Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

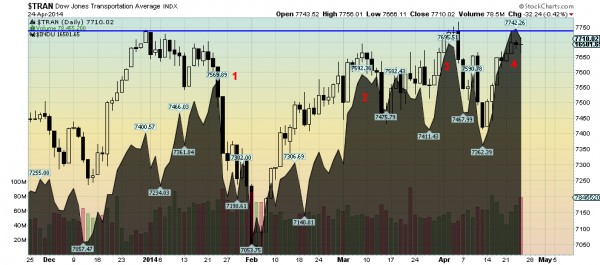

This may sounds like a a silly premise but stick with me for a few minutes. Many of you spend a lot of time looking at the US market structure, and from a technical perspective that means Dow Theory. You may not invest by Dow Theory and you may only follow it when the signals are close to confirmation, but you know what it is. When the Transports (ARCA:IYT) or Industrials (ARCA:DIA) make a new high, an uptrend is confirmed when the other one also makes a new high. I wrote Thursday about the phenomenon in a post I titled Don’t Be Stupid. The Transports have made 4 new highs since the beginning of the year but the Industrials are yet to confirm with a new high as shown in the candlestick chart of the Industrials with the area chart of the transports added above. So Dow Theory does not confirm the new continuation of the uptrend.

That is nice but I started this by talking about France and Europe. How does this tie in? The relationship is almost good enough for an SAT question: Industrials are to Transports as the German Market is to . The answer is the French Market. Check out the candlestick chart of the German DAX (DAX, ARCA:EWG) with the area chart for the French CAC (CAC, ARCA:EWQ) below. Notice any similarities? The big daddy in Europe is the German market and it has not made a new high since January, while the little brother, the French market has made 4 new highs. Perhaps it is time to start looking at the French Market a bit more closely as the transports keep making new highs, and watch the German market instead of trading in it.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.