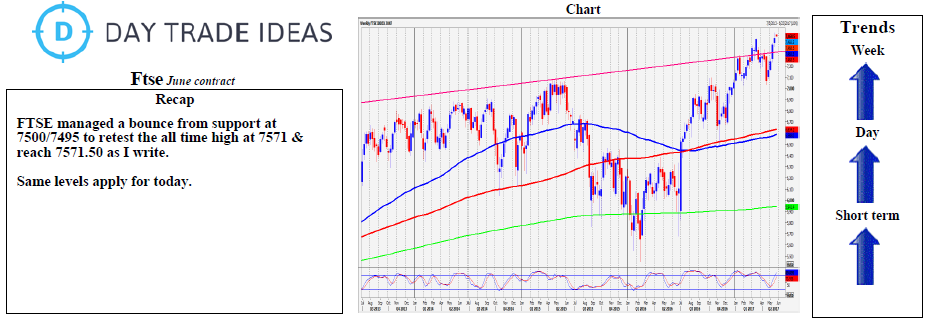

FTSE retesting the new all time high at 7571 but 8 month trend line resistance now at 7590/99 in severely overbought conditions should be the main challenge for bulls today. Bulls will need a sustained break above 7610, with a weekly close above tonight for further bullish confirmation targeting 7635/40 and eventually 7690/7700.

A double top at 7571 triggers short term profit taking to 7550/45 and perhaps as far as good support at 7500/7495. We do need a correction to ease overbought conditions so if a break below 7485 is seen look for 7470 and good support at 7448/43. Try longs with stops below 7430.