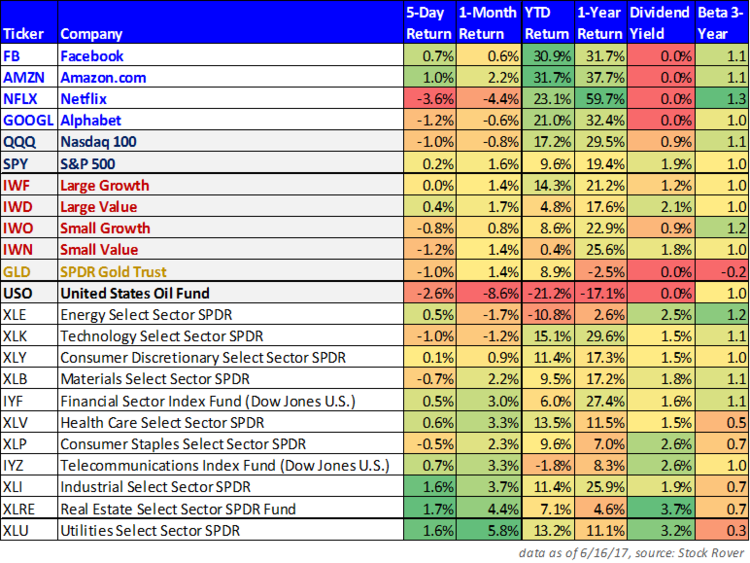

After being left behind during the Trump rally, dividend stocks have been quietly showing strength in recent weeks, as shown in the following table.

But despite the strong recent performance of "boring" dividend stocks (for example, utilities (Utilities Select Sector SPDR (NYSE:XLU)) and real estate (Real Estate Select Sector SPDR (NYSE:XLRE)) in our table above), the news coverage is dominated by giant left coast Nasdaq companies (for example, Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google (Alphabet) (NASDAQ:GOOGL), aka "FANG").

Before getting into the 10 big safe dividend ideas, we want to make a couple points about FANG stocks. First, we are not FANG-haters, and we fully understand these stocks can still (and probably will) go much higher in price. However, we also understand that many investors need steady income and they're not comfortable with higher volatility and uncertainty of aggressive growth stocks. Many investors prefer big safe dividend payments.

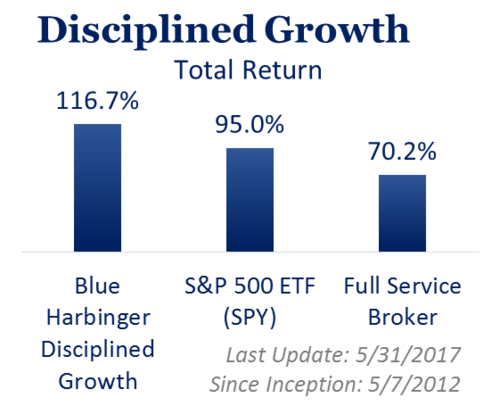

Second, we believe diversification is important. That means do not buy all aggressive growth tech stocks, but it also means don't buy all income and value stocks either. Despite our strong preference for value stocks over the long-term, we still have some exposure to FANG and other aggressive growth stocks via broadly diversified index funds that hold thousands of different stocks (for example, we have a small allocation to Vanguard's Total Stock Market ETF (Vanguard Total Stock Market (NYSE:VTI)); it's one of our favorite ETFs for its broad diversification and very low expense ratio). Also, we do own some shares of Facebook in our Blue Harbinger Disciplined Growth portfolio (we bought them in 2013 for roughly $27 per share). And finally we occasionally write options on aggressive growth stocks because they can present such attractive income-generating opportunities.

However, considering the recent signs of capitulation for FANG stocks (and large cap growth stocks (iShares Russell 1000 Growth (NYSE:IWF)) and technology stocks (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) as shown in our earlier table), combined with our contrarian philosophy towards investing in general, we believe now is a good time to consider big safe dividend investments, especially because many of their valuations remain attractive.

