For the strategies of covered call writing and selling cash-secured puts, we are selling the right, but not the obligation, to buy or sell 100 shares of the underlying security. That security can be a stock or and exchange-traded fund (ETF). In this article, I will highlight ETFs and demonstrate a few approaches to funding our option-selling portfolios with these securities.

Pros and Cons of ETFs

Pros

ETFs consist of a basket of stocks and, as a result, are instantly diversified to some extent. Therefore, to achieve appropriate portfolio diversification, we would require less cash to purchase the underlying securities. For individual stocks, the BCI guideline is that no one stock or industry should represent more than 20% of our total portfolios. Furthermore, ETFs require less management because we are not concerned about earnings reports, so we can actually stay with an ETF indefinitely if it remains a top-performer.

Cons

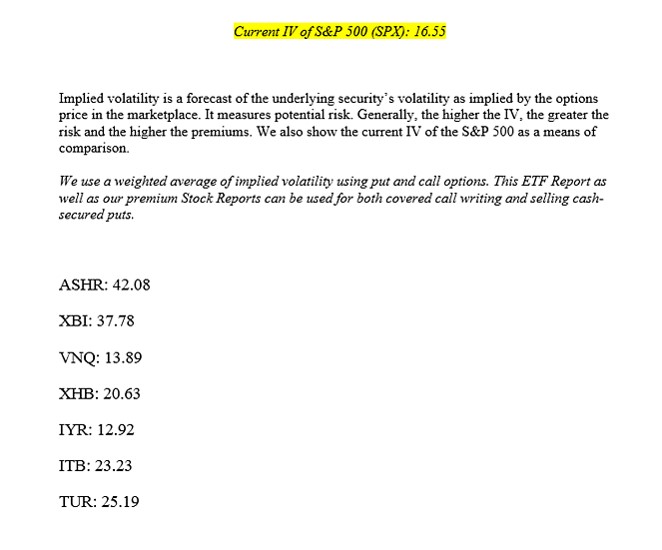

Since ETFs are baskets of stocks (in most cases), some are going up in value, some down, so as an aggregate the implied volatility (IV) of the security is lower than that of a typical stock. A lower IV means lower option premiums so when using ETFs we should set lower goals for our initial returns. I use 2% – 4%/month in my portfolios with individual stocks and 1% – 2% in my mother’s portfolio with ETFs.

Considerations when selecting ETFs for option-selling

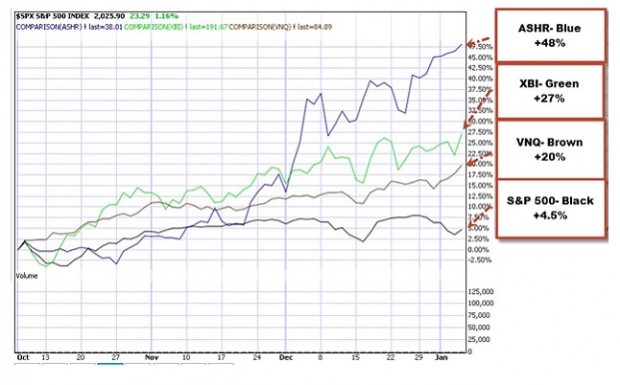

In the BCI methodology, we favor 1-month options (some members use weeklys and others longer-term options but most use monthlys as I do…all can work). Market segments fall in and out of favor with institutional investors so we want those currently in favor. As with stocks, we insist on minimum trading volume of 250,000 shares per day and adequate open interest for the associated options. To assess ETFs currently in favor, we compare the 3-month price performance to that of the S&P 500 and insist that the ETF is an out-performer with a relative strength (RS) rating greater than 60. In the chart below is an example of ETF out-performers (DB X-trackers Harvest China (NYSE:ASHR), SPDR S&P Biotech (NYSE:XBI), Vanguard Reit (ARCA:VNQ)), taken from our Premium Members ETF Report (produced weekly for members):

Exposure to the S&P 500 only

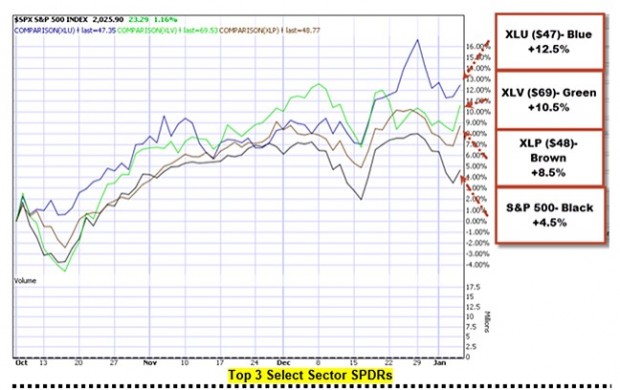

The Select Sector SPDRs are unique ETFs that divide the S&P 500 into 9 sector index funds. Many of our members use the current top 3 of these sectors to fund their option-selling portfolios as shown in the screenshot below, taken from a Premium ETF Report:

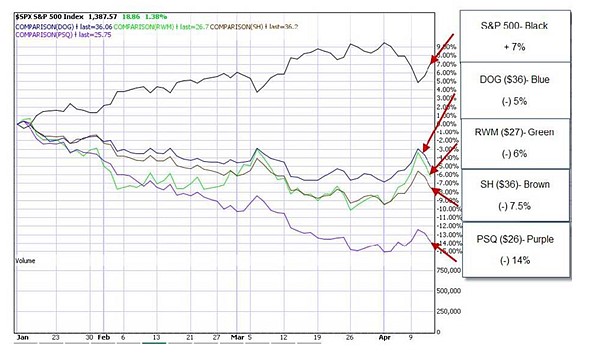

Extreme bear market considerations

Although it is rare that we would resort to these securities (2008 was an exception), Inverse ETFs use derivatives to bet against the direction of the financial markets. These are also known as bear or short ETFs. Many have options associated with them as well as adequate open interest for the near-the-money option strikes. Since the market historically goes up in value in the long run, these securities historically go down in value but may have some value in unusual circumstances. Below is a screenshot taken from a Premium ETF Report showing the inverse ETFs under-performing the S&P 500:

Measuring ETF risk

Although most ETFs have less volatility than individual stocks as stated earlier in this article, there is still a significant range in IV from one ETF to another. By looking at the implied volatility of an ETF and comparing it to the implied volatility of the overall market (S&P 500), we can make an informed decision as to the risk involved when using a specific security and whether it meets our personal initial goals and risk-tolerance. Below is a screenshot of part of the implied volatility section of our Premium ETF Reports (this information can be obtained for free @ www.ivolatility.com):

Summary

ETFs can represent a valuable security to include in a covered call writing or put-selling portfolio. There are advantages and disadvantages as with every approach but the selection process is as important as when using individual stocks. Initial return goals, time for management and personal risk-tolerance play vital roles in deciding between stocks and ETFs.