Markets are largely expected to be on edge this week as another decision on the Federal Funds Rate is due from the FOMC. However, this time around traders have largely been quiet ahead of the meeting, as the overarching view is that the central bank will keep rates on hold. Subsequently, a surprise rate hike could send the dollar soaring given the current lack of pricing in. The question therefore remains as to what is the actual risk of a hike from the unpredictable Fed.

Labour, Inflation, and the Fed’s Dual Mandate

In the past, the Federal Reserve has largely been responsible for satisfying the conditions of their “Dual Mandate”. In other words, maximising US employment whilst stabilising prices and potentially moderating long term interest rates. Subsequently, the recent fall in the US unemployment rate to 4.9% has largely fulfilled the central banks mission of maximising employment.

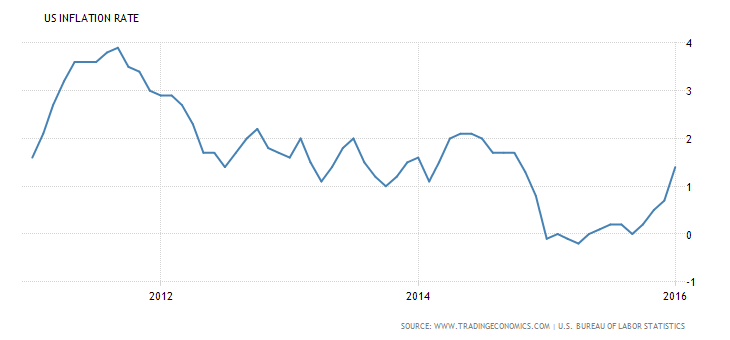

In addition, inflation has been creeping back towards the 2.00% targeted level as core inflation improved throughout the early part of 2016. Subsequently, the central bank is largely looking at a range of improved inflationary conditions for the remainder of the year. So the question subsequently remains as to why there is any question of a rate hike and the answer to that exists within the poor wage data.

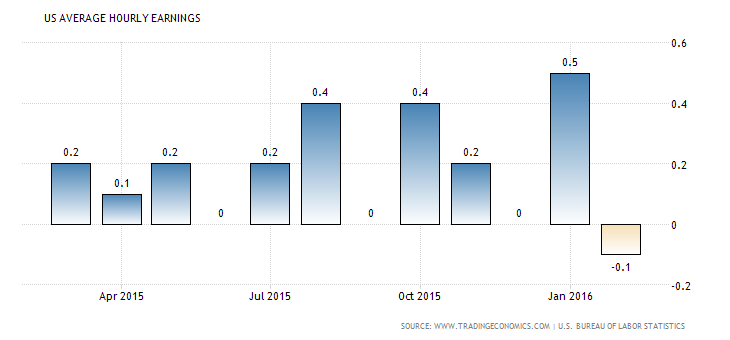

Wage pressures within the US have been relatively lacklustre over the past few years. In fact, US average hourly earnings has been particularly poor of late, with the figures released in February showing the indicator contracting by -0.1% m/m. Although the general trend of wage inflation has been rising, any gains have been marginal at best. This is largely due to the growth in part time employment within the US and also explains some of recently poor retail sales figures. Simply put, people working part time do not possess the large disposable incomes needed to support ongoing rampant consumerism.

Subsequently, the Fed is currently operating within a mixed economic environment that doesn’t necessarily conform to the standard “Dual Mandate” argument. This is even more prescient when you consider that the large tranches of QE that were injected in to the US economy have largely distorted various markets, and their respective results. It is therefore questionable, given the fact that the Fed has departed from the usual models (Taylor Rule) as to whether one can predict their bias for any given FOMC meeting outcome.

The Case for a Rate Hike in March

The truth is that the Federal Reserve has a credibility problem due to continuing use of the expectations channel. Throughout much of 2015, the central bank sought about warning markets of impending hikes, which only caused greater volatility in both currencies and equities. The on-going jaw boning only seemed to result in action, come December, as a small 25bps hit the markets.

