Harsco Corporation (NYSE:HSC) yesterday announced that its Environmental division secured $38-million contract from Moon Iron & Steel Company S.A.O.C. (“MISCO”). The news came in a week’s time after the company reported having completed the acquisition of Hatboro, PA-based Clean Earth, Inc. for approximately $625 million.

It is worth mentioning here that Harsco’s share price increased roughly 0.3% yesterday, closing the trading session at $26.97.

MISCO is a steel manufacturing complex with a capacity of 1.2 million tons. Notably, Gulf Investment Corporation, Oman Development Fund S.A.O.C., Sultan’s Special Forces Pension Fund and some steel industry experts are the promoters of MISCO.

Inside the Headlines

As noted, Harsco’s Environmental division will provide mill services, starting October 2019, to MISCO’s Sohar, Oman-based steel manufacturing facility. Among mill services, Harsco will engage in metal recovery, digging under furnace and related cleaning, scrap collection (internal) and related processing, material handling, site cleaning, and other activities.

We believe that such contract wins are reflective of Harsco’s commitment toward offering quality services to customers. In particular, the aforementioned contract will strengthen the company’s footprints in Africa and the Middle East.

Before we proceed further, it is worth mentioning that Harsco provides value-added environmental solutions through the Harsco Metal & Minerals segment. This segment accounted for approximately 58.4% of the company’s revenues generated in the first quarter of 2019.

Zacks Rank and Price Performance of Harsco

Harsco, with approximately $2.2-billion market capitalization, currently carries a Zacks Rank #4 (Sell).

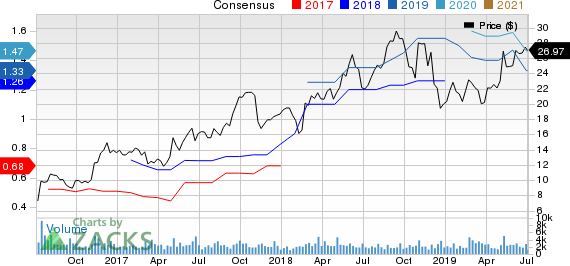

In the past 60 days, earnings estimates for the company have been lowered, indicating bearish sentiments. The Zacks Consensus Estimate for Harsco’s earnings is pegged at $1.33 for 2019 and $1.47 for 2020, suggesting a decline of 6.3% and 6.4% from the respective 60-day-ago figures.

Harsco Corporation Price and Consensus

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Chart Industries, Inc. (GTLS): Free Stock Analysis Report

Harsco Corporation (HSC): Free Stock Analysis Report

Original post

Zacks Investment Research