Summary: The US economy will soon be in its 8th year of expansion. The US will also have a new president next year. So, is a recession a certainty in 2017? No. Economic expansions don't die at a predetermined definition of old age, and changes in the presidency have not been a useful predictor of a coming recession.

The danger in forecasting based on these things is that it makes an imminent downturn appear to be a fait accompli. It's not, and believing that it is closes your mind to other possibilities. Maintaining a mind open to changes in the data and the opportunities they present is the essence of successful investing.

Will 2017 bring a recession? The calendar says it's likely.

The Great Recession officially ended in June 2009, 7-1/2 years ago. That is already a long time without a recession. Since 1900, the US has stayed out of a recession longer only two other times: the 1960s (9 years) and the 1990s (10 years).

There have been 23 recessions since 1900, and 21 of them have taken place within 8-1/2 years of the prior one's end. So, the historical odds based on the calendar say the next recession is likely to start in 2017 (21/23 = 91%).

Notably, the time between recessions has been expanding over time. At the turn of the 20th century, recessions took place very other year. They now take place nearly every other decade. Consider the following:

Between 1900 and 1928: a recession every 1 year and 10 months.

Between 1929 and 1949: a recession every 3 years and 8 months.

Since 1950: a recession every 5 years and 9 months.

Since 1990: a recession every 8 years.

If you are thinking that recessions used to be short and shallow and now they are less frequent but deeper, you are wrong. GDP fell 5% during the Great Recession. Between 1880 and 1928, economic activity fell an average of about 20% with each recession. At least 3 were worse than the Great Depression.

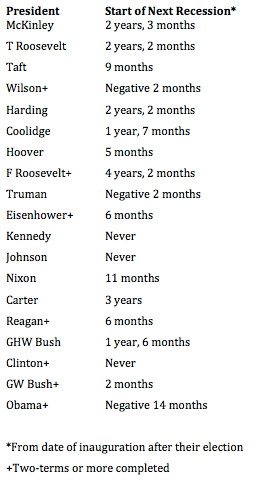

It's worth stressing that the timing of each recession has little to do with the election of a new president. Before Truman, at least one recession began during every presidency. Since then, there have been 5 presidencies where a recession never started after their election until they left office (Truman, Kennedy, Johnson, Clinton, Obama). In other words, in the past 67 years, in only about half of the presidencies has a new recession started (6/11 = 55%).

The following table lists every newly elected president in the past 120 years and the time between their inauguration and the start of the next recession. Based on this, the next recession either started a year ago or will not occur at all during the Trump presidency. That is not a very useful predictor.

Using only two term presidencies substantially lowers the sample size but doesn't change the result. Prior to Obama, there have only been 6 complete two term presidencies since Ulysses S. Grant 140 years ago (Wilson, FDR, Eisenhower, Reagan, Clinton and Bush). That's a small sample and in two cases a recession did not start during the term of the next elected president (Truman and Kennedy). Those odds are approaching random.

We have previously discussed other fallacies surrounding presidential cycles. Year 3 of a presidential term is supposed to the best for the stock market, gaining an average of 22% since 1950. In the 60 years prior to 2015, it had never been negative. We wrote about this before Obama's second 3rd year started, saying that the stock market was unlikely to follow the historically bullish pattern. In the event, the S&P lost 1% in Year 3 (that post is here).

Why did this presidential cycle set up fail? Because the year of the presidential term is irrelevant. What is important is what the stock market has done in the prior two years. Good years in the stock market follow bad years. 86% of the time, a recession or bear market has taken place in the two years prior to Year 3. That's why the market often rallies in Year 3. The presidential cycle on its own is irrelevant.

Nevertheless, given the propensity for recessions to occur every 8 years or so, a recession in the next year seems likely. Is it a slam dunk? No way.

Australia has not had a recession since 1991, 25 years ago. Poland has gone 21 years and South Korea has gone 18 years without a recession (data from WSJ).

If nothing else, appreciate that expansions don't blindly follow the calendar or die at some predetermined definition of old age. Like Year 3 of the presidential cycle for the stock market, there is more to it than that.

Why might this expansion cycle continue longer in the US?