December’s rate hike was largely symbolic as it failed to really adjust the demand for money too strongly given the amount that QE injected in to the economy. However, for a short time at least, analysts and pundits within the market took turns saying “told you so”. Regardless, the Fed then went ahead and boxed themselves in to a corner with their model driven box plot. Subsequently, the expectation had been set that 2016 would result in a significant period of rate normalisation.

Therefore, the expectation has clearly been set that the Federal Reserve’s FOMC will take decisive steps in the months ahead to embark upon a period of rate normalisation. For the central bank to back away from those forecasts could therefore put their credibility and future ability to impact market expectations at risk.

In addition, there is an argument to be made that viewing the current US economic data through the lens of simply the labour and inflation indicators also lends credence to the argument for a rate hike. In fact, CPI data appears to imply that there are some significant price pressures building within the economy that the Fed would probably like to get ahead of.

The Case Against a Rate Hike in March

Despite a few limited economic indicators, such as unemployment and CPI indicating growing pressures, most other metrics are demonstrating a status quo. Wage inflation is largely absent within the US and the rise of part time workers is especially concerning. Globalisation has hit the US work force hard and many of the highly paid specialised jobs have simply evaporated. In addition, the unemployment claims metric has been pretty volatile as those part time and casual roles ebb and flow with domestic demand.

In addition, the US Manufacturing PMI Index has provided some relatively poor results as the indicator slides towards contraction territory. In fact, 2015 saw successive declines which have largely continued into 2016, and could signal contraction in the coming months. US Industrial Production has largely followed suit as both of those wealth creating industries shrink and operations move offshore.

Further adding to the case for caution is the fact that global GDP and trade is diminishing and expected to be relatively lacklustre throughout 2016. In fact, the IMF’s world economic outlook confirmed slipping growth, which has largely started in the emerging markets. Subsequently, given the global nature of the US economy, the effects of any slipping growth in Asia should also impact the US domestic economy.

There is also a risk that ongoing turmoil within Chinese financial institutions could flow to the US if the PBOC’s vaunted TARP program fails to support their domestic banks. A Chinese financial collapse similar to Lehman Brothers could cause markets and confidence to reel and for trade to break down. Subsequently, there are some serious structural issues within China that are in need of reform and any one of the myriad issues could damage world trade, and by extension, the US growth outlook for 2016.

The Likely Outcome for March

Given some of the mixed messages that the US domestic economy is giving it is unsurprising that the Fed has become difficult to predict. However, the central bank is likely seeing something down the line which is causing them concern, inflation. Despite a myriad of pundits applauding the use of QE, rampant future inflation is a very real risk within the US economy. Sure, currently there appears to be little in the way of price pressures, but read what the economic text books have to say on the issue. There are literally no free lunches and you can’t simply print your way to economic growth (despite what a Keynesian will tell you). There is always going to be a by-product of that action, inflation.

Subsequently, the Fed is probably worried about what could potentially happen 1 or 2 years down the track given the incredibly large balance sheet that the central bank is currently carrying. As the employment market continues to firm the question remains, at what point will inflation raise its ugly head (this is probably something that keeps Janet Yellen awake at nights). Subsequently, this is a strong reason why the FOMC may be keen to keep to their schedule for hikes despite the absence of wage gains.

Unfortunately, the Fed has largely been playing their cards close to their chest in the lead up to the FOMC meeting. Subsequently, markets have literally priced in none of the risk inherent in any hawkish decision or statement. Therefore, anything other than a statement confirming a “hold steady” could see the dollar rise sharply.

However, given some of the aforementioned global risks, our analysis suggests that the bank will probably hold rates steady in March and, instead, preference the June meeting. Having said that, Janet Yellen is likely to convey some hawkish sentiment following the decision and this will be relatively bullish for the dollar. Subsequently, given the fact that little upside risk has been priced in by markets, the only way to play the FOMC decision is long.