Upcoming US Events for Today:- Personal Income and Expenses for April will be released at 8:30am. The market expects Personal Income to show a month-over-month increase of 0.4% versus an increase of 0.5% previous. Consumer Spending is expected to show a month-over-month increase of 0.2% versus an increase of 0.9% previous.

- Chicago PMI for May will be released at 9:45am. The market expects 61.0 versus 63.0 previous.

- Consumer Sentiment for May will be released at 9:55am. The market expects 82.5 versus 81.8 previous.

Upcoming International Events for Today:

- German Retail Sales for April will be released at 2:00am EST. The market expects a month-over-month increase of 0.4% versus a decline of 0.7% previous.

- India GDP for the First Quarter will be released at 8:00am EST. The market expects a year-over-year increase of 4.7%, consistent with the previous report.

- Canada GDP for the First Quarter will be released at 8:30am EST. The market expects an annualized increase of 1.8% versus an increase of 2.7% previous.

The Markets

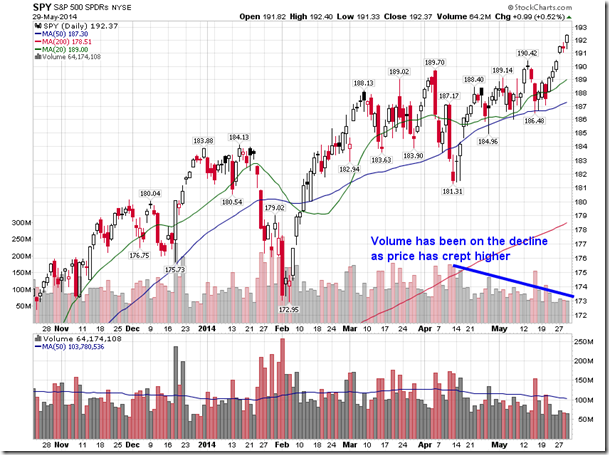

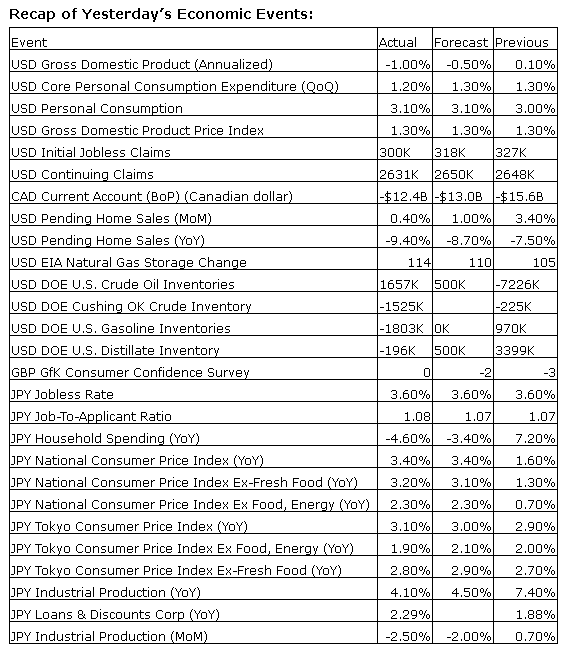

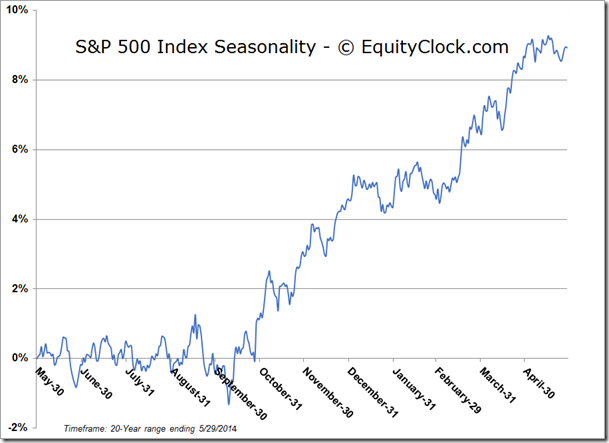

Stocks ended higher on Thursday, despite a weaker than expected GDP report for the first quarter. According to the report, the economy is indicated to have contracted by 1.0% during the first quarter, the first contraction since the third quarter of 2011. The decline is suggested to be the result of adverse weather conditions during the first three months of the year, which impacted inventory investment and net exports; analysts believe that the economy will show a rebound in the second quarter now that weather is no longer a factor. As investors digested the report, the S&P 500 Index closed at a new all-time high. Volume, according to the S&P 500 ETF (ARCA:SPY), was light with the number of shares trading hands almost 40% below the 50-day average. Volume has been on the decline throughout the month of May as price has crept higher, suggesting that investor participation at the present highs is on the decline, potentially unsupportive of sustained price appreciation.

As published at the bottom of each report, the S&P 500 remains within a rising trend channel that stretches back to around this time last year. The benchmark is presently testing the center line of the trend channel, having traded below this level for the last month and a half. With trading activity remaining in the lower half of the rising trend channel, the trend can be characterized as being weakly positive. Should the benchmark continue to hold within the lower half of the rising trading range, the likelihood of a break below the lower limit of the trend channel, now around 1845, increases.