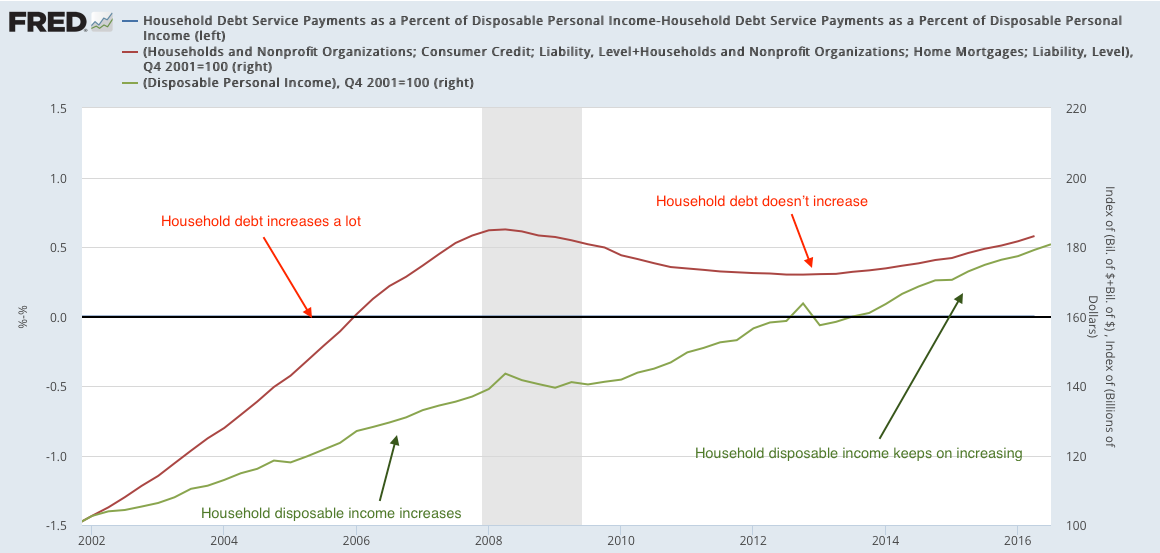

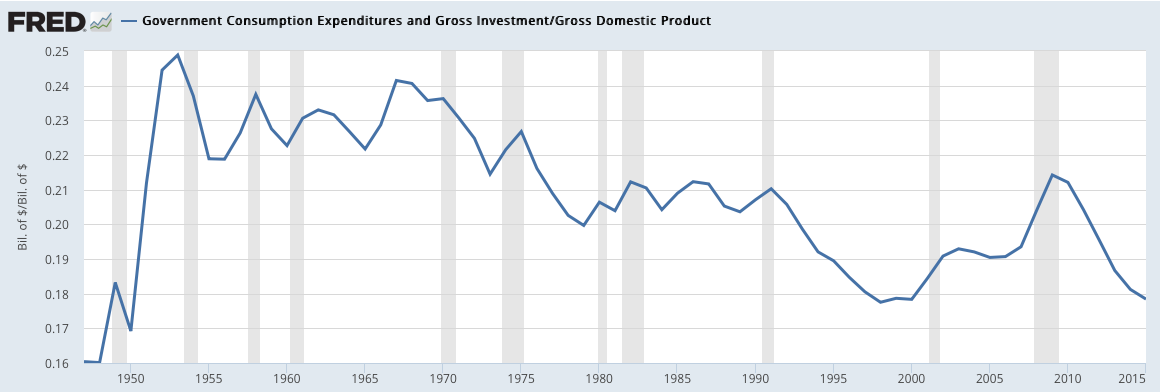

For starters, the current recovery in the US has been slow growing, in part due to consumer's deleveraging (first chart below) and discretionary fiscal spending from the government being restrained (second chart). A change in either of these could keep the current expansion moving forward through 2017 and beyond. Moreover, the cause of the Great Recession was different than any other recession in the past 80 years. It was also far deeper. It's therefore conceivable that the recovery will also be much different than other post-war recoveries.

More to the point, there are better ways to forecast the next recession than counting months on a calendar or focusing on changes in the presidency. How?

