month, its highest level since June 2010. The two activity indices point to increased factory activity in February consistent with Q1 GDP growth of about 2% annualized. Back in January, U.S. housing starts bounced back sharply to 699K, topping consensus expectations for 675K units. Single starts fell after three straight months of solid growth, while multi-unit starts rebounded slightly after a disappointing December. Building permits rose to 676K (from a downwardly revised 671K), roughly in line with consensus expectations. Single and multi-unit permits were up 0.9% and 0.4%, respectively. Hence, the January drop in single starts is not likely the start of a downtrend.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Euro area – The eurozone economy shrank less than expected in Q4. According to the Eurostat flash estimate, GDP fell 0.3% (non-annualized) after gaining 0.3% the previous quarter. France saw its economy grow 0.2%, providing some offset to the weakness in other member countries, including Germany (-0.2%), Italy (-0.7%) and the Netherlands (-0.7%). Of the countries that have reported GDP estimates, Portugal recorded the weakest economic activity (-1.3%). In comparison, the economy of the United States grew 0.7% in Q42011, while those of Japan and the United Kingdom contracted 0.6% and 0.2%, respectively.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.