And finally, with today being the last trading day of May and Monday being the first trading day of June, a look at the tendencies for these days may be prudent. Over the past 25 years, the S&P 500 has gained an average of 0.26% during the last trading session of May with positive results recorded 62% of the time. The first day of June saw an equally positive frequency of gains at 64%, however, returns averaged a minor loss of 0.02%. Portfolio managers typically reallocate positions around the end of the month/start of the next contributing to the positive tendency for stocks on these two days.

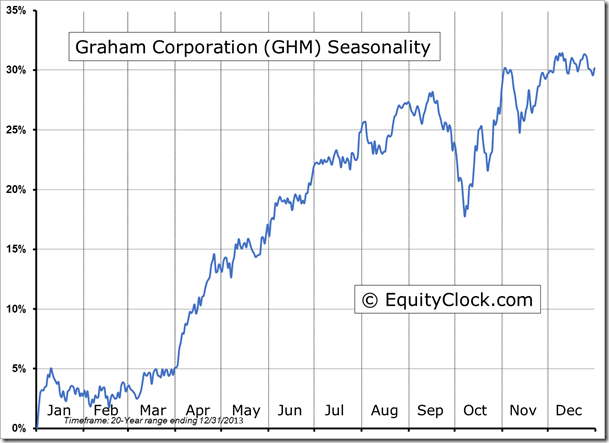

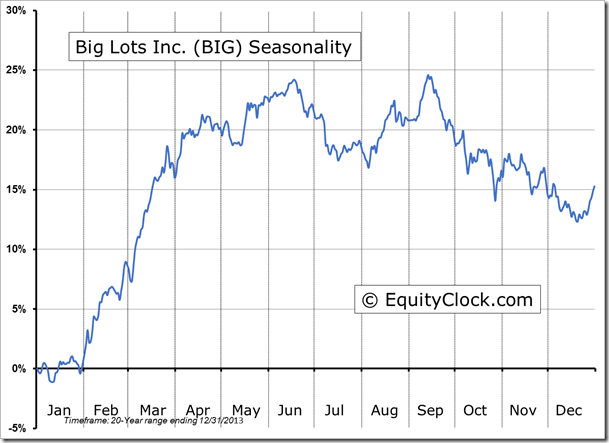

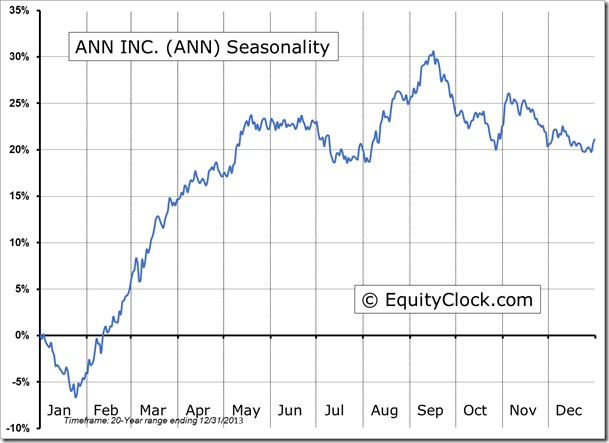

Seasonal charts of companies reporting earnings today:

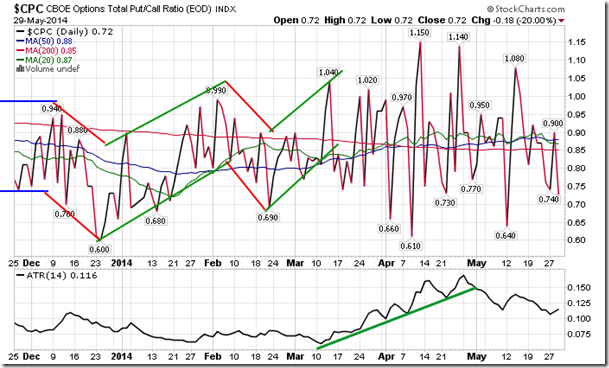

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.72.

S&P 500 Index

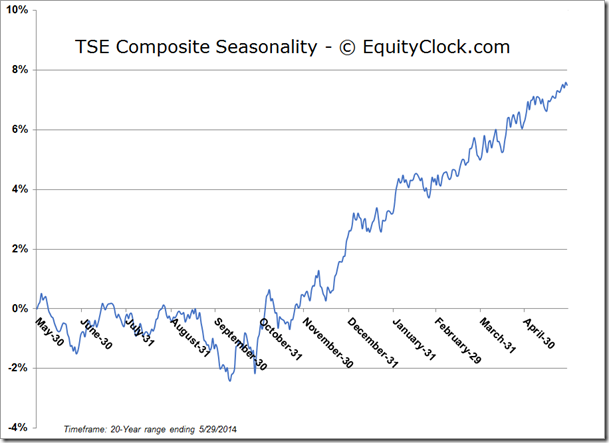

TSE Composite

Horizons Seasonal Rotation (TO:HAC)

- Closing Market Value: $14.65 (up 0.14%)

- Closing NAV/Unit: $14.64 (up 0.25%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.38% | 46.4% |

* performance calculated on Closing NAV/Unit as provided by custodian