Freeport-McMoRan Inc. (NYSE:FCX) has issued notices for the redemption of senior notes on Sep 18. The redemption includes $543 million aggregate principal amount of two series of Freeport-McMoRan senior notes and three series of Freeport-McMoRan Oil & Gas LLC (FMOG) senior notes currently outstanding.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Freeport-McMoran, Inc. (FCX): Free Stock Analysis Report

Original post

Zacks Investment Research

The company expects net income to gain roughly $11 million in the third quarter of 2017 in connection with the redemptions. U.S. Bank National Association, as trustee for the FCX senior notes, and Wells Fargo (NYSE:WFC) Bank, N.A., as trustee for the FMOG senior notes issued notices on Aug 18 to the registered note holders about the terms of these redemptions.

Post these note redemptions, FCX’s total debt will decrease from $15.4 billion as of Jun 30, 2017 to around $14.8 billion. Total cash interest cost savings are expected to be around $35 million per year.

Freeport has outperformed the industry over the last six months. The company’s shares have moved up around 3.1% in this period, compared with a 1.6% gain recorded by the industry.

Freeport’s adjusted earnings of 17 cents per share for the second quarter missed the Zacks Consensus Estimate of 20 cents. Revenues grew around 11.3% year over year to $3,711 million in the quarter, surpassing the Zacks Consensus Estimate of $3,678 million.

The company lowered its copper and gold sales volume guidance for 2017. Freeport now anticipates sales volumes to be roughly 3.7 billion pounds of copper (down from 3.9 billion pounds expected earlier), 1.6 million ounces of gold (down from 1.9 million ounces) and 93 million pounds of molybdenum, including 940 million pounds of copper, 375,000 ounces of gold and 22 million pounds of molybdenum for the third quarter of 2017.

Also, the company assumes average prices of $1,250 per ounce of gold, $2.65 per pound of copper and $7.50 per pound of molybdenum for the remaining year. Consolidated unit net cash costs (net of by-product credits) for copper mines are expected to average $1.19 per pound of copper for 2017.

Freeport is taking measures to manage costs and capital spending amid a challenging operating environment. The company also remains focused on deleveraging its balance sheet, partly through assets sale. It is also conducting exploration activities near its existing mines with a focus on opportunities to expand reserves that will support the development of additional future production capacity.

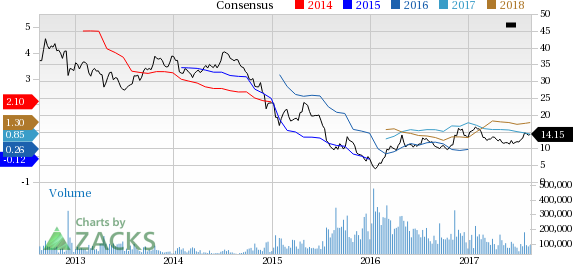

Freeport-McMoran, Inc. Price and Consensus

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Freeport-McMoran, Inc. (FCX): Free Stock Analysis Report

Original post

Zacks Investment Research