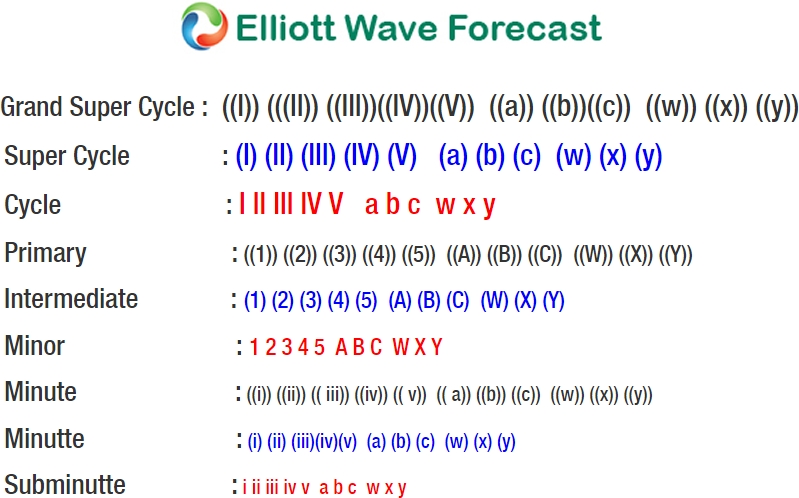

FTSE short-term Elliott Wave view suggests that the decline to 3/26/2018 low 6866.94 ended the cycle degree wave “b”. Above from there, the index is rallying higher in a strong Impulse Elliott Wave structure with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 waves impulse. In the case of FTSE, Minor wave 1, 3 and 5 should have internal subdivision of 5 waves impulse Elliott Wave structure of lesser degree.

Up from 6866.94 low, Minor wave 1 ended in 5 waves structure at 7042.37 and Minor wave 2 pullback ended at 6923.33 low. Above from there, Minor wave 3 remains in progress with extensions in another 5 waves structure where Minute wave ((i)) ended at 7109.93, Minute wave ((ii)) ended at 6971.75, Minute wave ((iii)) ended at 7572.98 high, and Minute wave ((iv)) ended at 7492.73 low.

Near-term, while above 7492.73 low, Minute wave ((v)) of 3 remains in progress looking to extend higher in another 5 waves structure approximately towards 7593.27 – 7625.36 inverse 1.236%-1.618% Fibonacci extension area of Minute wave ((iv)). But in case of extension in Minute wave ((v)), FTSE can extend higher to 7659.32-7701.40 100%-123.6% Fibonacci extension area of Minute wave ((i)) before ending the Minor wave 3. Afterwards, the index should pullback in Minor wave 4 in 3, 7 or 11 swings before further upside is seen. We don’ like selling it.

FTSE 1 Hour Elliott Wave Chart