After another excellent week for the Canadian dollar, our clients who export goods south of the border are getting increasingly nervous. Since the high of 1.4690 recorded on January 20, the Canadian dollar has gained 11% against the greenback, a surge that has taken many experts by surprise. Rising crude oil prices, the possibility of a more dovish than anticipated Fed in 2016 and the change in tone seen over the past two Bank of Canada meetings have been the main factors behind the growth of the CAD.

The details of tomorrow’s federal budget will be examined closely by investors and the scale of the infrastructure projects announced by the Trudeau government will bear particular scrutiny. Higher-thanexpected infrastructure spending would reduce the chances of another rate cut by the BoC and would favour the

loonie.

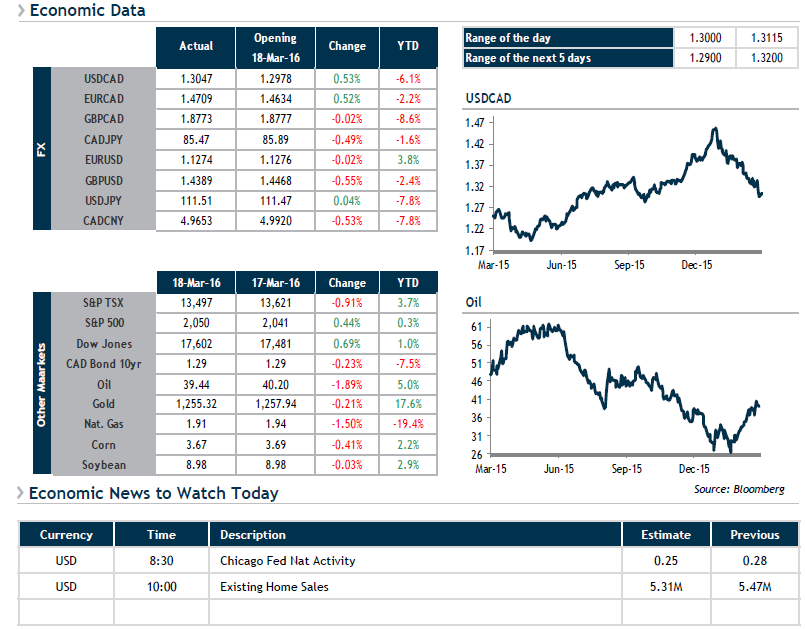

Today, our eyes will be south of the 49th parallel for the Chicago Fed National Activity Index at 8:30 this morning as well as Existing Home Sales at 10 a.m. Both crude oil and the loonie are down slightly this morning.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.