Nerves take ahold of markets

Nervousness and the fear of global slowing got the best of markets Tuesday further to disappointing Chinese manufacturing data, a continued slump in crude oil and corporate earnings that failed to meet expectations. Over the course of an eventful day, the loonie started off at 0.80, then plummeted 1.53% to close at 0.786, following in the path of its counterpart from Down Under, the Australian dollar, which plunged after the Reserve Bank of Australia announced a surprise key rate cut. Stocks around the world saw their largest downturn in close to a month, although it should be noted that profit-taking was inevitable, given the substantial 15% gains by the S&P 500 since February supported by the rally in crude oil. We’ll have to see whether a oneday drop turns into a more substantial correction in the days to come.

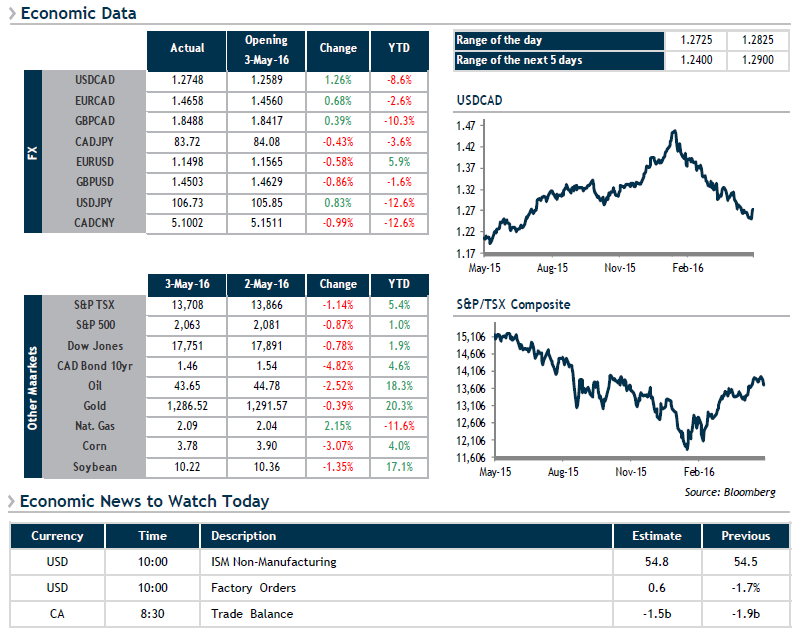

Today in Canada, we’ll be keeping an eye on International Merchandise Trade figures for March, which should be slightly better thanks to rising oil prices. South of the border, the ISM Non-Manufacturing Index and Factory Orders will be announced this morning. Crude Oil Inventories are also on tap and will set the tone for oil prices in the coming days. Stock markets are under pressure this morning and appear poised to rise, as does the USD/CAD pair, with potential resistance worth monitoring around 1.2860.