Over the past two weeks or so, I have focused my currency trading on fading the British pound (NYSE:FXB) and the Australian dollar (NYSE:FXA).

In “The Currency Market Is Lagging A Dramatic Shift in Brexit Sentiment,” I compared market sentiment versus the trading action and made the following claim (emphasis newly made):

“If my interpretation of Brexit interest remains correct, then the current divergence in financial markets from the dramatic shift in sentiment represents a unique opportunity to get ahead of the market. I interpreted heightened interest in a topic as meaning that market participants will get equally anxious about that topic. Anxiety in this case drives a sell-off in the British pound. A move to catch-up could be swift.”

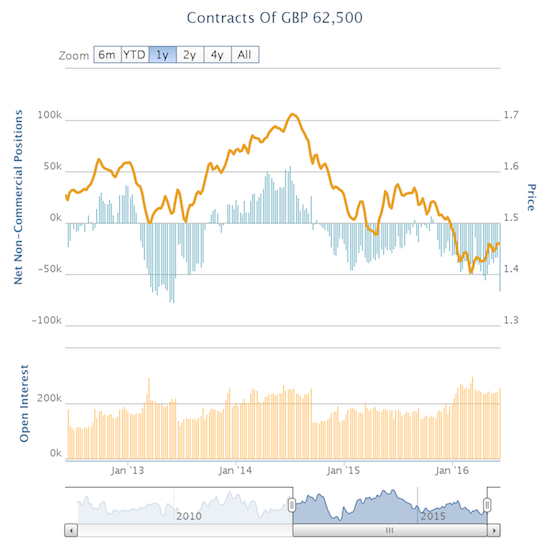

As luck would have it, the market did indeed catch up swiftly. Speculators have abruptly shifted from a waning interest in shorting the pound to carving out a fresh 2-year high in net short positions. Total open interest even increased a bit.

Speculators get back to ramping up bets against the British pound.

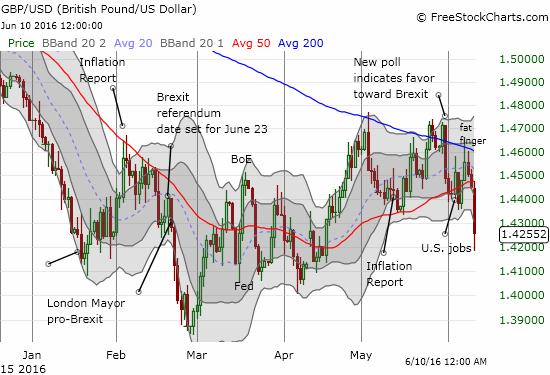

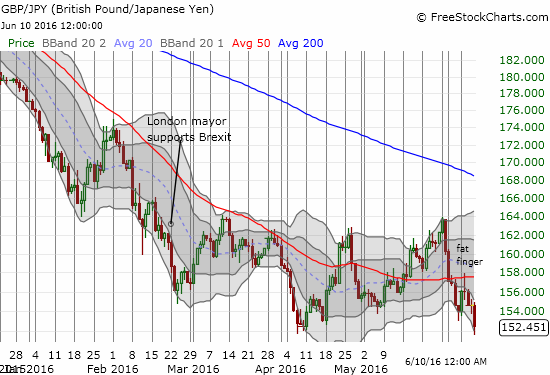

These data are the latest as of last Tuesday. That night, an excellent opportunity occurred for fading the British pound. I lamented in “Pre-Brexit Event Risk Abruptly Becomes Bi-Directional” that I was late in fading what must have been a “fat finger” trade that caused a massive surge higher in the British pound for about one minute. The British pound has sold off ever since across major currencies. On the daily charts below, the brief surge looks like a “wick” just below the label “fat finger.”

GBP/USD has confirmed a declining 200DDMA as resistance along with a very bearish 50DMA breakdown.

GBP/JPY set a new intraday low for the year and just barely closed above the former low, a level last seen almost two years ago.

Per my strategy, I closed out some positions against the pound and kept one open to stay net short. I remain ready to fade fresh rallies in the pound until the day before the June 23rd referendum on the UK’s membership in the European Union (EU).