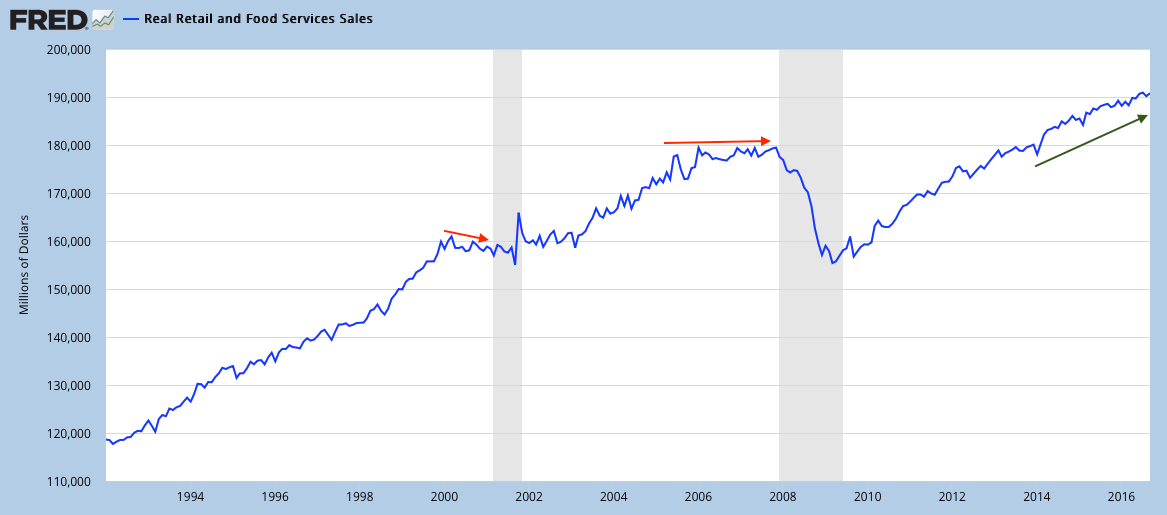

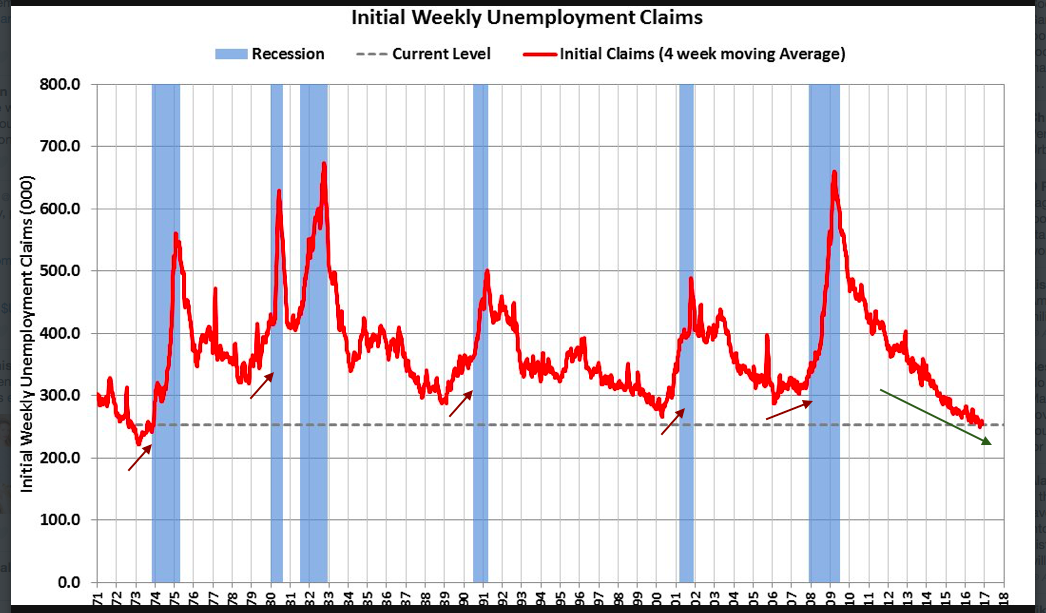

By monitoring changes in the macro data. A persistent slow down in retail sales, housing consumption, employment growth and other macro indicators will likely be a better method for indicating when a recession is becoming more likely. This is the stuff that matters most; the calendar and presidential terms are demonstrably inadequate on their own. Our regular commentary on the macro environment can be found here.

The most important point of this post is this: the danger in relying solely on a calendar or a change in the presidency to forecast a recession is that it makes a recession in 2017 appear to be a fait accompli. It's not, and believing it is closes your mind to other possibilities. Maintaining a mind open to changes in the data and the opportunities they present is the essence of successful investing.