Started second half of the last year market started pricing cheapening in bonds. Most of this expectation comes from the fact that central banks decided to reduce some portion of the stimulus they had offered earlier. The ECB announced decrease in asset purchasing program. Federal Reserve and Bank hiked in the fourth quarter stating three more hike expectations this year, Bank of England also increased bank rate stating one interest rate hike each year during next three years. All of this changed the market sentiment. But in line with everything mentioned above it also make sense to say that ECB is still away from their inflation target, Federal Reserve still has difficulties with transferring change in labor market to inflation and Brexit in case of Bank of England.

Obviously there are some limitations for an increase in yields that arise from actions taken by monetary policy authorities, but what about equities? Is there any hidden limitation that comes from equity market side? I think there is. Last couple of years were very positive for the US equities and capital gains even accelerated during and after the elections. S&P 500 increased by around 90% during last 5 years. Moreover there is a tax policy that is expected to favor companies and drive earnings upward.

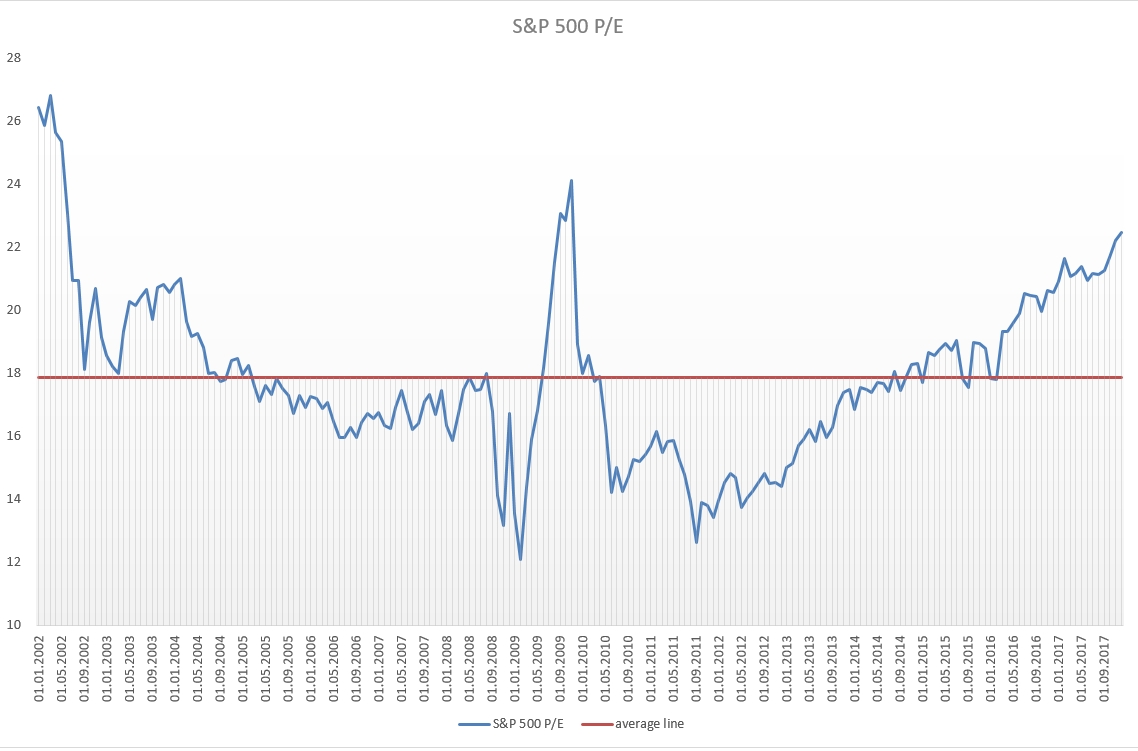

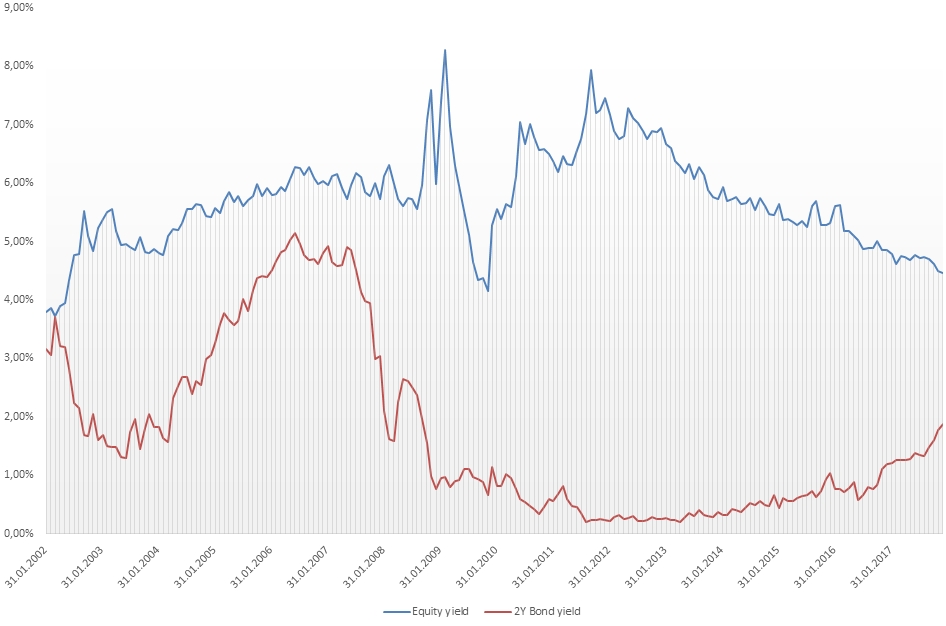

