Short term FTSE Elliott Wave view suggests that Primary wave ((4)) ended with the decline to 7199.5. The rally up from there is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and Intermediate wave (B) ended at 7437.42. Intermediate wave (A) has a subdivision of an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5, Minor wave 2 ended at 7289.75, Minor wave 3 ended at 7527.72, Minor wave 4 ended at 7493.68, and Minor wave 5 of (A) ended at 7565.11.

Intermediate wave (B) pullback unfolded as a double three Elliott Wave structure. Minor wave W of (B) ended at 7485.42, Minor wave X of (B) ended at 7560.04, and Minor wave Y of (B) ended at 7437.42. Intermediate wave (C) is currently in progress in 5 waves. The rally from 7437.42 low is unfolding as a diagonal where Minute wave ((i)) ended at 7532.36, Minute wave ((ii)) ended at 7478.88, Minute wave ((iii)) ended at 7580.93, and Minute wave ((iv)) ended at 7541.91. Near term, expect the Index to see another leg higher in Minute wave ((v)) before Minor wave 1 is complete and cycle from 10/25 low ends. Afterwards, Index should pullback in Minor wave 2 to correct cycle from 10/25 low in 3, 7, or 11 swing before the rally resumes. We don’t like selling the Index.

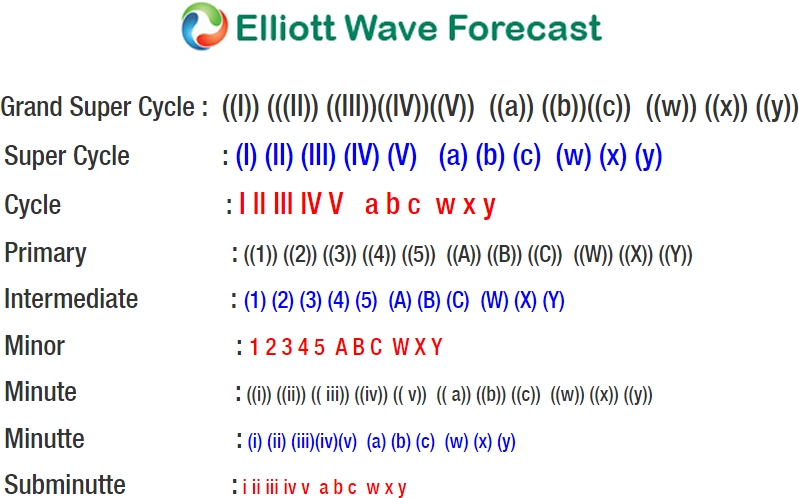

FTSE 1 Hour Elliott Wave Analysis