DXY testing bulls’ nerves

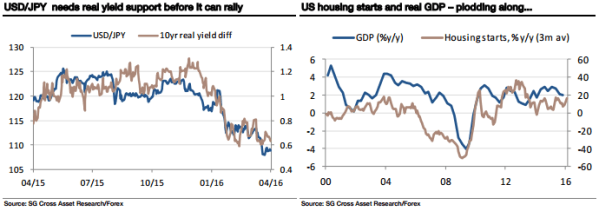

The end of the Kuwaiti oil workers’ strike has dragged crude oil prices lower (WTI just below $40/bbl) and put a dampener on risk sentiment this morning, though the trigger for the 4% (so far) fall in the Shanghai Composite index is more concern that policy will not be so accommodative going forwards. Still, the net result is retreat for NZD, ZAR, AUD, et al this morning. And the FX winner is, of course, the yen. 10-year JGB yields are down to -14bp, a new low, but the Japan/US real yield differential isn’t moving in the dollar’s favor, and that’s what counts here. The BOJ really needs some help from the Fed given that the Japanese authorities seem to have made the schoolboy mistake for asking their G20 colleagues if it would be OK for them to intervene. Best not to ask until afterwards, I suspect, but with intervention very unlikely unless we get to the other side of USD/JPY 105, yen bears remain locked up until the Treasury market can come to their help.

Yesterday’s softer-than-expected US housing starts data did nothing to send US yields up, and yesterday’s Euro Area current and capital account figures show how ECB policies are helping provide EUR 40bn per month of buying for foreign bond markets. The US housing figures are consistent with steady, dull US GDP growth, and today’s existing home sales should show a decent gain to a 5.39mln annual rate. However, it’s going to take more than that to drag Treasury yields back up. The upshot, EUR/USD remains in the top end of its range despite huge capital outflows, EUR/USD 1-month volatility is lower than at any point since 2014, and DXY is still looking awfully vulnerable to chart-lovers as it hovers above 94.

Today’s focus will be on oil prices and on equities after the Shanghai move. Successes in New York primaries for Hillary Clinton and Donald Trump won’t move markets, even if the battle lines in the Presidential election are getting clearer. Apart from the US data, we’ll get UK labor market figures, where we expect the ILO unemployment rate to fall to 5%, jobless claims to fall by 15,000 and wage growth to change little (heading up to 2.2% from 2.1%m, ex-bonus down to 2.1% from 2.2%..). Not much there to provide direction for sterling, and with oil prices lower our GBP/NOK short has run out of steam. Long AUD/NZD, Short USD/CAD and short EUR/RUB are all similarly uninspiring today even if we like them all. Buying 3-month USD/JPY risk reversals may be more sensible than any directional trade, for now.