I decided to look at relationship between equity yield (S&P 500) and both 2 and 10 year US treasury yields. But before I want to show you S&P 500 P/E from 2002 to 2018.

P/E ratio is well above historical average of 18. Well, looks like overvalued. So we keep in mind that equity market is overvalued. Last time such level was reached in 2009 (rest in peace real estate crisis). I also calculated equity yield for the S&P 500 and compared it with the 2 year treasury yield. Below is given the chart with both S&P 500 and 2 year treasury yields.

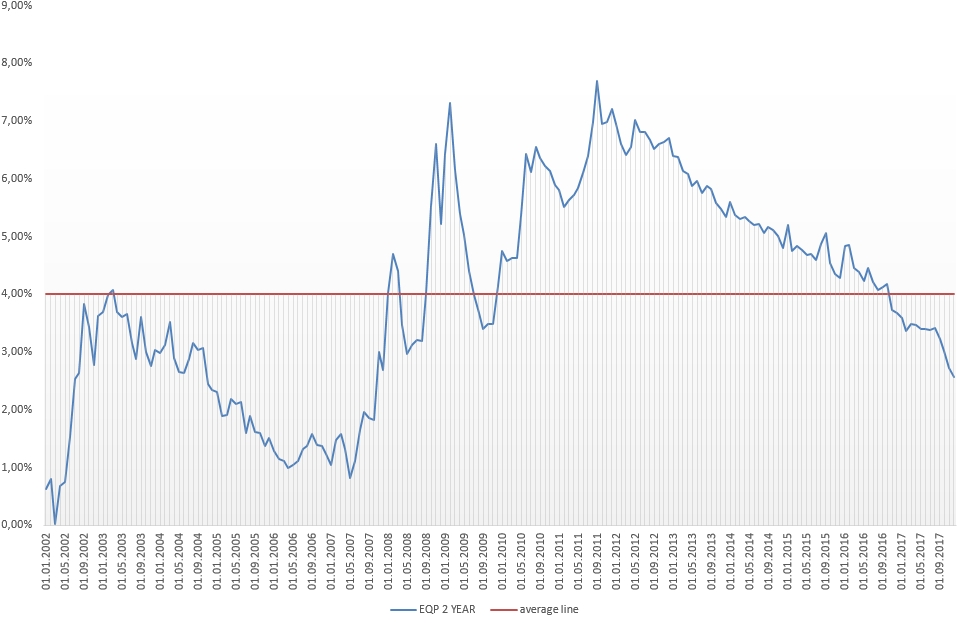

Started 2012 spread between two yields started narrowing, perhaps some investors switched from equity to bond based on their own risk sentiment. I am a strong believer of existing of such trades, when investors move significant cash from equity to bond market and vice versa. The climax of this story is presented below.

Equity premium which is the difference between equity and bond yield fell way below the average during last year. One can conclude that they were high because of the easing monetary policy and low yields. Thus, once low yields in the bond market pushed equity market up and the opposite can be expected started this year. Market expects yield to go up, but such a movement might be reversed as investors start switching decreasing equity yields to increasing bond yields.