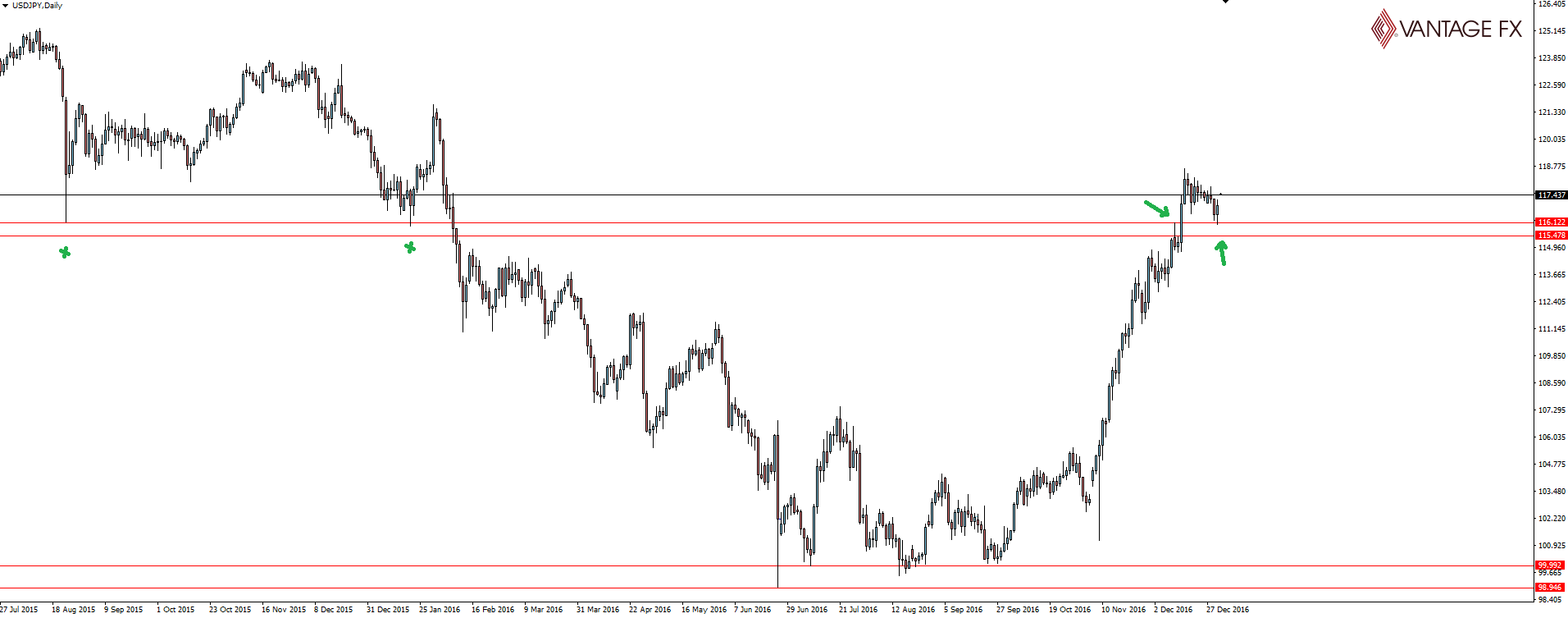

With USD/JPY pulling back to retest a key support/resistance zone, we asked the question if USD/JPY was ready for another run, or if it would fall in line with the USDX at resistance and drop straight through it.

USD/JPY Daily: ”

”

