- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FTSE 100: Set To Turn

The FTSE 100 has been climbing higher yet again.

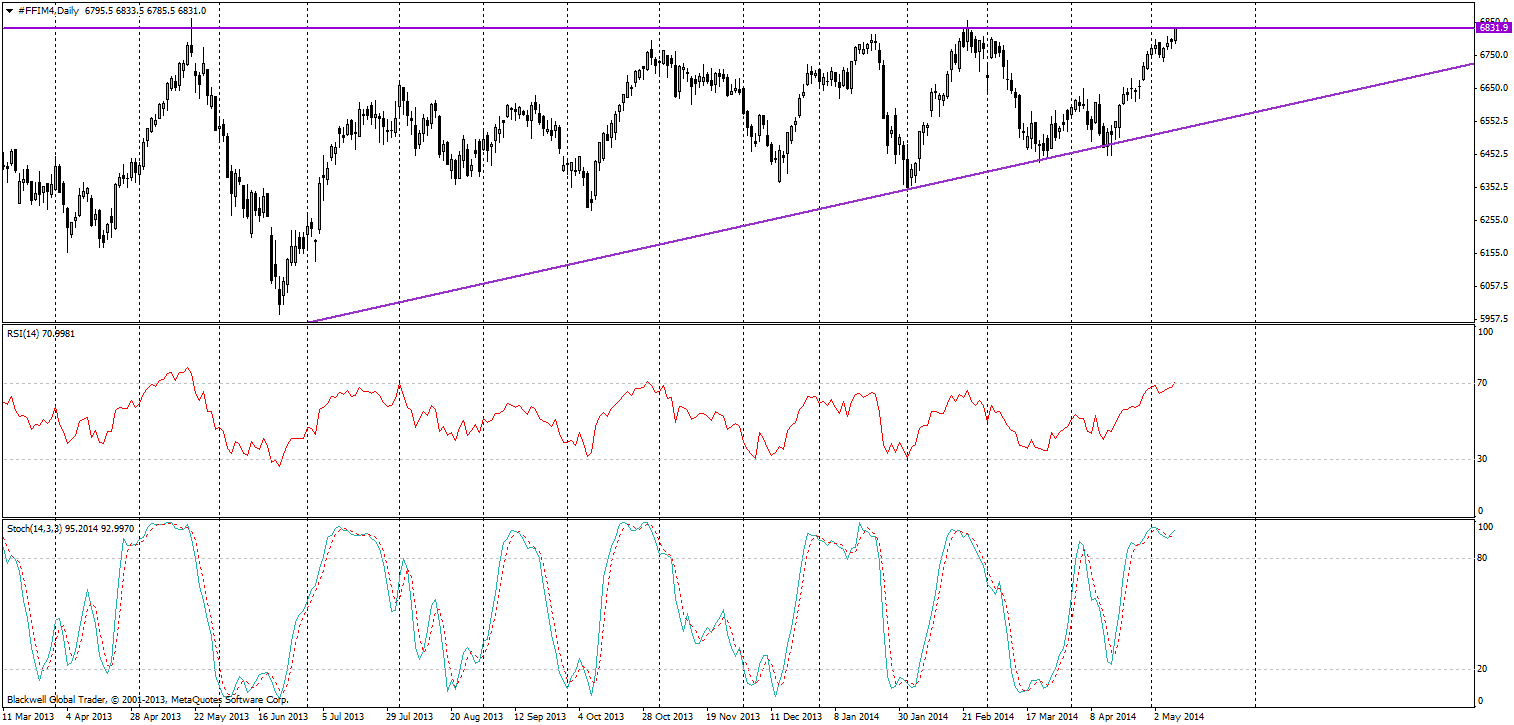

Source: Blackwell Trader (FTSE 100, D1)

The ascending triangle has been in play for some time and markets have looked to capitalise on it on a regular basis.

Current market sentiment has certainly been positive for equity markets, but unlike the S&P 500 and the Dow Jones, the FTSE 100 does not act like them at all. In fact, it peaked on 3 separate occasions over the last year. Markets are expecting the FTSE to break out, thus far though it has remained fairly constrained as the economic situation can be a bit chaotic at times and people are still a little uncertain on the Eurozone.

Looking at the indicators, the RSI is showing signs of overbuying which is quite serious for the FTSE 100 as many will notice it rarely touches, and when it does, it looks to pull back. The current top is certainly looking poised for a corrective pullback; especially when considering its sitting on resistance currently.

When looking at the stoch as well (as seen below) we can clearly see that momentum is certainly on the side of the buyers, with the current momentum putting pressure on the high, but these peaks are rarely sustained and certainly this push looks set to lose some steam at least in the short term.

