The following data cover the latest from the CFTC’s Commitment of Traders as reported by Oanda from the week of Monday, February 15, 2016. From Oanada:

“The Commitments of Traders (COT) is a report issued by the Commodity Futures Trading Commission (CFTC). It aggregates the holdings of participants in the U.S. futures markets (primarily based in Chicago and New York), where commodities, metals, and currencies are bought and sold. The COT is released every Friday at 3:30 Eastern Time, and reflects the commitments of traders for the prior Tuesday.”

In this edition of “Forex Critical”, I focus on notable changes in the currency positioning of non-commercial traders, also known as speculators. While speculators do not necessarily drive market action, they can provide good proxies for the market sentiment that DOES drive currency moves. Wherever meaningful, my snapshots of currency charts show U.S. dollar currency pairs to provide a common point of reference and a direct comparable to the charts provided by Oanda (the yellow line in the positioning charts). These charts come from FreeStockCharts.com. I provide Oanda’s embeded tool at the end of this post for your convenience.

Summary

Three developments caught my interest this week. Speculators have actually gone net bullish on their positioning on the Australian dollar (N:FXA). Speculators continued their net reduction of shorts against the Canadian dollar (N:FXC) and the euro (N:FXE).

The Australian Dollar

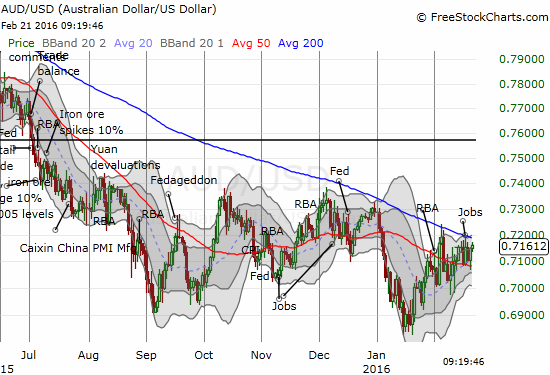

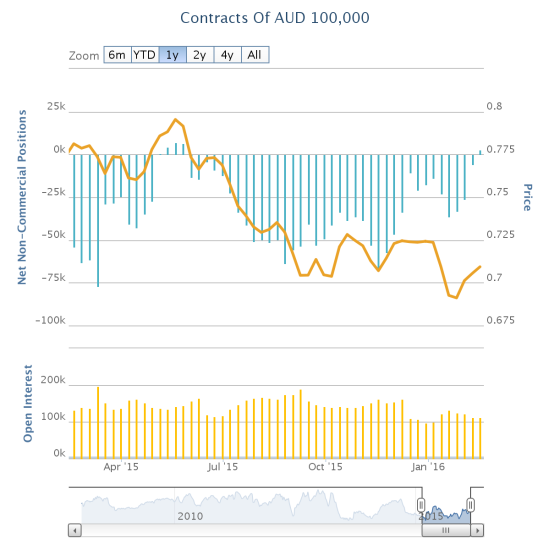

Speculators have retreated so much from being short that they are now net bullish on the Australian dollar. Speculators were last net bullish the week of May 25, 2015. That event occurred shortly after the S&P 500 (SPDR S&P 500 (N:SPY)) made its last all-time high, and the Australian dollar also peaked. While I am still stubbornly bearish against the Australian dollar, I have taken my cues and backed off my own short positions. In particular, I have stopped shorting AUD/USD altogether until some major technical break occurs. I am getting more and more aggressive on shorting GBP/AUD.

Speculators are suddenly net bullish on the Australian dollar by a tiny margin – first time since last May.

The Australian dollar and the U.S. dollar continue to churn in a very tight dance.

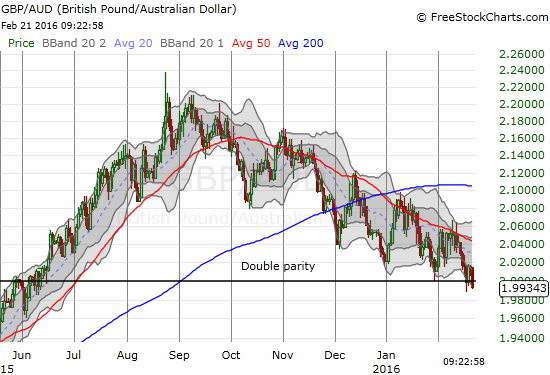

Shorting the British pound (N:FXB) against the Australian dollar (FXA) has become one fo the best, well-sustained carry trades. At the time of writing, GBP/AUD definitely broke through “double parity” at 2.0 as the downward trend continues apace.