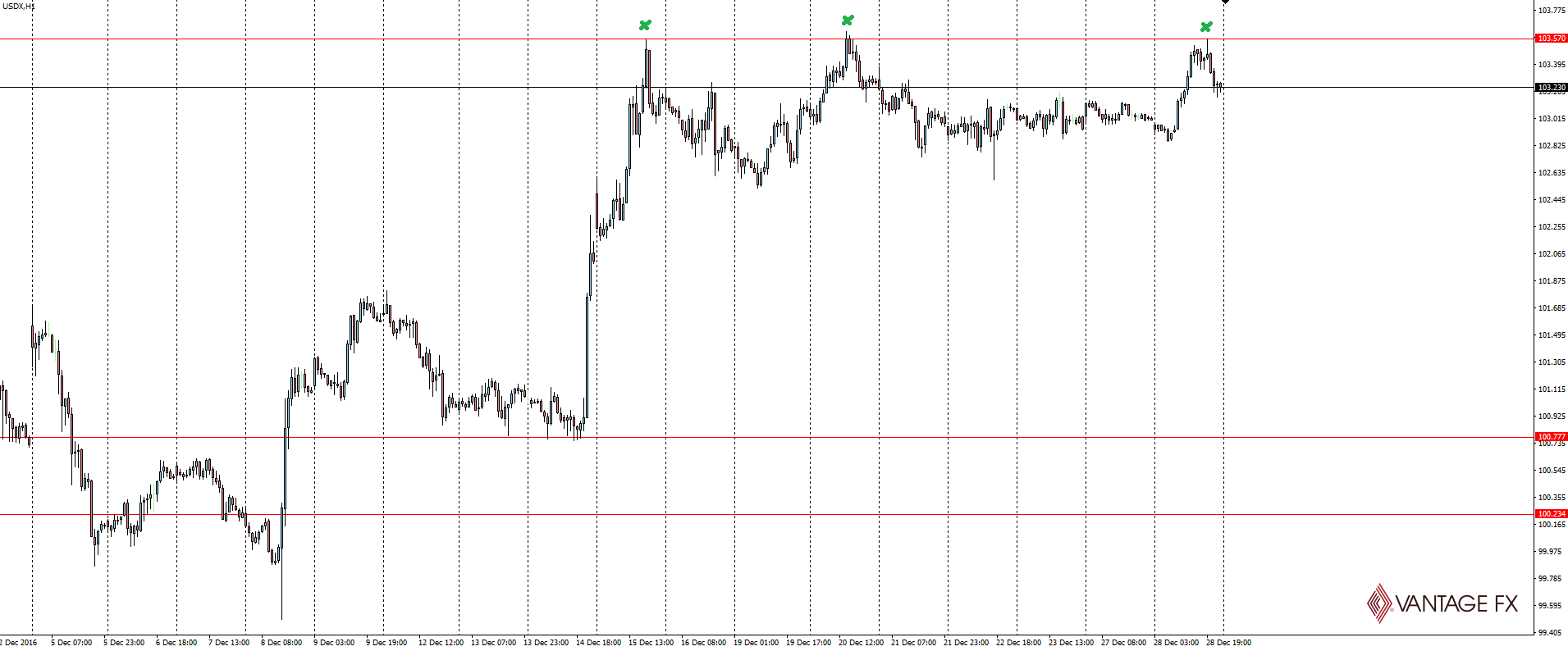

USDX Hourly: “

“

Being the first trading day of 2017 in a still holiday-shortened week, we naturally expected some liquidity issues. Price certainly jumped around as conditions were obviously thin, but it was definitely tradable.

USD/JPY Daily:

Click on chart to see a larger view.

Price pulled back into our entry levels, but the USDX momentum was too strong and they didn’t even look like holding.

The importance of using USDX in your trading analysis can’t be underestimated.

—–

Wednesday:

USDX was taking the heat we spoke about just above and on Tuesday it was time to take notice and join the ride rather than fight it.