For your consideration, we have highlighted ten attractive high-income investment ideas…

1. Diversified Real Asset Income Fund (NYSE:DRA), Yield: 7.5%

If you are an income-focused investor, and you like the idea of investing in real estate and utilities (two of the worst performing sectors over the last year, but two of the best over the last few weeks), then you might consider Nuveen's Diversified Real Asset Closed End Fund ("CEF"). Its two largest sector exposures are real estate and utilities, and it offers an attractive 7.5% yield. The fund is a closed end fund, which means you need to keep your eye on a few more moving parts (such as the discount/premium to NAV, use of leverage, derivatives, and fees). However, in this particular case, the fund is attractive. Specifically, its fees, holdings and use of leverage are reasonable, and it currently trades at a very attractive discount to its NAV, and we believe it continues to offer an attractive investment opportunity for contrarian yield seekers right now.

2. Verizon Communications (NYSE:VZ), Yield: 5.0%

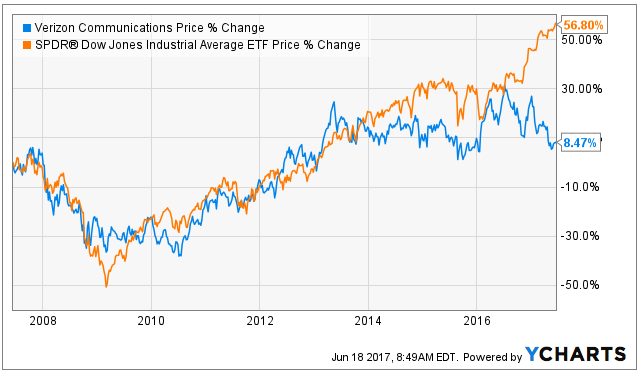

If you've never heard of the "Dogs of the Dow," it's a strategy whereby an investors buys the 10 highest yielding Dow Jones stocks annually based on the premise that Dow Jones companies don't change their dividend policies based on market cycle fluctuations, and therefore if a company has a high yield it is an indication of attractive value. Based on its recent relatively poor performance, and its big dividend yield, Verizon is an attractive Dog of the Dow. We've written about Verizon a couple times this year (for example: Verizon's Yield Is Creeping Higher). However, our basic thesis is that the company is evolving as the market moves away from wireline and wireless becomes increasingly saturated. Verizon is delving into new opportunities (for example, Yahoo (NASDAQ:YHOO)) to help keep its big dividend safe, but some investors are uncertain about the changes, and that's largely why the stock price has fallen.

As shown in our earlier table, Telecom stocks have delivered relatively poor performance over the last year, but they're perking up in recent weeks, and we believe Verizon currently presents an attractive high-yield investment opportunity that is worth considering.

3. Omega Healthcare Investors Inc (NYSE:OHI), Yield: 7.7%

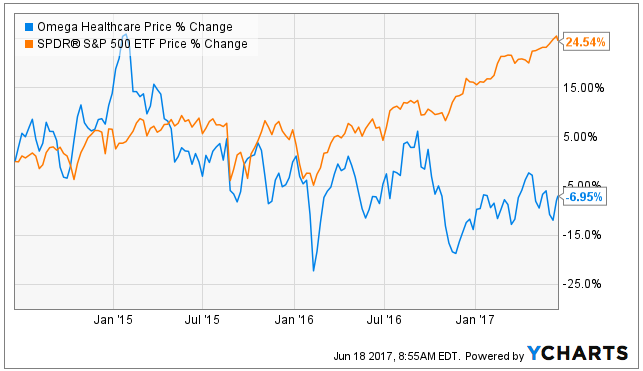

Omega Healthcare is a big-dividend healthcare REIT. And as we saw in the table near the beginning of this report, both real estate and healthcare sectors have delivered relatively weak performance over the last year, but they've been perking up and showing signs of life over the last few weeks. In Omega's case, not only has the stock sold off with the broader sectors, but it also faces unique risks related to healthcare reform (particularly reimbursement) uncertainties, which has caused the stock price to remain particularly weak.

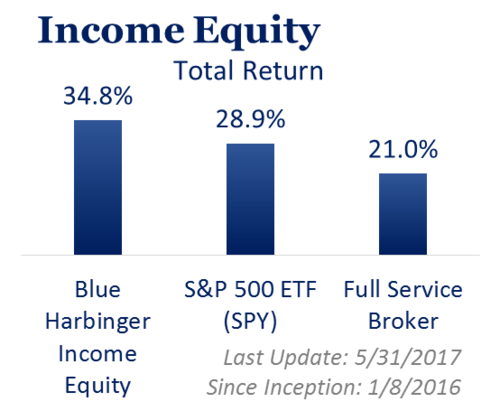

As we've written in the past, we believe the fear is overblown, and Omega presents and attractive investment opportunity. In fact, we currently own shares of Omega in our Blue Harbinger Income Equity portfolio.