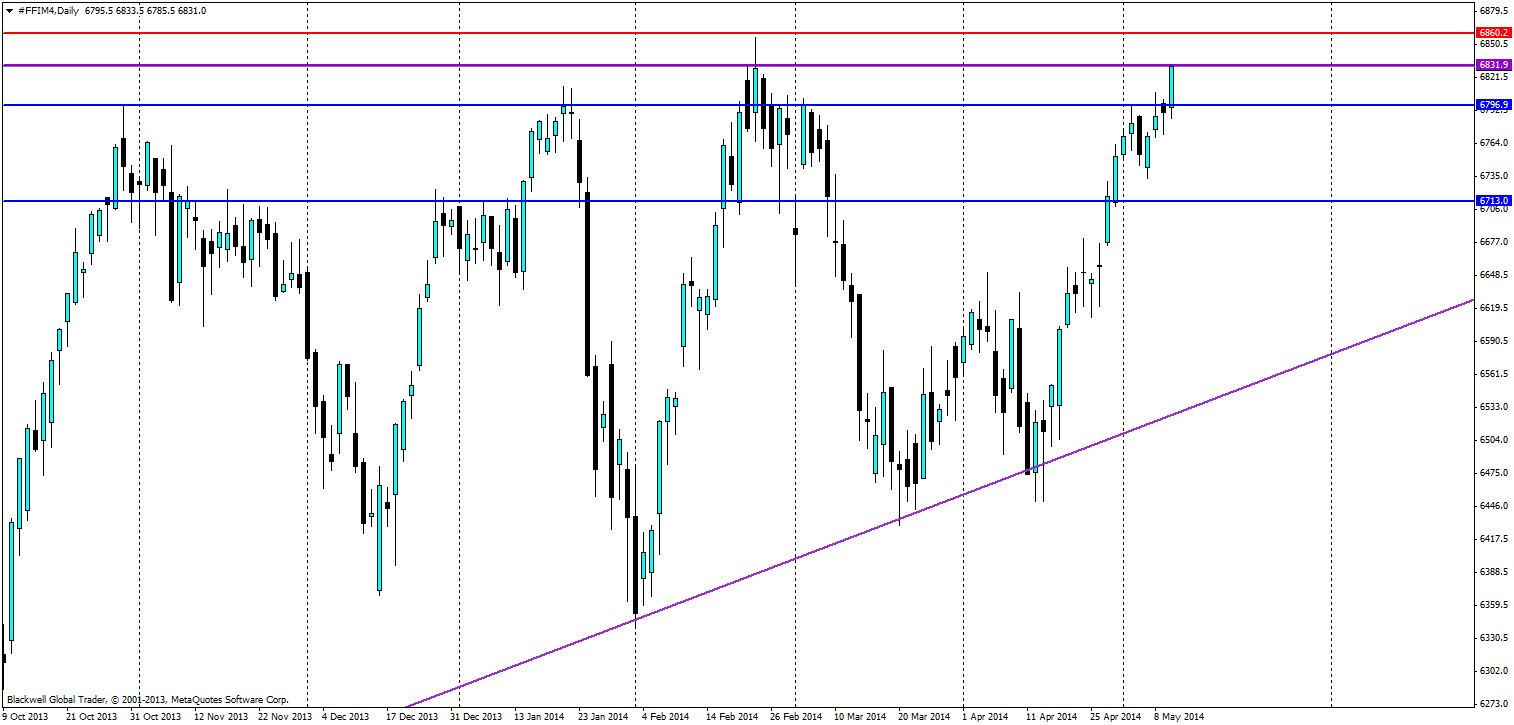

Source: Blackwell Trader (FTSE 100, D1)

Further movements higher are certainly restrained, with the only resistance level currently at 6860.00. Support levels are found at 6796 and 6713, it's likely though, they will only act as support in the medium term before the FTSE looks to find a foothold in the current market.

Source: Blackwell Trader (FTSE 100, D1)

When playing the FTSE its key that you don’t jump in at the top, but instead wait for the candles to form over the next few days. Look for conformation! Do not conform to the notion that you can time the market as it’s a recipe for disaster. I will be looking for a further bearish candle on the opening of the market before jumping in, as an ascending triangle can jump higher and lead to much higher highs.

So while this is a good trade, don’t look to jump in early. Wait till we see a further candle before making the plunge into the FTSE as the triangle is starting to get tighter and tighter, and a jump higher or lower may certainly be on the cards sooner rather than later.

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.