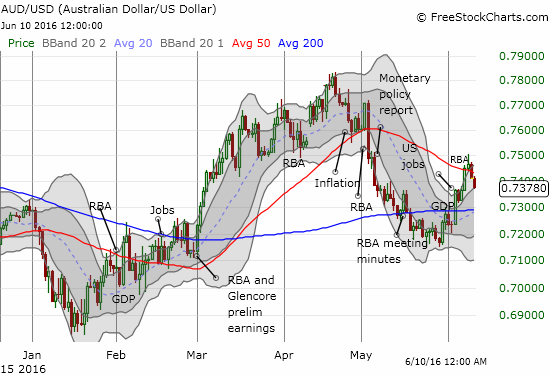

Like the British pound, the Australian dollar has also generated great setups for fading rallies. The last notable rally occurred after the Reserve Bank of Australia (RBA) delivered its June pronouncement on monetary policy. At the time I wrote in “The Australian Dollar Bounces Despite RBA’s Confirmation of Persistently Low Inflation” that the hopeful rally in the wake of the RBA set up a fresh opportunity to fade the currency:

“Just like the trigger buying that occurred in the wake of a strong GDP report, I think this latest spurt of buying will reverse. The next reversal could take more time since traders are still adjusting to the potential for the Federal Reserve to hike rates much later in the year than earlier expected. This adjustment includes making high-yielding currencies look relatively more attractive in the near-term.”

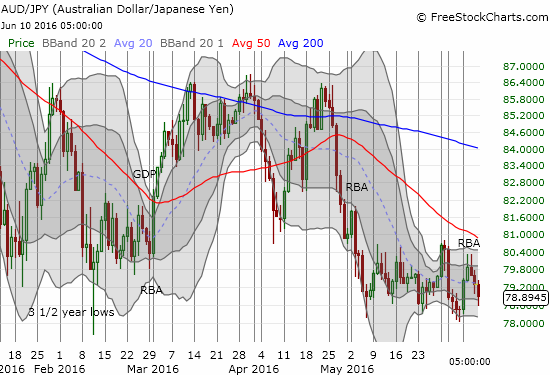

The reversal happened a lot sooner than I expected. Even against the U.S. dollar, the Australian dollar faded enough to reverse most of AUD/USD’s gains for the week. Against the Japanese yen, the Australian dollar lost just about all its original gains for the week.

AUD/USD fails to sustain a 50DMA breakout.

AUD/JPY is weak but still holding its trading rage in place since May.

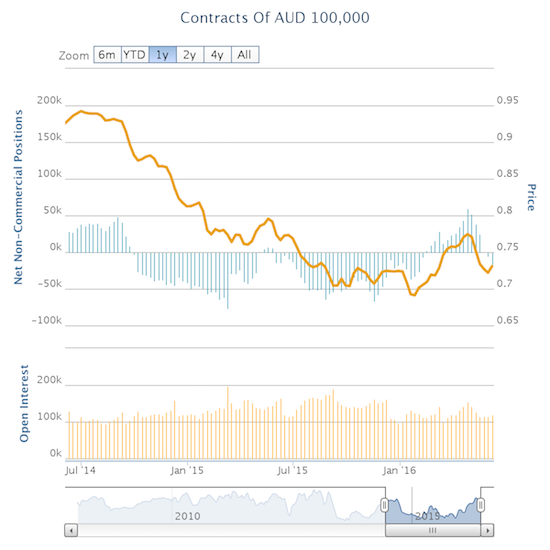

While the Australian dollar rallied, speculators took advantage of higher levels to grow net short positions. This growth is part of the unwind that I anticipated (but has yet to sustain for the Japanese yen). I am looking for the change in net positions to continue trending downward from the recent peak as the market’s current bearish reversal grows.

Speculators are net short the Australian dollar again after spending much of this year stubbornly net long.

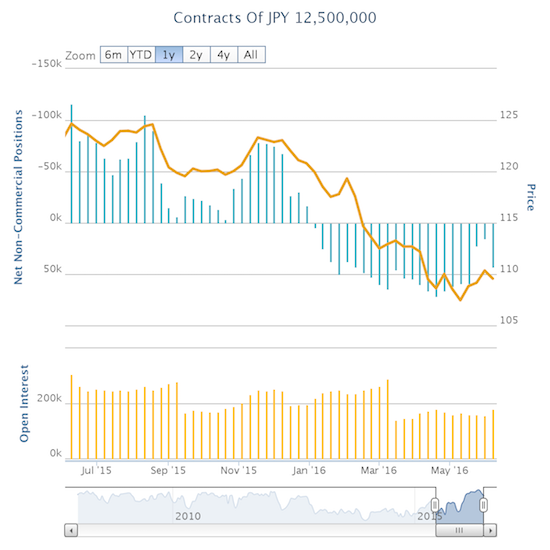

A sudden resurgence in net longs on the Japanese yen (FXY) seem to confirm new troubles on the horizon. Over the previous two weeks, yen bulls unwound net longs as I had anticipated in “Maximum Yen Bullishness Faces Off Against The Bank Of Japan.” Last week brought a quick end to the unwind: net long contracts jumped form 14,287 to 42,853. As the above charts of GBP/JPY and AUD/JPY demonstrate, the rush back into the yen has had a notable impact on yen currency pairs.

