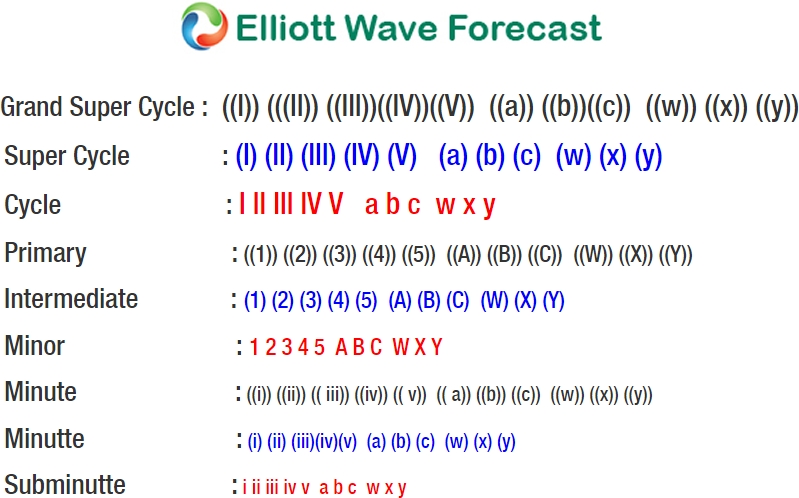

FTSE Elliott Wave view suggests that the decline to 7199.5 ended Primary wave ((4)). Up from there, the rally is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and pullback to 7437.42 ended Intermediate wave (B). Intermediate wave (A) is subdivided as an impulse Elliott Wave structure. Minor wave 1 ended at 7327.5, Minor wave 2 ended at 7289.75, Minor wave 3 ended at 7527.72, Minor wave 4 ended at 7493.68, and Minor wave 5 of (A) ended at 7565.11.

Intermediate wave (B) pullback ended at 7437.42 as a double three Elliott Wave structure. Minor wave W ended at 7485.42, Minor wave X ended at 7560.04, and Minor wave Y of (B) ended at 7437.42. Intermediate wave (C) is currently in progress as 5 waves where Minor wave 1 ended at 7582.85. Minor wave 2 pullback is in progress towards 7436.86 – 7455.32 area before Index resumes the rally higher or at least bounce in 3 waves. This view remains valid as far as pivot at 10/25 low (7436.69) remains intact.

Alternatively, if pivot at 7436.69 fails, then the Index can be doing a FLAT correction from 10/12 high. In this alternate scenario, Minor wave A ended at 7436.92, Minor wave B ended at 7582.85, and Index is currently in Minor wave C as 5 waves to correct cycle from 9/15 low (7197.66) before the Index resumes the rally higher. In conclusion, the Index at this stage remains bullish against 10/25 low (7436.69) in the first degree and against 9/15 low (7197.66) in the second degree.

FTSE 1 Hour Elliott Wave Analysis