- NZD CPI rose in line with expectations to alleviate a little pressure for RBNZ to ease in August. NZD remains the firmest major this session and over the past month. NZ TWI has moved up to a 3-month high.

- AUD and CHF are currently the weakest majors. Although AUD/USD did briefly move to an 8-day high in quiet trade.

- Equities and index futures traded cautiously higher ahead of earnings and US data.

- Brexit concerns continued to weigh on GBP and EUR, with investors nervous that Boris Johnson winning the leadership contest in just a couple of weeks.

Up next:

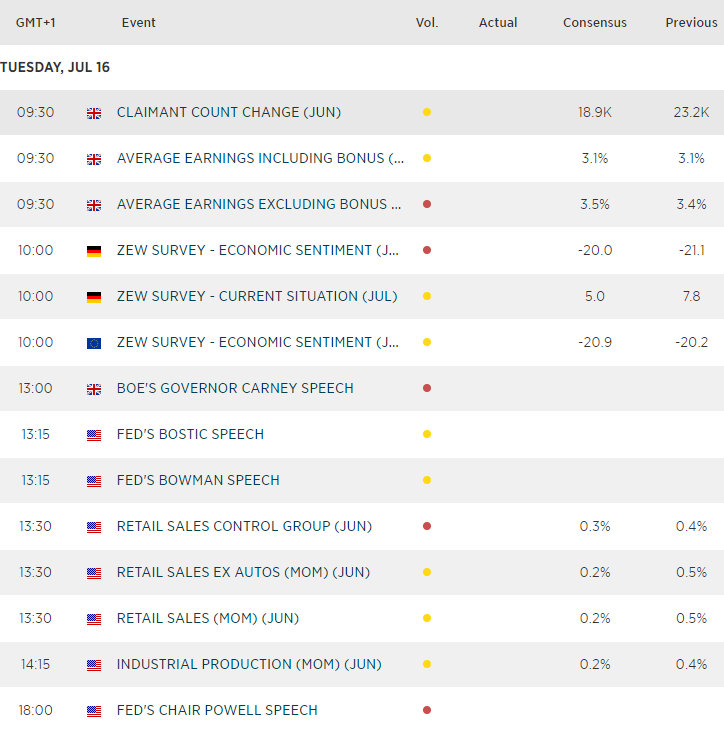

- U.K. employment data puts GBP crosses into focus, at a time when traders are adjusting to the potential for BOE to ease in-light of recent comments (therefore likely sensitive to any weakness in the data).

- Germany’s ZEW economic sentiment, which is seen as a leading indicator for the Eurozone’s broader ESI, has turned markedly lower at -21.1%, which could keep EUR crosses under pressure if these cracks continue to widen.

- U.S. retail sales, industrial production, manufacturing production make the bulk of data in the U.S. session to make the major in focus for traders.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI