Remember our possible opportunity to short AUD/JPY we featured back in mid December? Yes, the Christmas gift trade that gave us multiple chances to sell on short term retests after the higher time frame resistance zone held.

Well after maxing out at around 200 pips below the level, price has since pulled back and we have a carbon copy setup forming today.

The same zone, the same setup. The only question that now remains is whether we’ll get the same result.

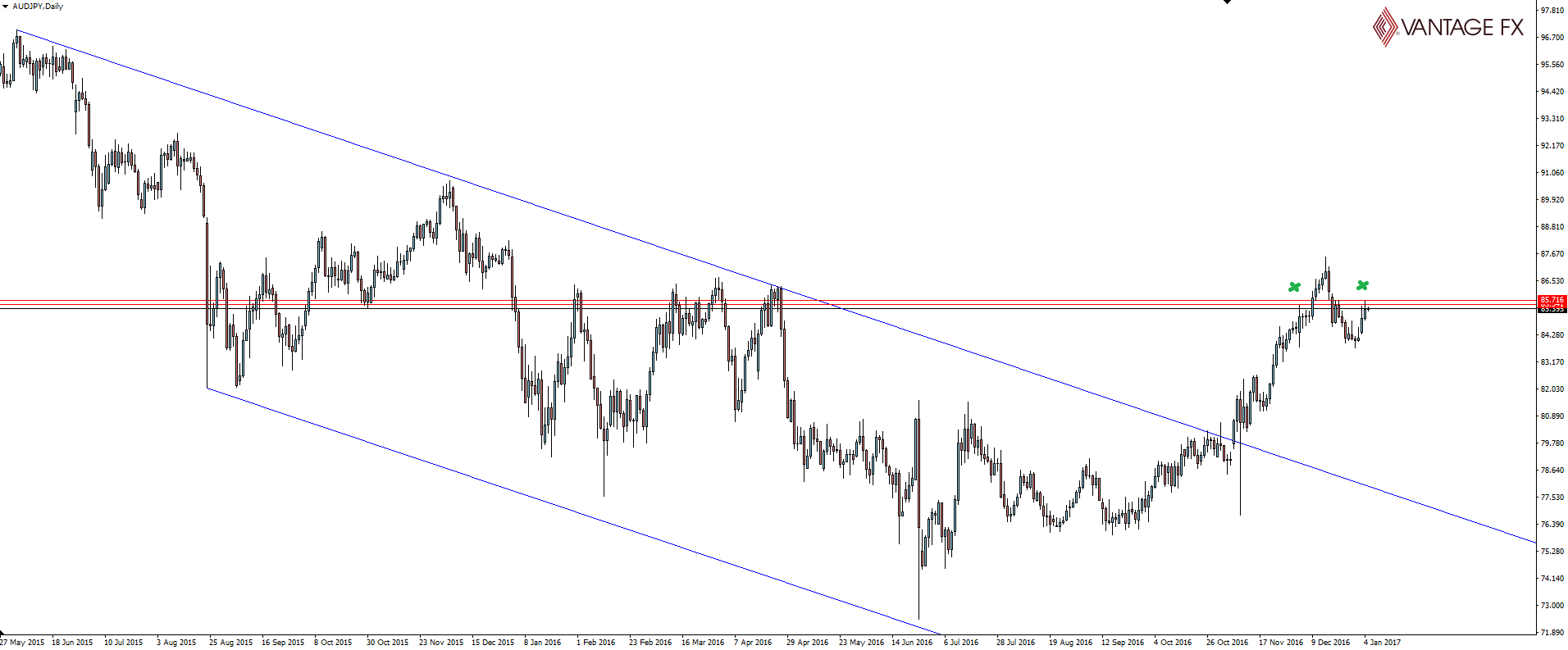

AUD/JPY Daily:

The AUD/JPY daily chart provides the higher time frame context as to why the level is significant.

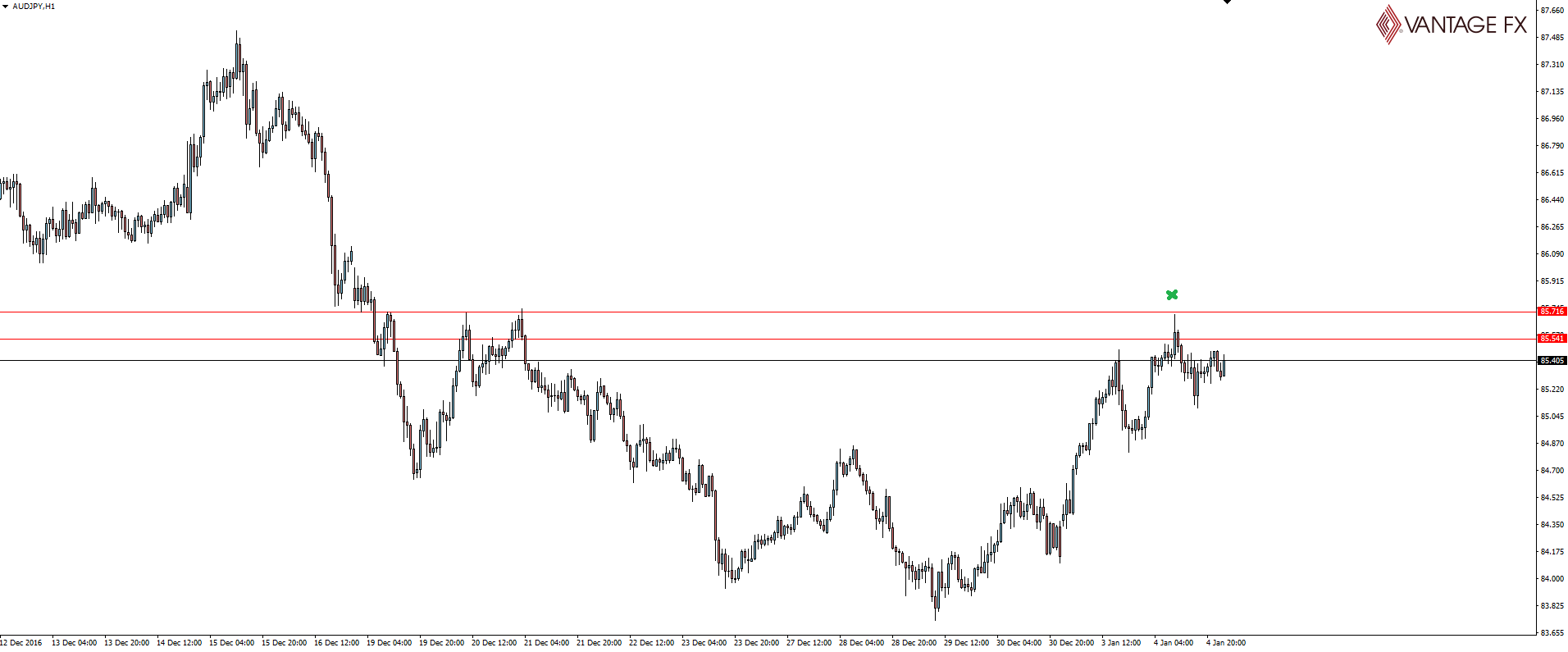

AUD/JPY Hourly:

But it is the hourly where we can see an actionable trading setup. It’s exactly the same as last time, where we have the higher time frame resistance level having held, and now a short term pullback to test previous short term support now as possible resistance.

This is the level that allows us to see excellent risk:reward in your trade, depending on how aggressive you want to be in your own setup.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.