Investing.com’s stocks of the week

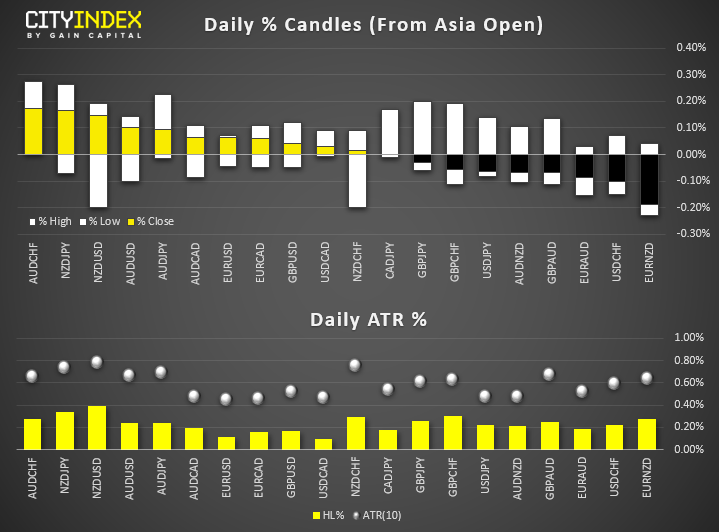

FX markets remain confined within tight ranges, following Friday’s volatile U.S. session. CHF and AUD are currently the strongest majors, EUR and USD are the weakest. The USD pared some gains from its NFP-driven strength.

- Equities were mostly lower as Friday’s strong NFP reduced expectations of the Fed cutting by 50bps later this month.

- ECB’s Villeroy said their next move will be decided by data, not the markets, in an interview released today.

- Trump (not for the first time) claimed China is devaluing their currency whilst speaking with reporters. He also said the Fed would lower rates if they knew what they were doing.

- On the data front, Japan’s machinery orders fell -7.8% in May, its fastest monthly decline since September. Bank lending also eased off to 2.3% YoY (2.6% prior). The Nikkei is currently trading at a 6-day low.

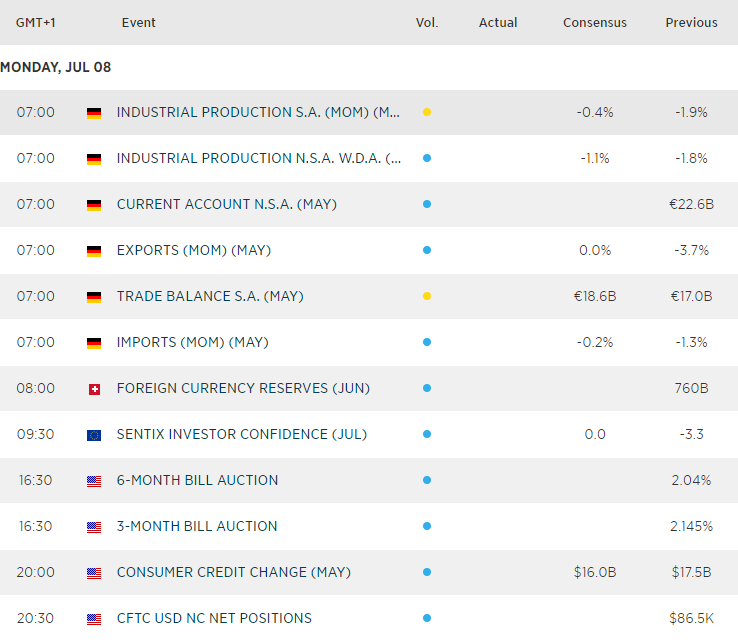

Up Next:

- Germany’s industrial output will be on the radar for EUR traders, after it fell -1.9% in May, its fastest rate of contraction since August 2014 (especially in light of Villeroy’s comment). With expectation for data to improve, it leaves potential for disappointment and a weaker Euro if it misses the mark.

- CFTC data will also be released in the US session, which has been delayed due to the US public holiday last week (so expect our weekly COT report to follow).