It’s Friday in the Wall Street Daily nation. For the new kids on the block hanging tough, that means it’s time to go to the charts.

Each week, I cull together a collection of graphics to convey some important and timely investing insights. And this go-round, I’m covering the most hated bull market in history, the not-so-almighty dollar and the new age of electrification.

Without out further ado…

No Bull?

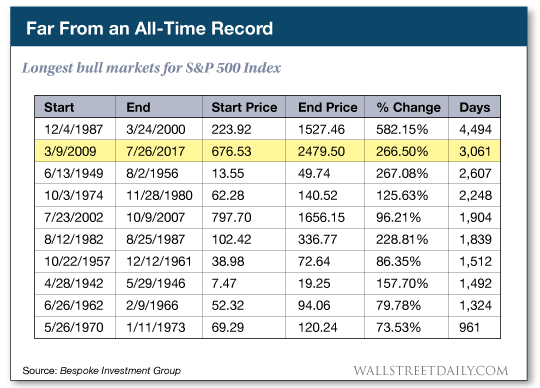

After years of rallying stock prices, it’s natural to wonder — how long can this last and how high can this go?

Turns out that the answer is a lot longer — and a lot higher. That is, if history is any guide:

Although the current bull market for the S&P 500 index ranks as the second longest ever, it’s a far cry from securing the top spot.

For that to happen, stocks would need to rally for almost another four years — and roughly double in price. Here’s to setting a new record!

From Highs to Lows

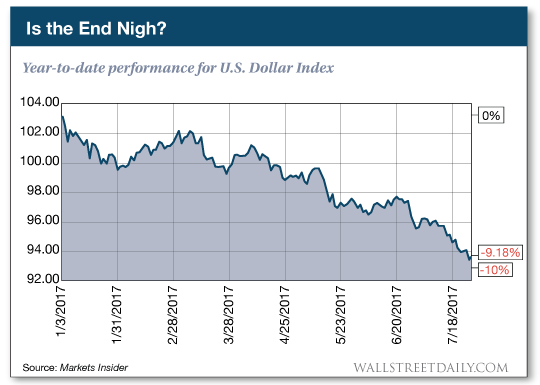

While stocks keep charging higher, the U.S. dollar keeps sinking lower. Year to date, the U.S. dollar index is down nearly 10%.

That’s a massive move for a currency.

Is the end nigh for the almighty dollar? If so, it means it’s the most profitable time to invest in this alternative currency.

Don’t miss out!

Is this the end of the greenback?

Welcome to the Age of Electrification

On July 5, leading Swedish carmaker Volvo, (OTC:VOLVF, ST:VOLVb) announced that it would convert to an all electric and hybrid fleet of cars by 2020.

“This announcement marks the end of the solely combustion engine-powered car,” said Volvo Chief Executive Officer Hakan Samuelsson.

Indeed! It also marks the beginning of a new age of electrification.

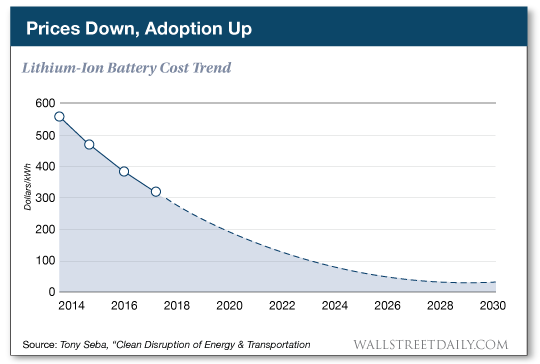

The largest obstacle to adoption of electric vehicles (EVs) has always been battery costs. But battery prices are plummeting.

Take a look:

Since 2014, lithium-ion battery prices have been cut in half. Since 2010, they’re down 80% — from roughly $1,000 per kilowatt hour (kWh) to about $227 per kWh.

The cheaper these batteries get, the more affordable EVs get — and, in turn, the more obvious an adoption boom is about to occur.

Is your portfolio positioned to profit?