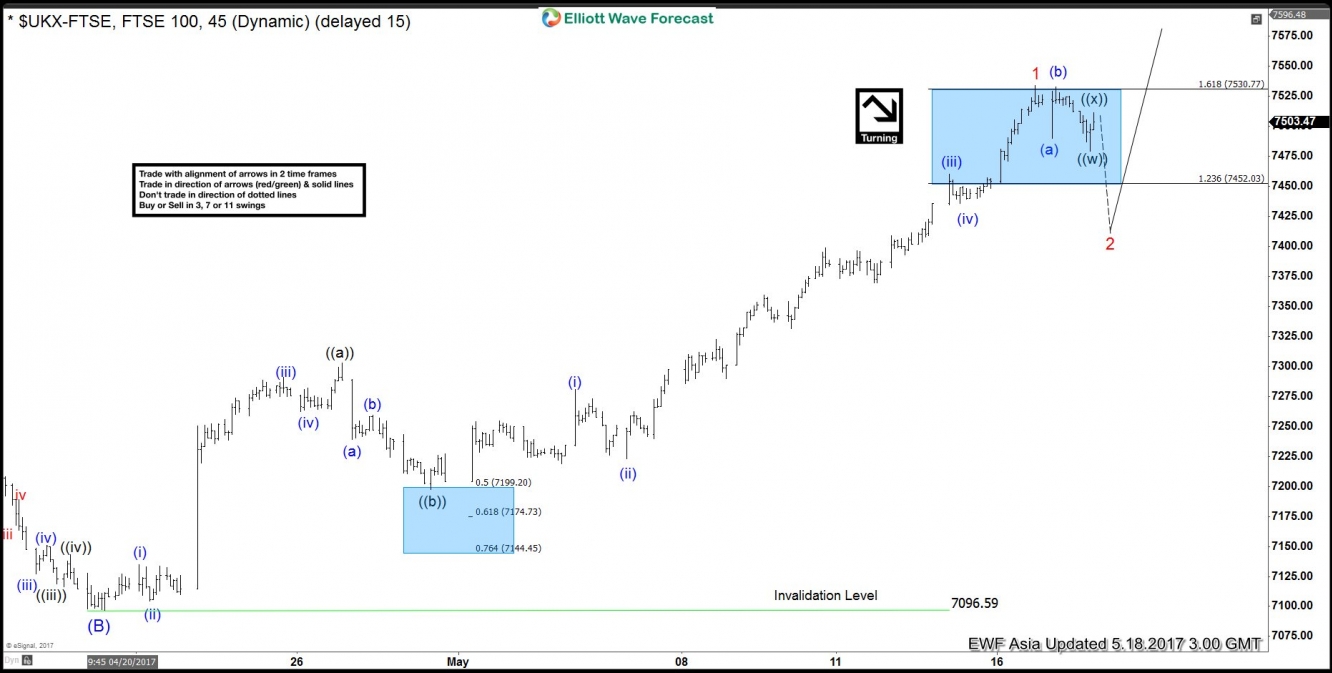

Short Term Elliott Wave view in FTSE 100 suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) is unfolding as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) ended at 7104.22, Minutte wave (iii) ended at 7290.82, Minutte wave (iv) ended at 7262.32, and Minutte wave (v) of ((a)) ended at 7302.57. FTSE 100 has since broken above 7302.57 suggesting Minute wave ((c)) has started.

Minute wave ((c)) is unfolding as an ending diagonal where Minutte wave (i) ended at 7280.7, Minutte wave (ii) ended at 7222.81, Minutte wave (iii) ended at 7460.20, and Minutte wave (iv) ended at 7435.64. Index has reached 1.618 extension of the Minute ((a)) – ((b)) and thus cycle from 4/20 low is mature and we are calling Minor wave 1 completed at 7533.7. Expect FTSE 100 to correct cycle from 4/20 low within Minor wave 2 in 3, 7, or 11 swing before the rally resumes. We don’t like selling the proposed pullback and expect buyers to appear again when Minor wave 2 pullback is over in 3, 7, or 11 swing.

If the Index does not do a decent pullback from here to correct cycle from 4/20 low, then the move from 4/20 low could be labelled as a regular 5 waves Impulse Elliott Wave structure in which case we are ending Minor wave 3 at recent high (7533.7) and the Index will do shallow pullback in Minor wave 4 and then extend higher again in Minor wave 5 before ending cycle from 4/20 low and see larger pullback. In both cases, we don’t like selling the Index and expect buyers to appear in the dips in 3, 7 or 11 swings.

FTSE 100 1 Hour Elliott Wave Chart