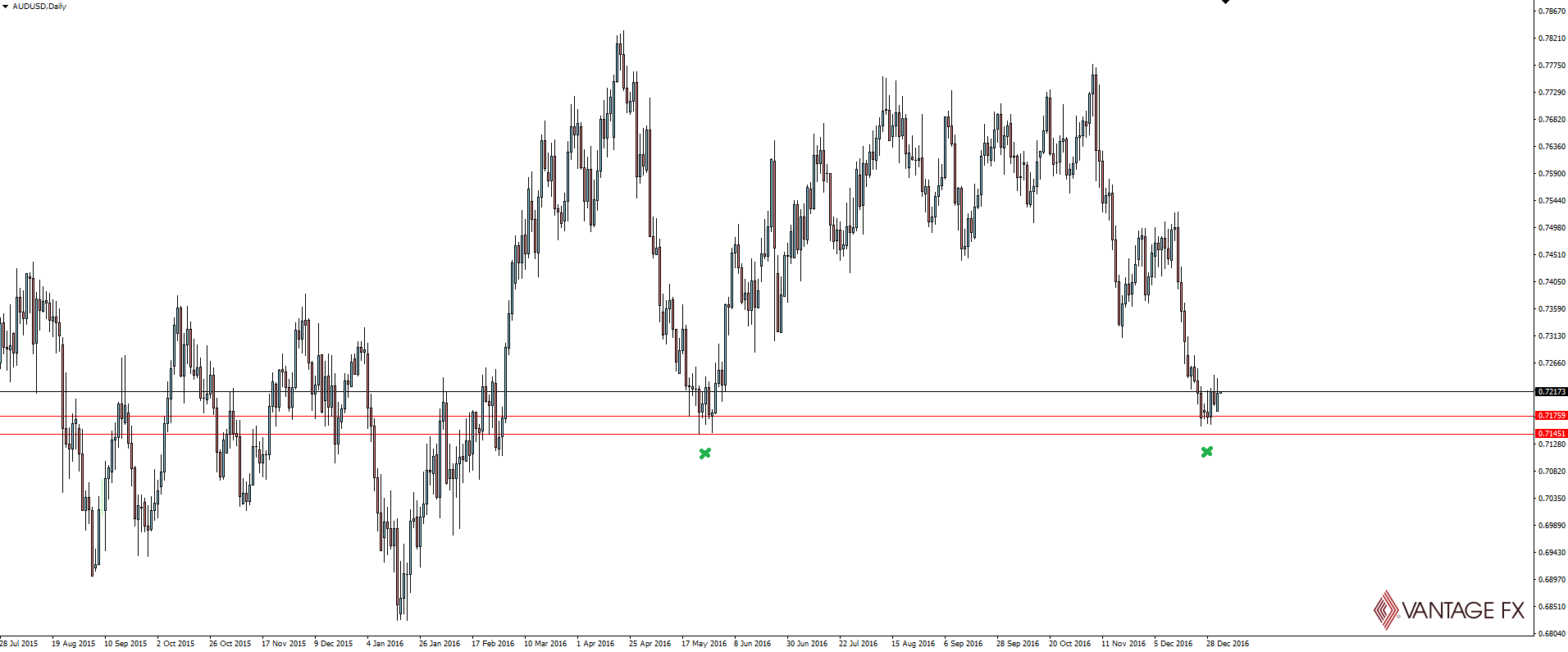

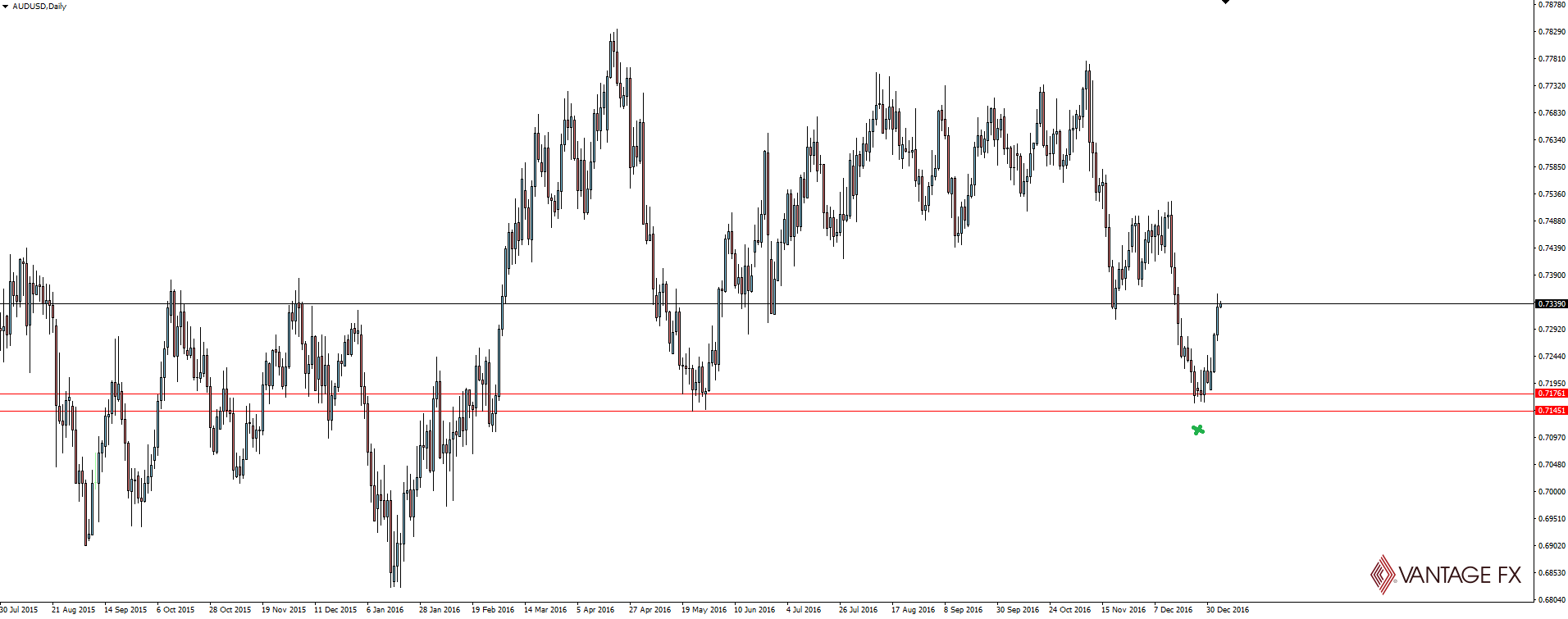

AUD/USD Daily: C“

C“

With AUD/USD testing previous support that had given a strong, V shaped bounce previously, the setup was there on the Aussie.

AUD/USD Daily:

That USDX rejection candle we highlighted in Wednesday’s blog was hugely telling and as the USDX continued to get hammered, the Aussie kept rallying.

There were enough intra-day pullbacks that the risk-averse trader should have gotten long somewhere along the way and the aggressive traders certainly cashed in.

Thursday:

