Short term FTSE 100 ( UKX-FTSE ) Elliott Wave view suggests that Minor wave B ended on 6/30 low 7302.7 and the rally from there is unfolding as a double three Elliott wave structure. Index has made a new high above Minute wave ((w)) peak 7515.1 and it's now showing incomplete 5 swings bullish sequence from 6/30 low. As far as pivot at 7338.2 holds, expect FTSE to extend higher towards 100% Fibonacci extension area at 7552.2 - 7602.59.

FTSE would be then ending the first leg of the move to the upside in Minor wave 1. From there, a pullback can take place in Minor wave 2 which should then find buyer’s again in sequence of 3, 7 or 11 swings for further upside provided the pivot at 7302.7 low remains intact. If pivot at 7302.7 low fails during later pullback, the Index would be still remain in the same cycle from 6/2 peak. Index should then extend the correction to the downside.We don’t like selling the Index.

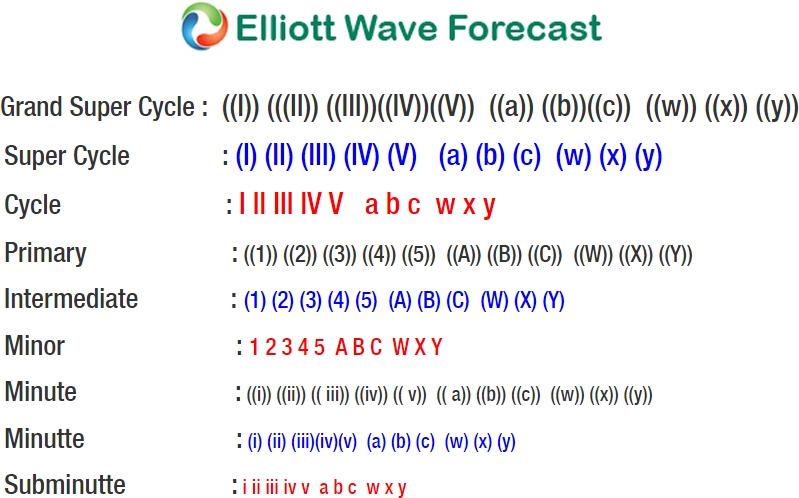

FTSE 1 Hour Elliott Wave Chart