Some analysts expect the stock market crash or even recession in the near future. Are they right? And how it would affect the gold market?

The elevated valuations of equities (see the chart below) make some investors worried about the sustainability of the current bull market. Indeed, the Shiller P/E ratio is currently about 30, higher than at any other time in history excluding only the dotcom bubble.

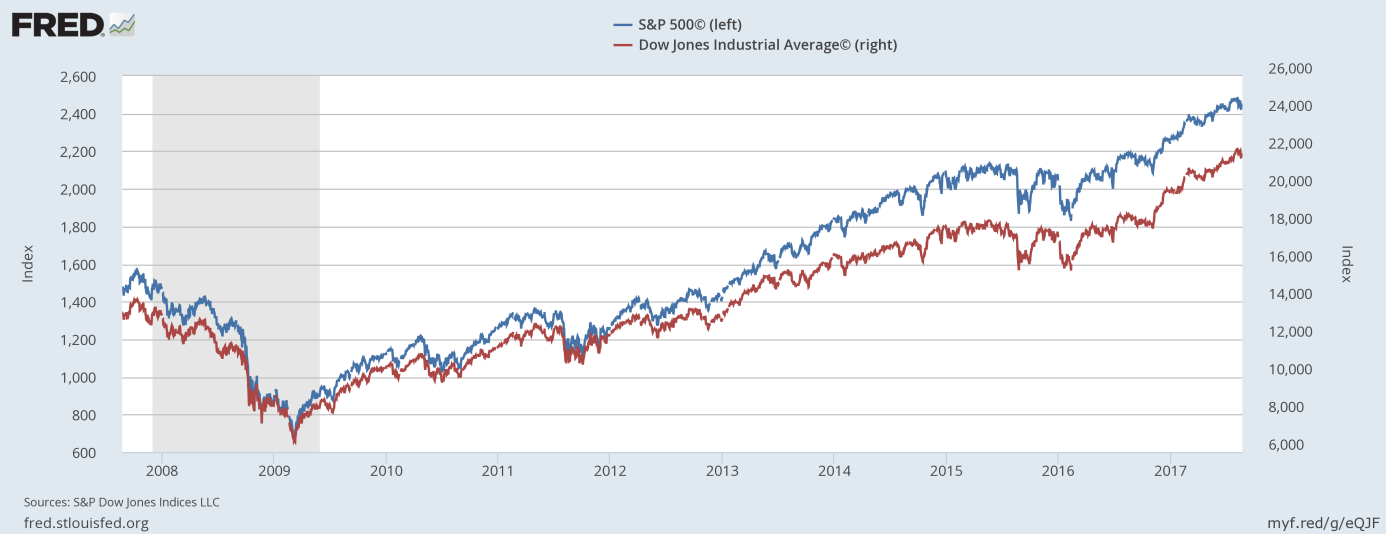

Chart 1: The S&P 500 Index (blue line, left axis) and the Dow Jones Industrial Average (red line, right axis) from 2007 to 2017.

Investors should remember that share buybacks largely contributed to the rise in stock prices, not necessarily improvement in fundamentals. Hence, if companies stop buying back their stocks, the market could correct.

Actually, stocks have gone for a long period without a major sell-off – it’s been several months since the last significant pullback. This is why analysts believe that the correction would be healthy at this point. For example, Michael Hartness, Bank of America Merrill Lynch chief investment strategist, forecasts that the market will correct this fall. Actually, we might be already in the correction, as individual stocks and sectors have been recently falling, but that pullback has not yet been visible in the aggregate indices.

Anyway, the pullback in the equity prices should be positive for the gold market, which serves as a hedge against such events. The increase in risk aversion would spur some safe-haven demand for gold.

However, investors should differentiate between the stock market correction and financial crisis or recession. We agree that valuations are high, but the global economy is in great shape: the U.S. economic growth continues to be healthy, the Eurozone rebounded and even Japan’s economy expanded 4 percent in the second quarter of the year.

Moreover, the current bull market is perhaps one of the least respected in history. Given that “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria,” we argue that the upcoming correction will be just that – a correction during a bull market.

The bottom line is that there may be stock market correction in the near term. The pullback in the equities should be a tailwind for the gold prices. However, the correction is likely to be temporary and it could enable the bull market to persist in the medium term, which would not be so good for the yellow metal.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.