Stocks Rebound After Trump Tariffs Rattle Markets

US equity markets are on course to open relatively unchanged at the start of the week after bouncing back from early losses on Friday, which came as Donald Trump announced hefty tariffs on steel and aluminium.

With the US President threatening tariffs on car imports should the EU retaliate, there is a real possibility that a trade war could unfold, which woudn't work to anyone’s benefit. The prospect of this rattled markets on Friday, but it didn’t last long and US equities quickly bounced back, with the S&P 500 ending the day half a percentage point higher. European stocks have been playing catch up at the start of the week, although automakers continue to struggle after Trump’s threats.

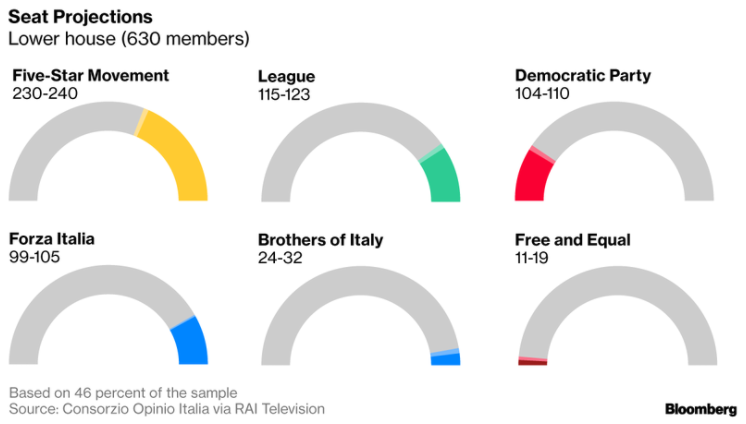

FTSE MIB Under Pressure As Populist Parties Are Italian Election's Big Winners

The Italian election over the weekend likely failed to produce a majority government, with projections showing the Five Star Movement was the strongest single party and the centre-right block received the most votes. Negotiations to form a government are likely to take months, and could yield a coalition between far-right party League and the Five Star Movement, which could be very problematic for Italy’s EU partners.

While European stock indices have largely shrugged off the Italian election result, the FTSE MIB was down more than 1% in early trade, as investors worry that prolonged negotiations and the possibility of an anti-establishment majority could harm the economy. The last 12 months have seen a number of anti-establishment parties defeated in elections across the EU, which was celebrated as a victory over the populists and an endorsement for the EU project. Conversely, the Italian vote suggests people aren’t as supportive as European leaders would have us believe.

Mixed PMIs Seen Across Europe

The euro has also been unaffected by the result, and trades only marginally lower on the day. PMI data for the region won’t be helping the currency, with the final readings being revised a little lower, although they still remain comfortably in growth territory. Retail Sales data also suggested that January wasn’t a great month for the region compared with December, although gradual progress is being seen year on year.

EUR/USD Daily Chart

The UK services PMI was more encouraging though, jumping to 54.5 in February, its highest since October. The services sector is incredibly important to the UK, covering more than three quarters of the country's total output, so movements in the PMI tend to be monitored very closely and can give a strong indication about the health of the economy, particularly during challenging periods like the current one. Still to come we have US final services and ISM non-manufacturing PMIs and we’ll also hear from FOMC voter Randal Quarles.