T2108 Status: 64.5%

T2107 Status: 63.5%

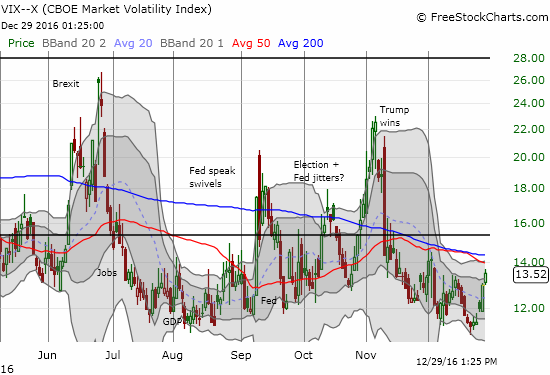

VIX Status: 13.5

General (Short-term) Trading Call: cautiously bearish

Active T2108 periods: Day #217 over 20%, Day #37 over 30%, Day #36 over 40%, Day #34 over 50%, Day #28 over 60% (overperiod), Day #3 under 70% (underperiod)

Commentary

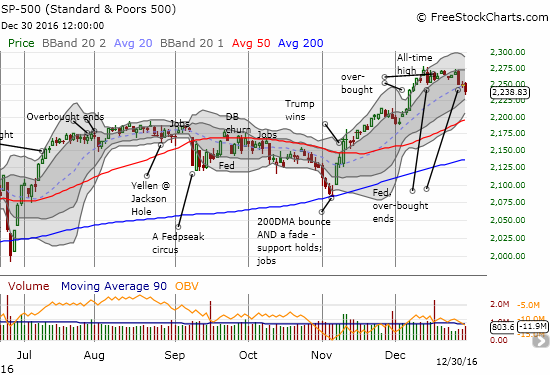

The S&P 500 (SPY (NYSE:SPY)) ended 2016 by following through on the bearish trading signals I identified in the last T2108 Update. Today’s 0.5% loss came on slightly higher volume and on an additional push higher in the volatility index, the VIX. T2108, the percentage of stocks trading above their respective 50-day moving averages (DMAs) dropped to 64.5%.

The S&P 500 (SPY) ended the year with a whimper as the Santa Claus rally delivered a rare (albeit minor) loss.

The volatility index, the VIX, pushed higher for the fifth straight day.

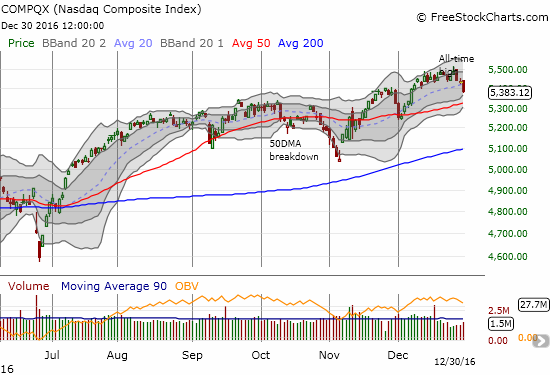

The PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) delivered an even more convincing loss on the day. The tech-laden index’s 0.9% drop confirmed the end of the previous (short) consolidation period.

The NASDAQ (QQQ) broke its primary uptrend at its 20DMA. A test of 50DMA support is now in play.

Note that both major indices broke through primary uptrends represented by their respective 20DMAs.

Interestingly, several other important signals held their ground right at the edge of additional bearish confirmations.

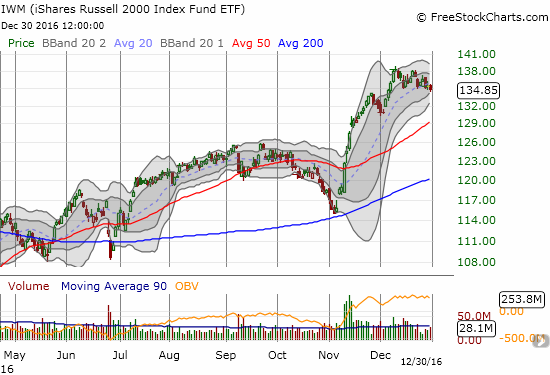

The iiShares Russell 2000 (NYSE:IWM) topped out three weeks ago, but it is still barely clinging to the bottom of its consolidation range. The Financial Select Sector SPDR ETF (NYSE:XLF) managed to stay flat a day after finishing a reversal of its last breakout. The previous day, XLF also traded below its primary trend at the 20DMA for the first time since November 4th. The Australian dollar (Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)) versus the Japanese yen (Guggenheim CurrencyShares Japanese Yen (NYSE:FXY)) marked a sixth day in a consolidation pattern that abruptly ended a sharp slide from the most recent high. AUD/JPY’s 50DMA is rushing upward to attempt a delivery of support.

