Dax 40 March is forming a sideways consolidation as volatility decreases, which is normal in both a bull and bear trend. We do not know how long this process will take, but there is no sell signal.

We held a range of about 250 ticks last week, so there are few decent trading opportunities until we see some movement again.

FTSE 100 March held a 100 tick range last week, so the same levels apply today as we wait for a move.

Remember, when support is broken, it usually acts as resistance and vice-versa.

Today's Analysis

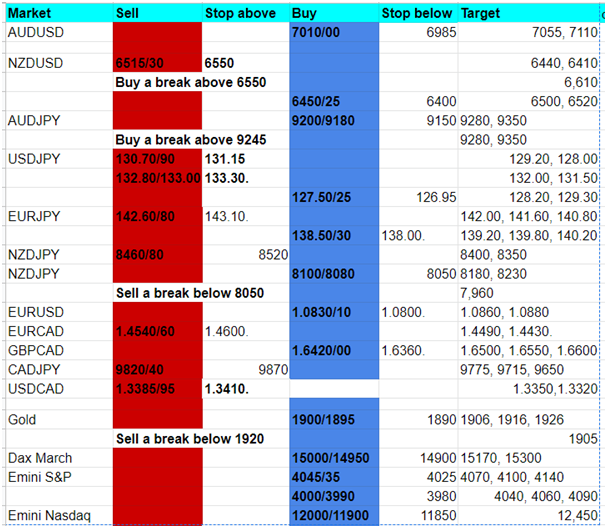

Dax March held a 115-tick range on Friday. Support at 15000/14950 (a low for the day, just 33 tocks above yesterday) with a bounce from here to target minor resistance at 15170/200. If we continue higher, look for strong resistance at the January high of 15300/330. Shorts need stops above 15380. A break higher is a buy signal.

First, support again at 15000/14950. A break lower targets 14870/850, then strong support at 14770/720.

FTSE March longs at first support at 7695/75 worked perfectly yesterday as we established a sideways trend for an easy 50-tick profit on the bounce to strong resistance at 7745/65. (A high for the day here yesterday, in fact) - Shorts need stops above 7785. A break higher is a buy signal targeting 7825 before a retest of 7850/60.

First, support again at 7695/75. Longs need stops below 7865. Emini S&P March reversed from my next target and 1-month rising trend line resistance at 4095/4100 to hit first support at 4045/35. A low for the day here, but longs need stops below 4025.

Nasdaq 100 Futures March wiped out all of Friday's strong gains as we establish a new sideways range. Emini Dow Jones March is clearly in a sideways pattern for two months.

Today's Analysis

S&P 500 Futures March held 1-month rising trend line resistance at 4095/4100 today after that 100-point jump I expected by the end of the week.

The bearish engulfing candle on the 1-hour chart triggered a move to the first support at 4045/35, exactly as predicted. Longs need stops below 4025. A break lower meets a buying opportunity at 4000/3990. Longs need stops below 3980.

Longs at 4045/35 can target 4075, perhaps as far as resistance at 4100/4110. A break higher can retest the December high at 4140/45.

Nasdaq March bearish engulfing candle on the 1-hour chart triggered a move to the downside exactly as predicted to the first support at 12000/11950, with a low for the day right here. Longs need stops below 11850. A break lower today can target 11730/700.

A bounce from first support at 12000/11950 targets 12300, then 12460/480.

Dow Jones Futures hit my next target of 34180/200 on Friday, then reversed on Monday, breaking support at 33980/930 to hit my next target of 33800/750, with a low for the day exactly here. A break below 33700, however, risks a slide to 33500/450.

We should have strong resistance at 34150/200. Shorts need stops above 34300.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.