Franklin Resources, Inc. (NYSE:BEN) is scheduled to report third-quarter fiscal 2017 results, before the opening bell on Jul 28. Revenues and earnings are projected to decline year over year.

Why a Likely Positive Surprise?

Our proven model shows that Franklin is likely to beat on earnings in the fiscal third quarter. This is because the company has the combination of two key ingredients for a possible earnings beat – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is currently pegged at +1.37%. This is a very significant and leading indicator of a likely positive earnings surprise for the company.

Zacks Rank: The combination of Franklin’s Zacks Rank #3 and a positive ESP makes us confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement.

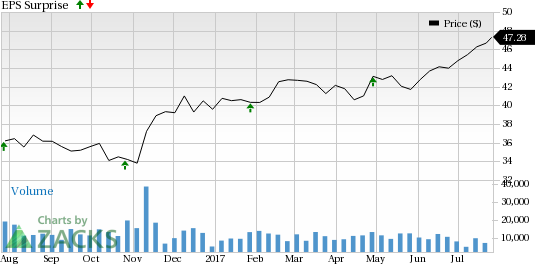

Franklin recorded positive earnings surprise in all the trailing four quarters, with an average positive surprise of 14.80% as depicted in the chart below:

Additionally, shares of Franklin gained 6.3% during the fiscal third quarter ended Jun 30, 2017, compared with 7.5% rally of the industry it belongs to.

Factors to Influence Q3 Results

The Apr-Jun quarter in 2017 recorded a strong performance of equity markets. The S&P 500 Index gained 3.1% in the quarter. Moreover, the index measuring international equity performance – the MSCI EAFE Index – climbed around 6.37% during the quarter.

Given Franklin’s AUM disclosure for Jun 2017, the upcoming release will display higher assets under management on a year-over-year basis. Additionally, the company is likely to record inflows mainly tied with Global Fixed Income asset class, Global Equity and U.S. Equity.

Franklin’s cost-control efforts should support bottom-line growth to some extent. Notably, management expects expenses in fiscal 2017 to remain flat or decline slightly, considering the impact of previous cost-cutting initiatives.

Further, we believe that the company’s top line should get support from its diversified portfolio offerings, as well as its global presence.

Notably, this investment manager could not win analysts’ confidence during the quarter. The Zacks Consensus Estimate remained unchanged at 73 cents, over the last seven days.

Stocks that Warrant a Look

Here are some stocks you may want to consider, as according to our model these have the right combination of elements to post an earnings beat this quarter.

OM Asset Management PLC (NYSE:OMAM) is scheduled to report second-quarter results on Aug 3. It has an Earnings ESP of +2.63% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Och-Ziff Capital Management Group LLC (NYSE:OZM) is +50.00% and it sports a Zacks Rank #1. The company is slated to release second-quarter numbers on Aug 2.

Hilltop Holdings Inc. (NYSE:HTH) has an Earnings ESP of +2.33% and a Zacks Rank #2. It is set to report second-quarter results on Jul 27.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

OM Asset Management PLC (OMAM): Free Stock Analysis Report

Och-Ziff Capital Management Group LLC (OZM): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Original post