The iShares Russell 2000 (IWM) peaked on December 9th, but it is still clinging to the bottom of a consolidation range.

The Financial Select Sector SPDR ETF (XLF) looks toppy, but it still sits on the edge of a true breakdown.

Is this the pause that refreshes for AUD/JPY or the calm before resuming the storm?

These collective signals set up the first week of 2017 as an extremely important test of buying interest.

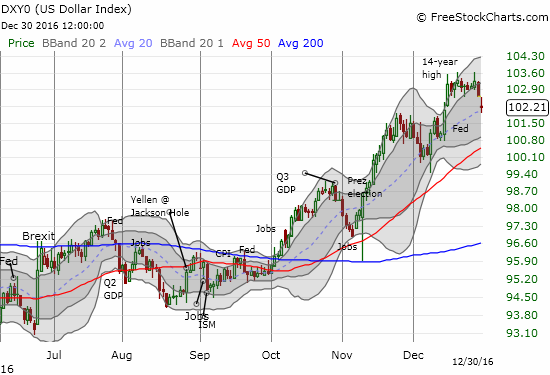

Even the U.S. dollar index (DXY0) is stepping into 2017 with a hint of caution. Post-Fed the dollar printed two straight strong days to a new 14-year high. The dollar failed to make any further progress for two weeks. It ended 2016 with two days of selling that neatly reversed half its post-Fed gain and a near erasure of the last breakout.

The U.S. dollar suddenly looks very tentative as it closed the year right on its primary uptrend defined by its 20DMA.

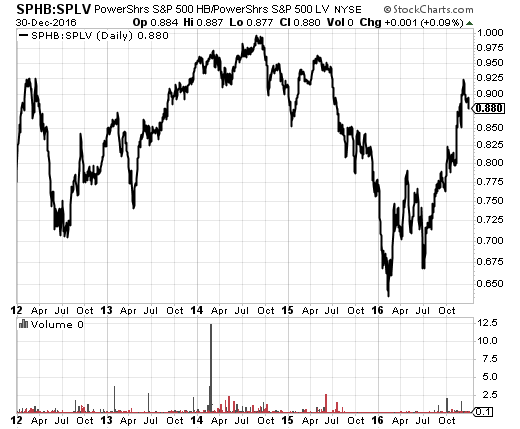

There is a freshly interesting dichotomy between the low volatility and high beta components of the S&P 500. The Powershares S&P 500 Low Volatility Portfolio (NYSE:SPLV) has held its ground since first selling off in the wake of the U.S. Federal Reserve’s latest pronouncements on monetary policy. SPLV is in a small consolidation pattern and is holding support at its 50 and 200DMAs. The Powershares S&P 500 High Beta Portfolio (NYSE:SPHB) last topped out on December 9th. The Fed slightly greased the skids, but the confirmation selling did not arrive until this week. As a reminder, the S&P 500 generally tends to perform better when SPHB is rallying AND is out-performing SPLV. The S&P 500 generally tends to perform worse when SPHB is in decline and especially when it is under-performing SPLV. The ratio of SPHB/SPLV is currently in decline.

Sharp rallies in SPHB/SPLV supported robust rallies in 2016. Are the tailwinds turning into headwinds now that the ratio is in decline again?

All things considered, I left my short-term trading call at cautiously bearish.

I am ending another year of T2108 Updates with some brief follow-ups.

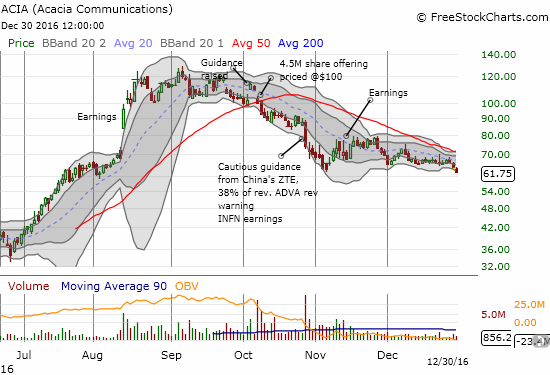

Two months ago, I wrote “Awful Offerings: Acacia Communications and Twilio.” I noted the poor market response to the companies after they each returned to the till to extract additional funds from the stock market. I held out earnings as an important to test to see whether the companies could reignite excitement in their respective stocks. Both companies failed to deliver. While both TWLO and ACIA experienced some bouts of interest after reporting earnings, both stocks closed 2016 at new post-earnings lows. The two stocks also share precarious technicals with their respective 50DMAs carving out well-defined and declining resistance levels.

