Looking at the upcoming Thursday session, without a doubt the most important announcement will be the FOMC Statement coming out of the United States. While we do not anticipate any type of change to the interest rate, we believe that the market will be paying attention to what the potential timeline of an interest rate hike would be.

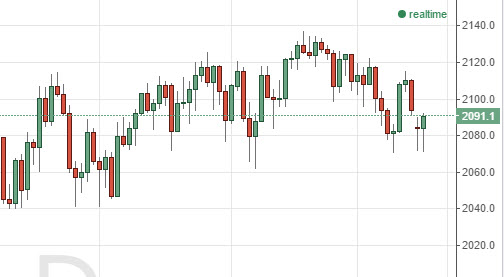

With that being said, we look at the S&P 500 and recognize that there could be a trading opportunity here. We believe that the 2080 level continues to offer support, and that short-term pullbacks based upon knee-jerk reactions might offer value that we can take advantage of via calls. With this, we remain bullish.

Looking at the EUR/USD pair, we remain range bound between the 1.11 handle on the bottom, and the 1.14 level on the top. We believe the pullbacks will continue to offer short-term call buying opportunities and will take advantage of such value. We have no interest in buying puts as we believe eventually this market will break out to the upside.

Silver continues to be magnetically attracted to the $16 handle, and we believe that will be the case going forward. We are simply buying calls down at the 15.85 level, and buying puts at the 16.15 level. Ultimately, we believe the market eventually will go higher, but it’s probably going to take a bit of time and momentum building to get to that point in time.