Yen bulls are back in force.

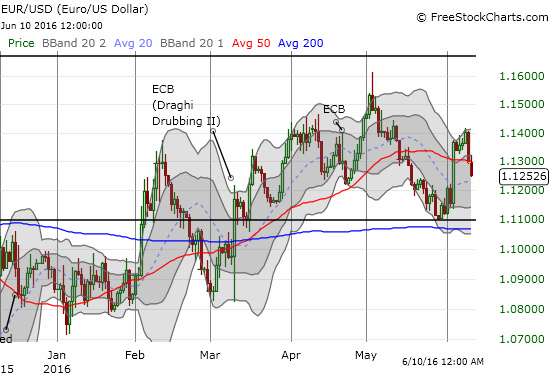

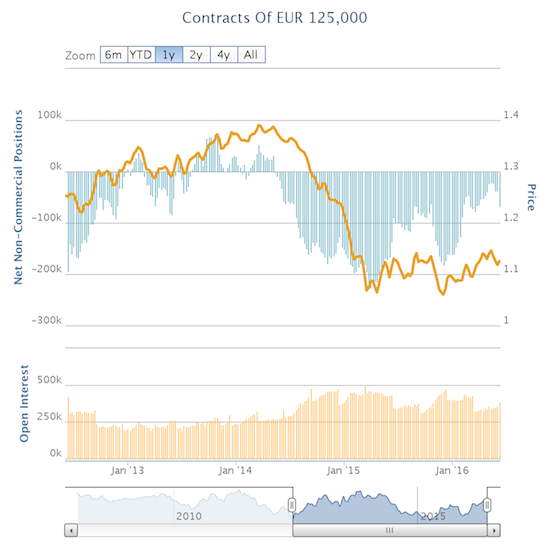

Combine a resurgence in yen bullishness with a sudden rise in euro shorts and trouble starts. Speculators together made their largest one-week percentage increase in euro net shorts in at least four years. The closest episodes occurred in May, 2013 with a 72% increase and last October at 69%. This surge is particularly interesting because it happened in the wake of the euro’s large jump in sympathy with the poor U.S. jobs report in the previous week. Selling in EUR/USD did not show up until the last two days of the week.

Interest in shorting the euro significantly wavered until last week.

The euro did not sell off against the U.S. dollar until the end of the week….

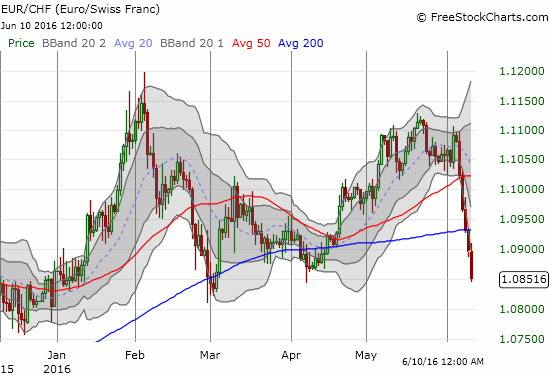

…however, the euro sold off hard all week against the Swiss franc (NYSE:FXF)

Just in case there is any doubt that something is again amiss in the eurozone, the yield on the 10-year German bond dropped to a record low (0.011%!). European banks buckled on Friday as well. Deutsche Bank AG (DE:DBKGn) NA O.N. (NYSE:DB) gapped down for a 5.8% loss that confirmed a recent 50DMA breakdown.

The extended downtrend on Deutsche Bank (DB) took a break with February’s all-time low. However, a series of lower highs and April’s close call suggest that DB is headed for fresh all-time lows in due time.

As I noted in an earlier post, the Fed’s meeting on June 15th is likely the next catalyst to impact the outlook on market sentiment. In the meantime, taken together, all these currency moves suggest a fresh sense of heightened risks. Traders are rushing toward (perceived) safety and refreshing bets against currencies that are vulnerable to increased risks in the financial system.

Be careful out there!

Full disclosure: net short the Japanese yen, British pound, Australian dollar, and euro. Net long the U.S. dollar. Long DB put options