4. Realty Income Corporation (NYSE:O), Yield: 4.5%

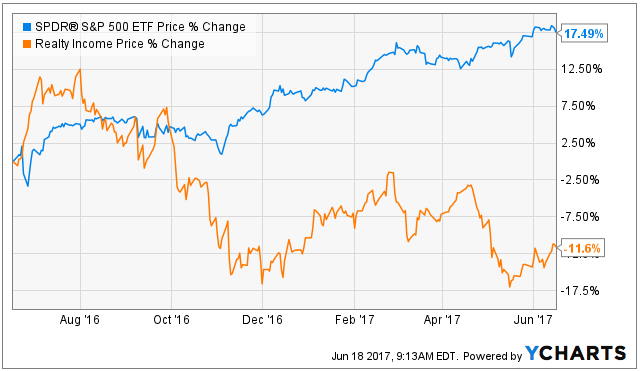

There is a false narrative going around that Amazon is going to put all "brick and mortar" stores out of business. Absolutely not true. For example, Realty Income owns roughly 5,000 retail properties across the US (as well as a handful of industrial and office properties), and the company continues to grow. It has also raised its divided 77 quarterly in a row (the dividend is paid monthly, by the way), and it expects to pay out only ~83% of its adjusted FFO as dividends in 2017, which is a healthy margin of safety for this low-beta company.

We believe Realty Income is an attractive big-safe dividend, and we recently added it to our list of 10 Attractive High-Yield Blue Chips For Contrarians.

5. Energy Products Partners (EPD), Yield: 6.2%

Energy Products Partners is a midstream energy services provider, it offers an attractive 6.2% distribution yield, and the shares are on sale, in our view. EPD has a large and strategic footprint across the US, and despite challenging energy markets, it has a very stable (largely fee-based) business to support the distribution payments to investors. The company also has continued growth opportunities ahead. We recently wrote about EPD (see: Enterprise Products Partners: Big Yield, Stable Growing Income), and if you are looking for big steady income, EPD is worth considering.

6. Duff and Phelps Global Utility Income Closed Fund (NYSE:DPG), Yield: 8.5%

If you are looking for attractive yield, and you like the safety of utilities companies, then you may want to consider the Duff & Phelps Closed-End Fund . This particular fund owns a portfolio of domestic and foreign utilities companies, and it currently trades at an attractive discount to its net asset value. For your consideration, earlier this year wrote about some of the things investors need to consider when investing in closed-end funds in this article (for example, distribution sustainability, leverage, derivatives, and fees). However, if you are an income investor, and you are attracted to the utilities sector in light of its recent performance (as shown in our table near the beginning of this report), the DPG is worth considering.

7. Royce Global Value Trust Inc (NYSE:RGT), Yield: 7.5%

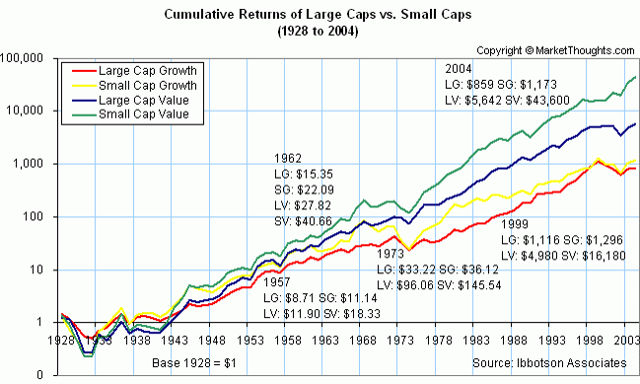

Small cap and value stocks have a track record of being the best performing "style box" over the long-term and across market cycle, yet so far this year it has been the worst performing style box as shown in our table near the beginning of this report. And from a contrarian standpoint, this makes us like the category even more.

and more recently...

One way to play the category (small value), and still generate very high-yield, is via the Royce Value Trust. This particular closed-end fund offers an attractive 7.5% yield, and a top quality management team. We always advocate investors "look under the hood" before investing in a fund. In this case, the expense ratio is relatively very low (0.62%), discount to NAV is high (11.5%), and the leverage ratio is low (5.0%). Worth noting, the actual holdings currently lean a little more towards growth than the fund's name might suggest, but they are truly small cap, and the high quality management team gives us increased confidence is the fund's security selection.

