Into the abyss

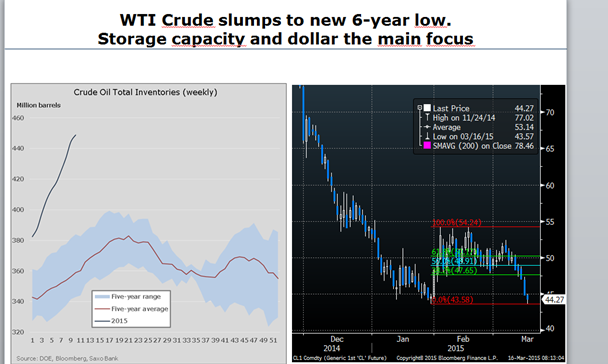

US oil benchmark WTI is staring into the abyss Monday after hitting a six-year low of $44.27/barrel with a potential path all the way to $31/b opening beneath its feet.

""The US inventory build-up story over the last few weeks is the culprit here combined with the weakness of so many currencies against the dollar," says Saxo Bank's head of commodities Ole Hansen. "There is support at the January lows that could see the price retrace to $47.65/b."

"A break below, however, and there is an extension in play all the way down to $31/b."

WTI crude was at $44.47/b at 0800 GMT. European benchmark Brent crude was at $54.46/b.

Not surprisingly, WTI is among those being hit by a "wash-out on commodities with net-selling across the board," says Hansen. WTI lots fell to 160,000, the lowest since January 2013 on the Bloomberg Commodity Index.

Other commodities taking a horrendous hit include sugar, he says. "There is a huge net short here that needs a constant flow of negative news to keep it there or there will be fireworks."

Ke-ching Keqiang

Meanwhile, Chinese prime minister Li Keqiang may have helped quell some fears over China's economy this weekend in a speech on China's GDP growth targets when he said there was ample room to exercise fiscal stimulus this year and that it has a host of policy measures available across the board, according to the Singapore desk's Christoffer Moltke-Leth.

Asian markets reacted mixed, says Motke-Leth, with the exception of the Shanghai Composite Index which jumped 2.2% to a seven-year high.

Spend a penny

Across the water, Japan's Shinzo Abe was fighting a different kind of battle as he railed against the big Japanese corporations who seemingly don't want to participate in his ongoing war on Japan's economic malaise.

"Abe is struggllng to pressure the big Japanese corporations to share some of their profits and help to pull Japan out of deflation," says Moltke-Leth.

Abe has already agreed a plan to raise basic wages by some JPY 4,000 a month although that is some way short of the JPY 10,000 that workers are demanding.

FOMC coming

From the Floor's eyes are, much like the rest of the market, now firmly trained on this Wednesday's Federal Open Market Committee meeting which is casting its shadow through numerous classes and assets.

Saxo Bank's head of macro strategy Mads Koefoed expects the major change Wednesday to be a drop of the "patient" terminology from the FOMC's statement but still does not anticipate a move earlier than September, despite the clamour for a June rate hike.

"it's quite tricky as, while the NFP is booming with an average of 293,000 jobs, the core CPI is only up 1% which indicates that there are still deflationary pressures in the economy," he says.

Nevertheless, currency pairs are watching on nervously against the overall wave of dollar strength.

EUR/USD, for example, hit a low of 1.0457 Friday and, while back to 1.0536 at 0800 GMT today, vols in the FX Options desk have been on a bit of wild ride as they gear up for the pivotal meeting.

"EUR/USD one-month vols have been extremely sensitive to spot and we are opening on the high side of the vols at 13.2," says the FX Options Desk's Gustave Rieunier. "We expect vols to get given very aggressively with the main focus of the day coming from Europe with the ZEW and CPI up at 1000 GMT."

Gold's switch

Gold too very much has the meeting in view with support coming in at the $1,150/oz mark after nine consecutive falls equated to the worst performance since 1973.

"There could be a move back up to $1,167/oz but actually, all of the action is really in XAU/EUR," says Hansen. "There is not that much appetite to be long ahead of the FOMC."