Forex News and Events:

The week opens with little risk appetite. The decline in iron ore futures revived concerns on Chinese recovery, USD/CNY advanced to 6.2430 in Hong Kong, AUD/USD traded with negative bias. The economic calendar for Euro-zone, UK and US being light today, we expect the technicals to drive FX prices. From tomorrow, economic data and events will jump back in the game. UK inflation and growth figures, Japan’s trade data, BoE & Fed minutes and Canadian inflation are amongst the important releases to monitor this week.

Event full week in UK

UK steps into a fresh event full week. April CPI figures (Tue), BoE minutes, retail sales (Wed) and 1Q (prelim) GDP read are on the economic agenda this week. As a quick reminder, last week’s ILO report showed that UK unemployment fell to 6.8% in March (3-month average), while the average earnings missed the market estimates. The BoE released its Quarterly Inflation Report; the Governor Carney gave a halfhearted speech vis-à-vis the UK recovery. Pointing at the “slight” contraction in the spare capacity of the economy over the last three months, he stated that the first bank rate increase will wait until Q1 or even Q2 of 2015.

GBP/USD hit 1.6732 post-QIR, however the positive divergence in UK economy is likely to sustain upside pressures in GBP-complex. Over the past week, the sovereign curve further steepened in the front end (up to 6-months), while easing on longer maturities. The 10-year yield dropped to 2.52%, the lowest since August 2013 as traders adjusted positions on Carney’s speech. Now that the overbought conditions are successfully washed out, GBP/USD waits for fresh direction. Week started with faster growing house prices in May (released by Rightmove), the y-o-y increase reached 8.9%, the highest since Q4, 2007. The BoE Governor Carney said that UK housing market has deep structural programs, stipulating that the BoE cannot solve issues on this end. Moving forward, the expectations on Tuesday CPIs are optimistic; the consensus is a y-o-y acceleration of 1.7% in April (vs. 1.6%a month ago). Any positive surprise should boost GBP-bulls; we are looking for a breakout above 1.6903 to talk about a fresh bullish direction.

Iron ore trades below $100

Iron ore futures fell below $100/ton for the first time since the contract has been launched last year. The contract for June settlement dropped to $98.00 in Singapore today, contract for July settlement traded at $97.75. According to Shanghai Steelhome Information Technology and Co., the stockpiles in Chinese ports rose to record high of 112.55 million tons. Given the weak data stream out of China, the growing Chinese inventories only raise concerns on stability of Chinese recovery. The Chinese equities started the week in red, while TWSE, Kospi and Sensex outperformed their Asian peers.

We see meaningful positive correlation between the Aussie and iron ore futures since March, where iron ore prices first dipped to year lows on China concerns. AUD/USD traded down to 0.9345. Trend and momentum indicators are flat; a break out of 0.9325/0.9415 range is needed for fresh short-term direction.

Today's Key Issues (time in GMT):

2014-05-19T00:00:00 USD No data/event scheduledThe Risk Today:

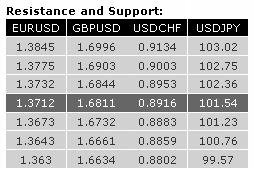

EUR/USD has made a bullish intraday reversal near the key support area between 1.3673 (see also the wedge formation) and 1.3643 (see also the 200 day moving average). A break of the initial resistance at 1.3732 would confirm a short-term phase of stabilisation. Other resistances can be found at 1.3775 (12/05/2014 high) and 1.3845 (09/05/2014 high). In the longer term, EUR/USD is still in a succession of higher highs and higher lows. However, the recent marginal new highs (suggesting a potential long-term rising wedge) indicate an exhausted rise. A break of the key support area between 1.3673 (04/04/2014 low) and 1.3643 (27/02/2014 low) is needed to confirm a long-term bearish trend reversal (see potential double-top).

GBP/USD has thus far successfully tested the support implied by its long-term rising channel. A break of the resistance at 1.6903 is needed to confirm a resumption of the underlying uptrend. An hourly support can now be found at 1.6732 (15/05/2014 low). In the longer term, prices continue to move in a rising channel. A bullish bias remains favoured as long as the support at 1.6661 (15/04/2014 low) holds. However, we are reluctant to suggest an upside potential higher than the major resistance at 1.7043 (05/08/2009 high), especially given the general overbought conditions.

USD/JPY continues to be weak and is now challenging its key support at 101.20. Given the other key support at 100.76, a short-term rebound is favoured. An hourly resistance can be found at 101.67 (16/05/2014 high). Another resistance lies at 102.36. A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. Monitor the support area provided by the 200 day moving average (around 101.23) and the rising trendline from the 93.79 low (13/06/2013). A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF has thus far successfully tested the strong resistance at 0.8953, favouring a short-term phase of consolidation. Hourly supports can be found at 0.8883 and 0.8859 (12/05/2014 low). From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. A decisive break of the key resistance at 0.8953 is needed to validate a bullish reversal pattern (see potential double-bottom formation).