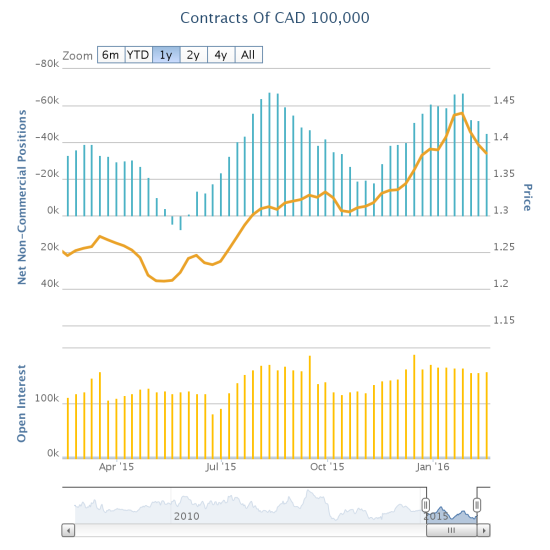

The Canadian dollar

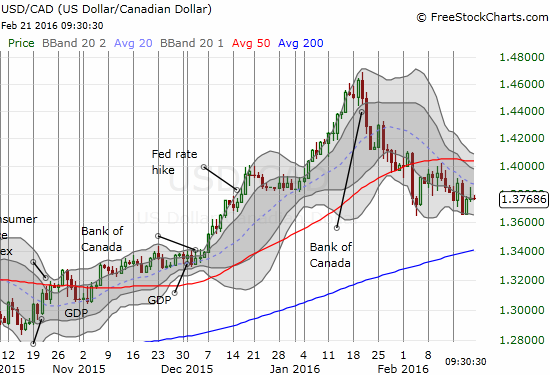

Speculators have resumed a notable retreat from short positions against the Canadian dollar. The sharp ascent in USD/CAD looks all but over now. I am focused on shorting rallies until/unless USD/CAD breaks above overhead resistance at the 50-day moving average (DMA). The next big test SHOULD be 200DM support.

Speculators are no longer so bold on their shorts against the Canadian dollar. Are they sensing an imminent bottom for oil?

USD/CAD has stabilized below the 50DMA. The next move should be as swift as the one that brought USD/CAD below 50DMA support.

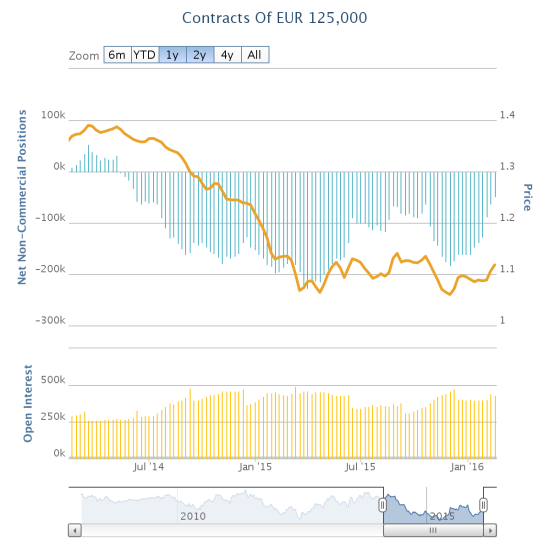

The euro

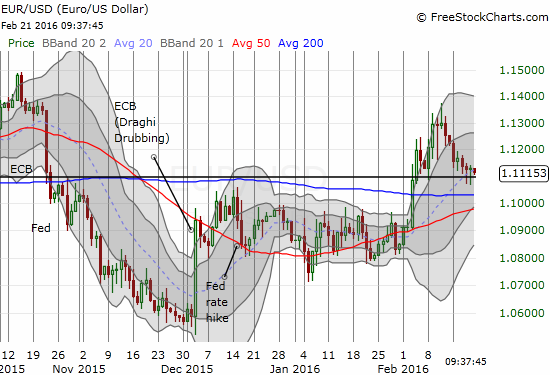

Speculators have been retreating from net short positions against the euro (FXE) ever since such positions reached a peak at the end of November. Net shorts have not been this low since June, 2014. Mario Draghi has a HUGE task ahead of him to convince markets that the European Central Bank (ECB) is truly serious about fighting deflation with a weaker currency. The ECB’s failure to even meet market expectations last December still stands out as a major flub. The U.S. dollar has managed to strengthen against the euro since February 11, but that momentum is slowing. Despite the growing reticence of speculators, I remain bearish on the euro. For now I am well hedged against that position.

Speculators have retreated short positions back to levels last seen almost two years ago!

EUR/USD has retreated toward a critical test of 200DMA support. (The thick, horizontal line comes from the level EUR/USD hit immediately after the Greek anti-austerity party won back in January, 2015).

Be careful out there!

Full disclosure: short EUR/USD, short USD/CAD, short GBP/AUD, long FXC