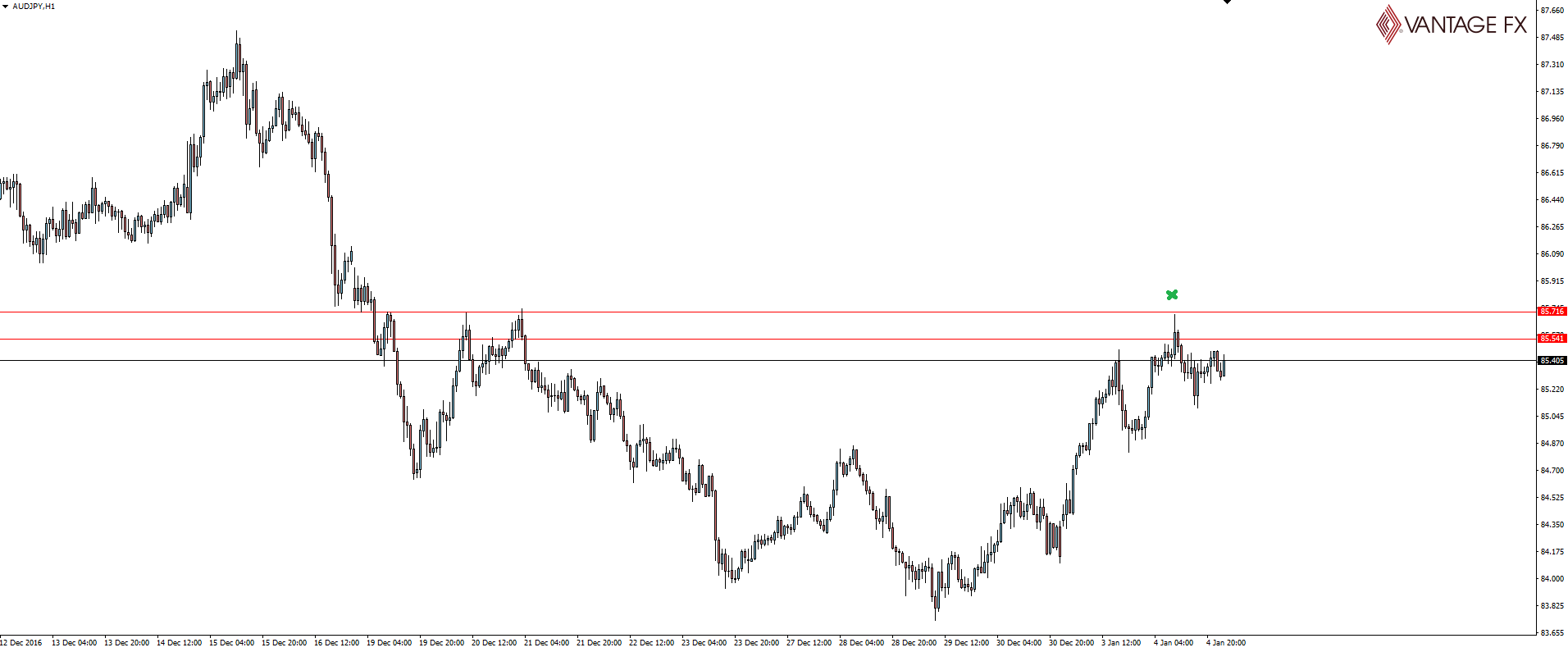

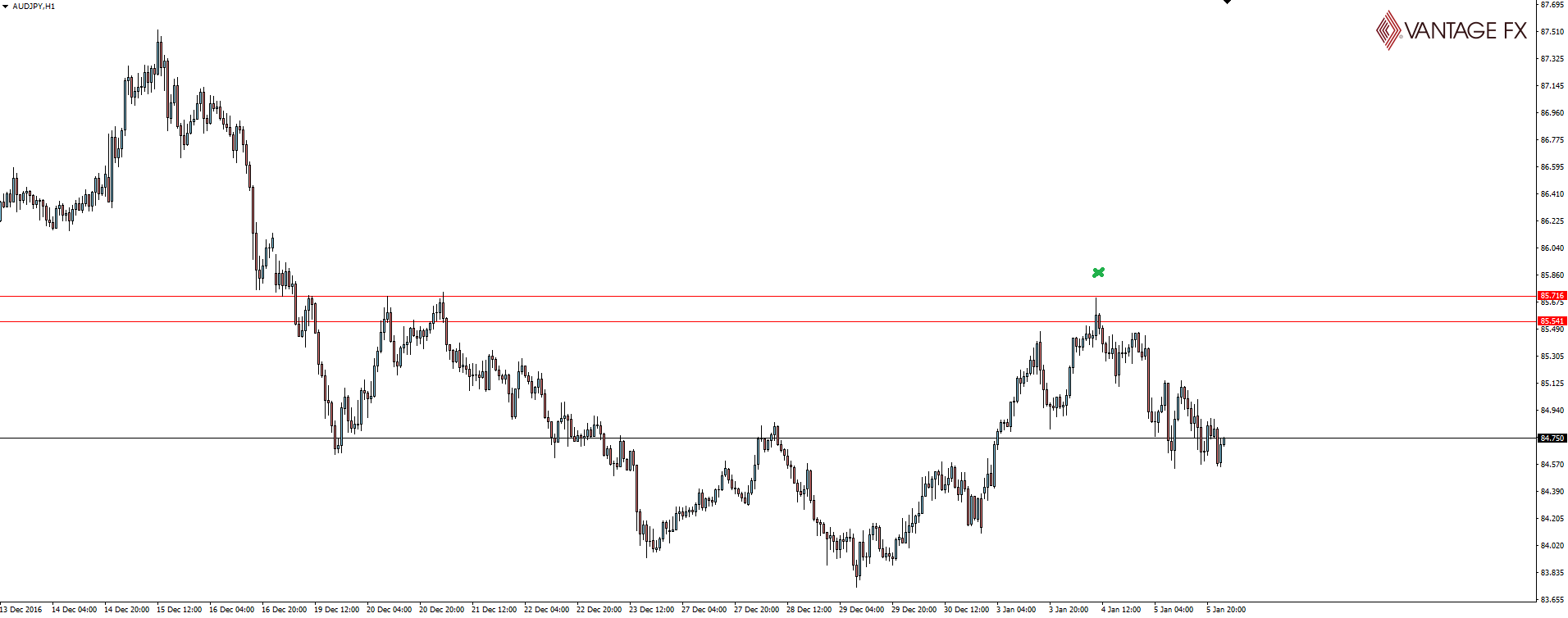

Yesterday’s opportunity to short AUD/JPY was an exact carbon copy of the previous AUD/JPY setup we spoke about in mid December.

AUD/JPY Hourly: “

“

It was exactly the same as last time where we have the higher time frame resistance level having held, and now a short term pullback to test previous short term support now as possible resistance. This is the level that allowed us the excellent risk:reward as we shorted.

AUD/JPY Hourly:

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.