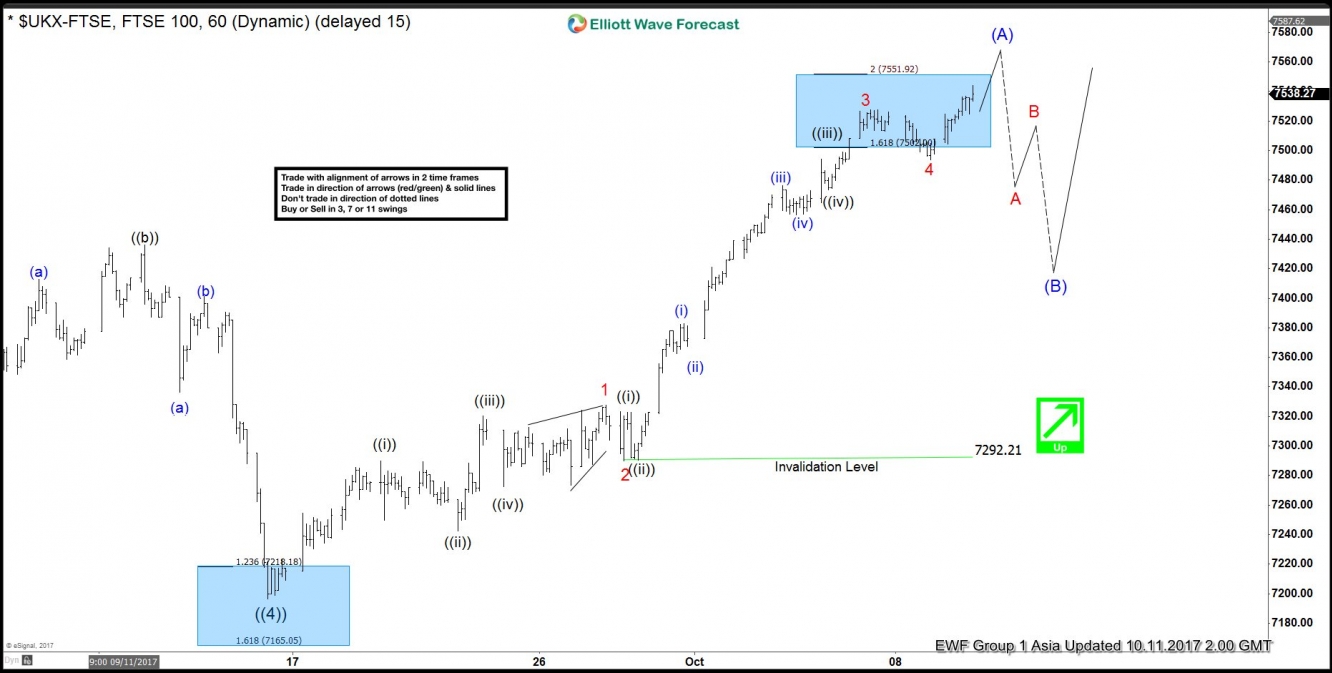

FTSE Short term Elliott Wave analysis suggests the decline to 7196.58 on 9/15 low ended Primary wave ((4)). The Index is currently within Primary wave ((5)) which is subdivided as a zigzag Elliott Wave structure. The first leg Intermediate wave (A) of this zigzag is in progress as 5 waves impulse where Minor wave 1 ended at 7327.50 and Minor wave 2 ended at 7289.75. Up from there, Minor wave 3 ended at 7527.59 and Minor wave 4 ended at 7493.68. The Index has broken above Minor wave 3 at 7527.59, suggesting that it’s in the final Minor wave 5 higher which should also complete Intermediate wave (A).

Cycle from 9/15 low is mature and Intermediate wave (A) could end soon. Once Intermediate wave (A) is complete, Index should pullback in Intermediate wave (B) in 3, 7, or 11 swing to correct cycle from 9/15 low (7196.58) before the rally resumes. We do not like selling the proposed pullback. As far as pivot at 9/15 low stays intact in the Intermediate wave (B) pullback later, expect Index to extend to a new high.

FTSE 1 Hour Elliott Wave Chart