It’s Friday in the Wall Street Daily nation.

Per our weekly routine, we’re ditching our commentary-based articles in favor of a graphical representation of the week’s most important economic and investment news.

This week, we’re profiling two sucker’s bets — and we’re being diplomatic about it. One is on the long side of the market. The other is on the short side. We’re into equal-opportunity humiliation here.

Then we’re finishing off the week with one of the surest bets in the market. Convention says such a thing shouldn’t exist. But the data don’t lie.

So let’s get to it…

Shorty Got Whacked

When Amazon.com Inc (NASDAQ:AMZN) announced its acquisition of Whole Foods Market Inc (NASDAQ:WFM), that’s all the financial press talked about.

The same thing happened Wednesday after streaming giant Netflix Inc (NASDAQ:NFLX) reported blistering subscriber growth.

As I shared during my appearance on Cheddar, it’s all about the growth.

Sure enough, the swelling subscriber ranks led to a rapidly expanding share price. Netflix shares surged nearly 15% on the day to close at a record high of $183.60.

Subscribers to one of our premium advisory services were popping Champagne bottles when the news broke. Why? Because our strategy enabled them to pocket gains as high as 140% on the day.

However, not everyone was celebrating. Heading into Netflix’s report, short sellers pressed their bets that the stock price would collapse to near-record levels. But the only thing that’s collapsing now are their account balances. Take a look…

Shorting red-hot momentum stocks, no matter how frothy the valuation, is a sucker’s bet. Always.

Not-So-Hot IPOs

We’re no stranger here to panning “hot” IPOs — like Snap Inc (NYSE:SNAP), Twitter Inc (NYSE:TWTR) and Fitbit Inc (NYSE:FIT), among others.

While each serve as an effective case study against buying the latest IPO Wall Street is hyping up, now we have more comprehensive research to back up our avoidance behavior.

The long-term chart of the Bloomberg IPO Index reveals that hot IPOs have been anything but hot for the last half decade.

Or as Bespoke Investment Group put it, “IPOs have lagged [large caps]… and lagged badly.”

This wasn’t always the case, as you can see in the chart. So what’s changed?

We can blame it on excess VC funding, a lack of any truly innovative companies or anything else that sounds reasonable. But the cause doesn’t really matter — only the investment takeaway does.

Avoid this sucker’s bet too!

The Surest Way to Beat the S&P 500

File this under, “No Impressive Feat Goes Unpunished.”

I’ve long been an admirer of the research and analysis of one of the first financial bloggers, Eddy Elfenbein of Crossing Wall Street.

His approach is no frills, no fuss — just lots and lots of research.

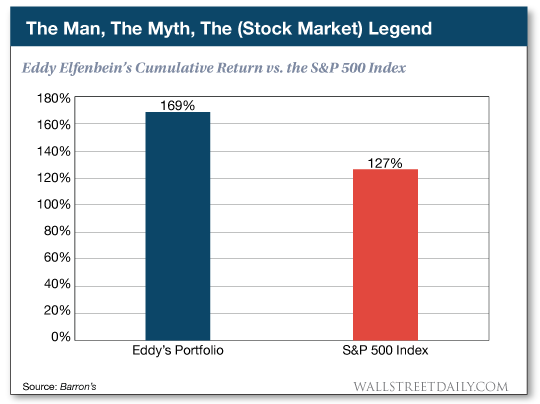

And his results are unparalleled. He’s the rare active manager that outperforms the S&P 500 index on a consistent basis. He’s done it for eight of the last 10 years and is on track to do it again this year.

He’s so successful he became the first financial blogger to parlay his strategy into a full-fledged actively managed ETF. Now longtime fans of his work (and results) can hit the “easy button” and outperform the market too.

Yet for some reason, Barron’s decided to publish an irrelevant and overly critical article focusing on the fees his fund charges relative to passive index ETFs. Talk about comparing apples to oranges.

As Elfenbein readily admits, his AdvisorShares Focused Equity ETF (NYSE:CWS) is for “people who are stock pickers.” Not indexers.

Instead of giving into the temptation of our times to be a crybaby, Elfenbein issued a refreshing response to the unfair characterization. Wall Street and the world need more class acts like him.

If you’re looking to consistently outperform the market, I recommend you consider his ETF.

Full disclosure: I get zero, zip, zilch, nada for recommending it — other than the satisfaction of knowing you can’t go wrong trusting your hard-earned capital to such a stand-up guy.