Twilio Inc (NYSE:TWLO) surged last week on Amazon.com (NASDAQ:AMZN) rumors. The buying quickly hit a brick wall at 50DMA resistance. I find it telling that all those gains have reversed and left TWLO at a new post-earnings low.

Acacia Communications Inc (NASDAQ:ACIA) has yet to give its downtrending 50DMA a test as volume dried up soon after November earnings. I find the lack of interest very telling…

Another chart that has my interest is Splunk Inc (NASDAQ:SPLK). At the beginning of December, I noted how SPLNK’s post-earnings chart printed an ominous bearish pattern.

SPLK managed to bounce right back after that gap and crap, but it never generated much altitude above its 200DMA. SPLK closed the year at a new post-earnings low that confirmed the second 200DMA breakdown.

Splunk (SPLK) confirmed a rounded topping pattern with a new post-earnings low. Note that SPLK now sits right at its post-Brexit low.

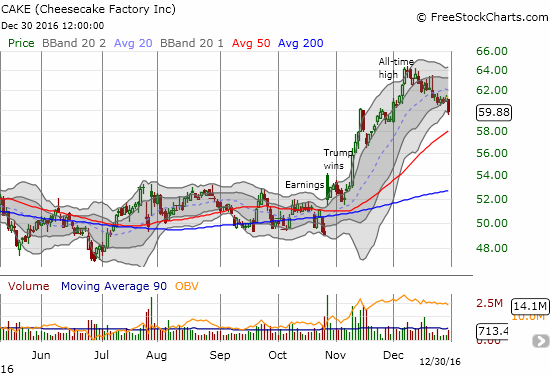

For one somewhat positive follow-up I offer The Cheesecake Factory (NASDAQ:CAKE). I have stalked this stock since I noted its bullish post-election surge in mid-November. CAKE never did fall back to my preferred support level, and I should have jumped right into the pool after noticing the water was going to stay warm. Instead, I watched as CAKE soared to additional all-time highs. A limit order I placed along the way for call options finally triggered on the last day of the year just as CAKE returned to that first post-election all-time high…

Cheesecake Factory (CAKE) gained as much as 19% post-election. Like so many post-election rocket ships, the ride came to an end on December 7th. Re-entry for CAKE has been particularly sharp as it ended 2016 with a return to its first post-election (and all-time) high.

I made a rare exception from my short-term trading call for CAKE. However, if the market starts 2017 with more confirmation of the current bearish signals, I doubt CAKE will be able to weather the storm with any kind of out-performance.

Here is to a prosperous New Year no matter how and where the winds blow…

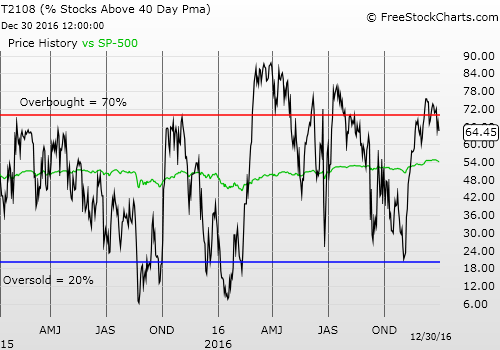

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

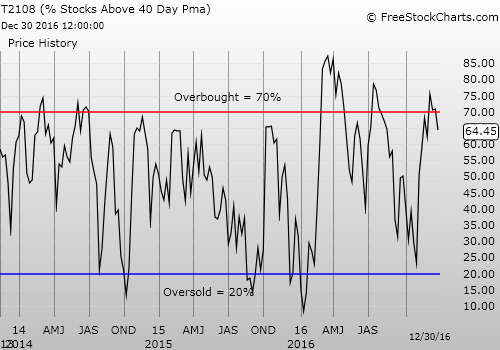

Weekly T2108

Be careful out there!

Full disclosure: long SDS, short AUD/JPY, long CAKE call options