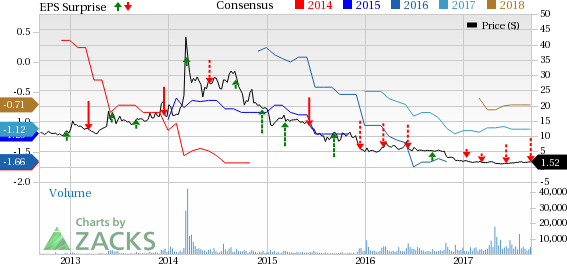

FuelCell Energy Inc. (NASDAQ:FCEL) reported an adjusted loss of 31 cents per share in the third quarter of fiscal 2017, wider than the Zacks Consensus Estimate of a loss of 23 cents. However, it was narrower than the loss of 38 cents in the year-ago period.

Total Revenue Fails to Impress

In the third quarter of fiscal 2017, FuelCell Energy’s total revenue was $10.4 million, missing the Zacks Consensus Estimate of $19 million by 45.6%. Total revenue also dipped 52% from $21.7 million in the year-ago quarter.

The drop in the total revenue was primarily due to lower contribution from the product segment.

Highlights of the Release

As of Jul 31 2017, the company’s total backlog was $437 million, as against $392.1 million in the year-ago period.

In the quarter under review, the company’s cost of revenues was approximately $13 million, down 40% from $21.3 million in the prior-year quarter.

Operating expenses were $11.7 million, 9.3% lower than the year-ago quarter.

Financial Details

As of Jul 31, 2017, cash and cash equivalents were $35.7 million, down from $84.2 million as of Oct 31, 2016.

As of Jul 31, 2017, the long-term debt and other liabilities totaled $70.3 million, down from $80.9 million as of Oct 31, 2016.

Zacks Rank

FuelCell Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peers Release

NextEra Energy (NYSE:NEE) Partners, LP (NYSE:NEP) , a Zacks Rank #3 stock, delivered second-quarter 2017 earnings of 24 cents per unit, missing the Zacks Consensus Estimate of 43 cents by 44.2%.

Dominion Midstream Partners, LP (NYSE:DM) , a Zacks Rank #3 stock, reported second-quarter 2017 earnings of 31 cents per unit, missing the Zacks Consensus Estimate of 35 cents by 11.4%.

Ormat Technologies, Inc. (NYSE:ORA) , a Zacks Rank #3 stock, reported second-quarter 2017 earnings of 58 cents, beating the Zacks Consensus Estimate of 55 cents by 5.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Dominion Midstream Partners, LP (DM): Free Stock Analysis Report

Ormat Technologies, Inc. (ORA): Free Stock Analysis Report

NextEra Energy Partners, LP (NEP): Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL): Free Stock Analysis Report

Original post

Zacks Investment Research