8. GAMCO Global Gold Natural Resources & Income Trust Pref (NYSE:GGN_pb), Yield: 10.9%

As our earlier performance table shows, gold has not delivered a great return on your investment dollars over the last year. However, some investors continue to be attracted to the low beta and inflation-hedging qualities of gold. And considering the massive quantitative easing and market stimulus that is just starting to roll off the books of the US Fed and Treasury, many investors are afraid of what inflation could do to the long-term value of their investments (not to mention the risks of more government monetary policy and manipulation). One way to get exposure to gold, and still maintain a high yield, is via the GAMCO Global Gold closed-end fund . For your consideration, we've written about this particular fund before: 15 Attractive 7% Yields Worth Considering.

9. Gilead Sciences (NASDAQ:GILD)

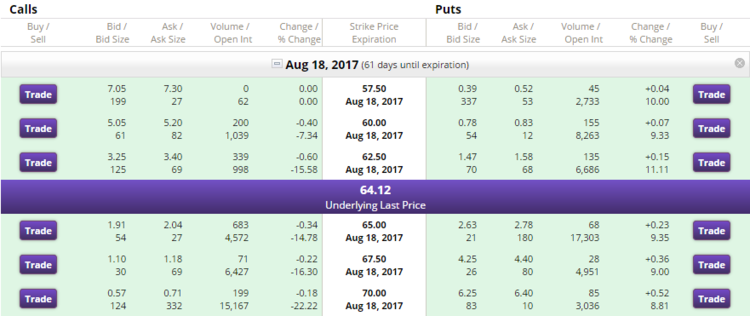

Research-based biopharmaceutical company, Gilead Sciences, continues to offer attractive yield to those investors willing to sell insurance on the shares (i.e. writing put options). For example, the August 2017 put options currently offer a $1.47 premium on the $62.50 strike, which annualized to approximately a 14% annualized yield.

We don't currently have any positions in Gilead put options, but we have generated income by writing Gilead put options in the recent past (Our basic thesis is that the market is overly fearful about increasing competition and Gilead's uncertain future pipeline).

If the shares never get put to you then you simply keep the premium for selling the puts, and if the shares do get put to you then you get to buy the shares of an attractive dividend-paying company (+3.2%) at an even lower price, plus you still get to keep the premium income.

10. Selling FANG Insurance, Yield: +10% annually

As we mentioned earlier, FANG stocks (Facebook, Amazon, Netflix and Google (Alphabet)) have experienced strong price appreciation, especially so far this year, but in recent weeks they have been showing signs of increased uncertainty and the potential for capitulation. As contrarian investors, we have a hard time buying stocks with very high valuations, particularly after the price has just rallied. However, we also acknowledge that the FANG stocks are powerful revenue generators with the potential for a lot more upside ahead.

One way we like to take advantage of this situation is to generate income by selling insurance (i.e. writing puts). And in the case of FANG stocks (and other aggressive growth stocks, in general) anytime the market shows increased fear (like we have been seeing in recent weeks) the premiums for selling insurance (put options) increases. Uncertainty and fear are still very low relative to where they have been in the past, but they're still slightly higher, and this is creating opportunities to generate income now and potentially own attractive companies at much lower prices in the future.

For example, the premium for selling July Amazon puts with a strike price of $935 (more than 5% out of the money) is $8.15, which equates to approximately an annualized premium (income) of 10.5%. If the shares never get put to you, then you keep the income. And if they do get put to you then you own a revenue generating juggernaut (we've been bullish on Amazon for a while) at a lower price, and you still get to keep in the income.

Attractive high-income options opportunity exists for selling puts on Facebook, Netflix and Alphabet, as well. And as Blue Harbinger members are aware, we have been taking advantage of similar income-generating opportunities by writing lucrative options on other various growth stocks.

Conclusion

While aggressive growth stocks (such as FANG) may have significantly more price appreciation ahead, we understand not all investors can stomach the uncertainty, especially considering they don't offer the steady dividend income payments that many investors need. And despite the financial news' constant focus on popular aggressive growth stocks, there continues to be attractive income-generating opportunities in this market, such as the ten we've highlighted in this article. Most importantly, rather than chasing the most popular stocks, investors should always cater their personal investment portfolios to meet their own individual needs and tolerance for risk.